Despite losing the positive momentum, the price of platinum is still trading well above its key support of $940, and a new artificial intelligence (AI) model has delivered potential price targets for silver’s pricier cousin in the next year, based on the available information and predictions.

Indeed, the price movements of the rarest precious metal and a popular commodity among investors are still working their way up to $1,000, unlike gold, which has consistently beaten its own record highs. However, some predictions suggest it might happen in 2025.

Meta AI’s platinum price prediction 2025

In this context, Llama 3.1, the recent AI model by Meta Platforms (NASDAQ: META), has offered insights that might help forecast platinum’s potential price performance in 2025 and provided specific platinum price range predictions from the standpoint of August 23.

As it happens, Meta’s AI platform has drawn upon available predictions from sources such as ANZ Research, WalletInvestor, UBS Bank (NYSE: UBS), and the World Platinum Investment Council (WPIC), concluding that the potential price range for platinum in 2025 could be between $900 and $1,200 per ounce.

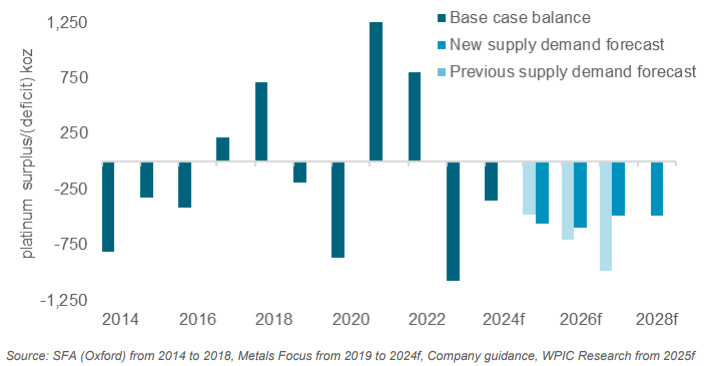

For instance, in January this year, experts at the WPIC expressed their expectation that the platinum market “would remain undersupplied through at least 2028,” with average supply deficits of 550 koz between 2025 and 2008, supporting higher prices, as their report demonstrates.

Platinum price analysis

So, what is the price of platinum today? For now, it stands at $950.77, down 1.19% on the day, up 0.04% across the previous week, down 0.97% on its monthly chart, and declining 2.96% since the year’s turn. At the same time, the platinum price per gram at press time amounted to $33.85.

Ultimately, this precious metal might demonstrate mixed performance for now, but its limited supply could lead to continuous buying pressure, resulting in a steady price increase in 2025. That said, doing one’s own research is critical when investing significant amounts of money.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.