While Michael Burry, the man who famously bet against the housing market before the 2008 financial crash, is successful in his stock trading endeavors through his hedge fund, Scion Asset Management, 2024 has been particularly profitable for ‘The Big Short’ investor.

What’s more, it might shock some that Burry has managed to achieve his substantial trading accomplishments by concentrating his efforts on a very small, carefully curated number of assets in the stock market, as well as that he currently holds shares of only 10 companies.

#1 Alibaba (BABA)

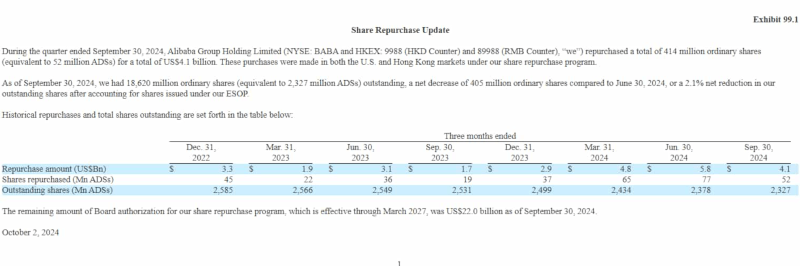

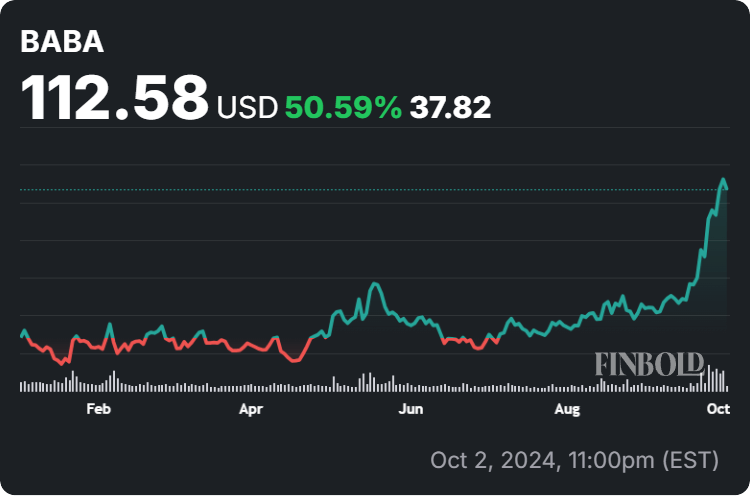

Specifically, the first on the list is Alibaba (NYSE: BABA) stock, which Certified Public Accountant (CPA) and financial blogger known as Oliver | MMMT Wealth said had “more room to run,” at least until the $125 range, although $140 might not be out of reach either thanks to the company’s recent buyback update.

In addition to recording a 3.88% revenue growth year-on-year (YoY) and enterprise value-to-sales (EV/Sales) of 1.9x, BABA stock is currently trading at $112.58, which represents an increase of 50.59% since the year’s start, as well as a 37.01% gain in the past month.

#2 Shift4 Payments (FOUR)

Furthermore, another one of Burry’s major investments is in the shares of payment processing firm Shift4 Payments (NYSE: FOUR), which has experienced revenue growth of 29.83% and EV/Sales of 2.7x this year, thanks to its exponentially growing and diversified software offering.

On top of that, equities researchers at Oppenheimer recently began coverage on Shift4 Payments by setting an ‘outperform’ rating and a $109 price target, beside many other Wall Street analysts expressing a bullish view on the payment processing company’s shares.

At the time of publication, the price of FOUR stock stood at $89.18, which represents an increase of 21.35% year-to-date (YTD), while also advancing 12.63% over the past 30 days, according to the most recent data retrieved by Finbold on October 3.

#3 Molina Healthcare (MOH)

Next is Molina Healthcare (NYSE: MOH), a managed health insurer with more than 5 million members, an EV/Sales of 0.5x, and a YoY of just under 20%, which has managed to recover more quickly amid post-Covid rising healthcare costs affecting the industry than its peers.

In fact, Molina Healthcare has captured investors’ attention due to its strategic focus on Medicaid, as well as a balanced range of product offerings and its active mergers and acquisitions (M&A) strategy, that have positioned it as a prominent player in the sector.

Meanwhile, MOH shares are trading at the price of $330.16 and are recording a decline of 11.14% since the year’s turn, although they started to recover in early August and might gain more strength in the future if its operations continue to attract success.

#4 Baidu (BIDU)

In addition to Alibaba, Burry’s other China-based stocks include Baidu (NASDAQ: BIDU), a dominant force in the Chinese artificial intelligence (AI) and search engine industry following Google’s exit, which is recording a revenue growth of 0.37% YoY and an EV/Sales of 1.7x.

Despite the recent price rebound that followed the formation of a falling wedge chart pattern and sent it above the 50-day and 200-day exponential moving averages (EMAs), Baidu stocks are still very cheap, considering their all-time high (ATH) at February 19, 2021, stood at $339.91.

For now, the price of Baidu stocks amounts to $110.60, also recording an accumulated decline on its year-to-date (YTD) chart but mustering a substantial recovery in the past month, which saw it advance as much as 32.33%.

#5 JD.com (JD)

At the same time, e-commerce giant JD.com (NASDAQ: JD), another one of Burry’s favorite picks, has also delivered strong Q2 earnings results, and JP Morgan analyst Andre Chang said it was “too cheap to ignore,” having upgraded its stock to ‘overweight.’

As it happens, Chang observed at the time:

“We believe JD’s strategy adjustment and valuation have reached an inflection point for the stock to outperform in the next 6-12 months, leading us to upgrade it to Overweight with a new June 2025 price target of $36.”

For the time being, JD stock is changing hands at $44.40, managing to climb 63.22% since the beginning of this year, the majority of which happened in the past month, during which JD.com shares managed to gain a whopping 66.75%.

Other stocks

Finally, Burry’s other five stock positions, which had mixed success, include Hudson Pacific Properties (NYSE: HPP), the online luxury marketplace Realreal (NASDAQ: REAL), insurance firm American Coastal (NASDAQ: ACIC), haircare brand Olaplex Holdings (NASDAQ: OLPX), and biopharma company Bioatla (NASDAQ: BCAB).