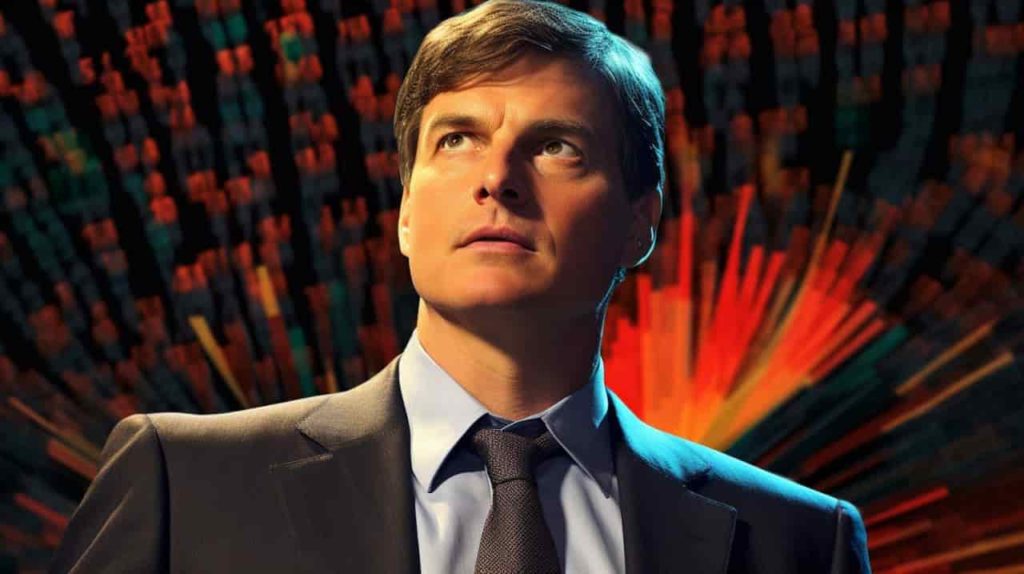

Earlier this week, a report by Finbold provided insights into the performance of Michael Burry’s recently revealed ‘big short’ $1.6 billion bet against the stock market, particularly the SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust (QQQ) funds.

Based on the assumption that he was holding these positions, the widely-followed investor who predicted the 2008 mortgage market crash was down 42% on his short bet, according to data retrieved on August 27.

In the next few days, the US stock market witnessed a notable rally, thereby further widening Burry’s losses. As a result of this upswing, the legendary investor is now down 53% on his S&P 500 and Nasdaq short positions, stock trader Gurgavin disclosed on August 29.

“After today’s rally, Michael Burry is now down 53% on his ‘$1.6 billion’ S&P 500 and Nasdaq short positions if he is still holding it.”

– Gurgavin noted.

It’s worth highlighting that despite the substantial total notional value of $1.6 billion for both positions, Burry’s investment in establishing his significant new short position was a relatively small fraction of that amount.

Based on Gurgavin’s earlier calculations, Burry allocated approximately $26.5 million to construct his substantial short.

Commenting on his bearish move, renowned US economist Steve Hanke thinks Burry’s short made sense due to wide expectations of recession.

“It looks to me like Burry has made a good move,” Hanke said, who anticipates an economic downturn in the first half of 2024.

US stocks rebound

Woes for Burry’s latest ‘big short’ come after a noteworthy rebound in US equity prices. Notably, The Nasdaq Composite rose over 1% on Tuesday as investors jumped back into tech stocks after what’s been a challenging August for the market.

The tech-focused stock index climbed more than 1.7% to 13,943. Similarly, the S&P 500 soared 1.45% to 4,497, marking its best day in nearly three months, while the Dow Jones Industrial Average advanced 0.85% to close at 34,852.

The tech rally was led by AI chip giant Nvidia (NASDAQ: NVDA), which surged more than 4.1%. Shares of other technology giants, including Meta (NASDAQ: META), Tesla (NASDAQ: TSLA), and Apple (NASDAQ: AAPL), also ended the session higher.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.