The dominance of memecoins in the altcoin market has significantly declined since April, with analysts suggesting a shift from speculative trading to focusing on fundamentals.

Despite this trend, memecoin liquidity has doubled since the start of the year, reaching an all-time high of $128 million in early June. This surge in liquidity, even amid declining dominance, indicates a complex market sentiment shift.

Data from on-chain analytics firm CryptoQuant shows that memecoins in the altcoin market are facing a steady decline. Ki Young Ju, the founder and CEO of CryptoQuant, highlighted on X (formerly Twitter) the marked decrease in memecoin dominance from September 2022 to May 2024.

Initially, there was a peak in November 2022, reaching approximately 0.075, followed by a steady decline stabilizing around 0.045 in early 2023. Throughout 2023, the ratio showed minor fluctuations but generally trended downward, averaging around 0.04 by early 2024.

A sharp decline was observed from March 2024, with the dominance ratio falling below 0.03 by May 2024. Analysts suggest this shift mirrors a transition from speculative trading to a focus on fundamentals, similar to trends seen in previous years.

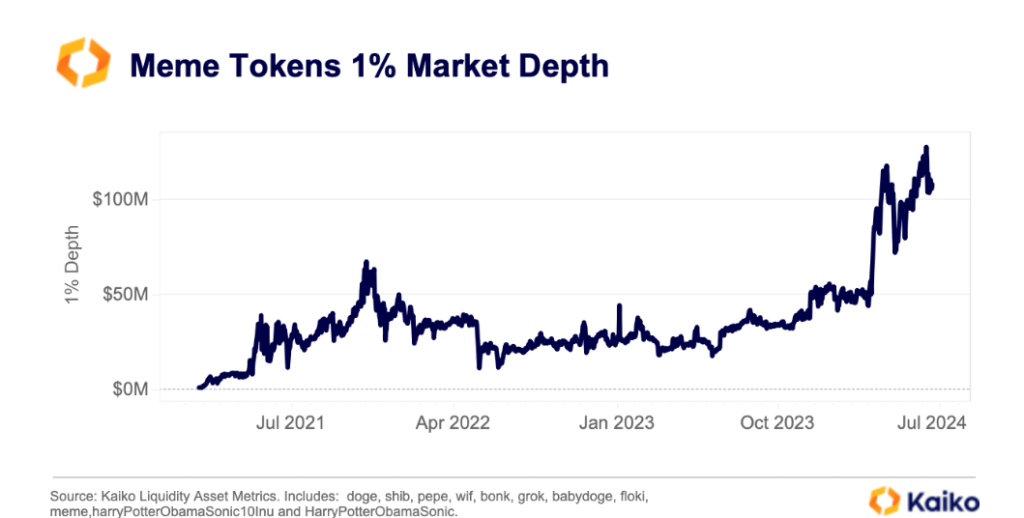

Memecoin liquidity and market performance

In contrast, memecoin market liquidity has surged, with tokens like Dogwifhat (WIF), Memecoin (MEME), and Book of Meme (BOME) experiencing liquidity growth ranging from 200% to 4000% in native units.

The average price growth of memecoins in Q1 2024 was 1,313%, significantly outpacing the 286% growth in the real-world assets (RWA) sector, according to CoinGecko.

Kaiko’s 1% market depth metric further highlights this surge, with memecoin market liquidity reaching an all-time high of $128 million in early June.

The recent sharp correction in memecoin prices has led to significant sell-offs, reflecting plummeting market sentiments. The broader cryptocurrency market mirrored this trend, with overall market capitalization dropping below $2.4 trillion.

The memecoin market cap also fell to $49.9 billion from highs above $68 billion earlier this year. Despite these corrections, 2024 saw notable events such as the Solana(SOL) memecoin frenzy, driven by the approval of Bitcoin (BTC) spot exchange-traded funds (ETFs) and heightened institutional interest. Positive sentiment boosts led to memecoin surges, but low volumes or adverse macroeconomic factors triggered investor pullbacks from these high-risk assets.

Analyst insights on memecoin trends

Crypto analyst Altcoin Sherpa recently shared his thoughts on X regarding the ongoing memecoin super cycle. He reflected on the historical patterns of memecoins like Dogecoin (DOGE), which have traditionally seen explosive growth followed by significant retracements, only to repeat the cycle.

In the past, the market would cycle through major coins, mid-caps, and then memes, often signaling the end of a cycle. However, Sherpa believes this changed in 2024. Unlike previous cycles, memecoins have now become the leading sector in crypto, overshadowing even strong tech projects.

Sherpa acknowledges that memes will always have a place in the market, with at least one memecoin consistently showing significant gains. However, he emphasizes that in 2024, the entire memecoin sector has outperformed other sectors for extended periods.

Despite their popularity, Sherpa also highlighted the risks associated with memecoins, including high scam potential and insider manipulation.

These factors could impact market dynamics unfavorably. Nonetheless, he advocates for including memecoins in diversified investment portfolios.

While memecoin dominance in the altcoin market is declining, the sector’s liquidity and popularity remain robust, driven by both retail and institutional interest.

This trend suggests a nuanced market behavior where fundamentals and speculative trading coexist, shaping the future landscape of cryptocurrency investments.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.