The cryptocurrency volatility hit the market again this last week with notable “ups” and “downs” while traders built their positions. In particular, some millionaire investors have accumulated millions of dollars worth of Solana (SOL), with their activities observed onchain.

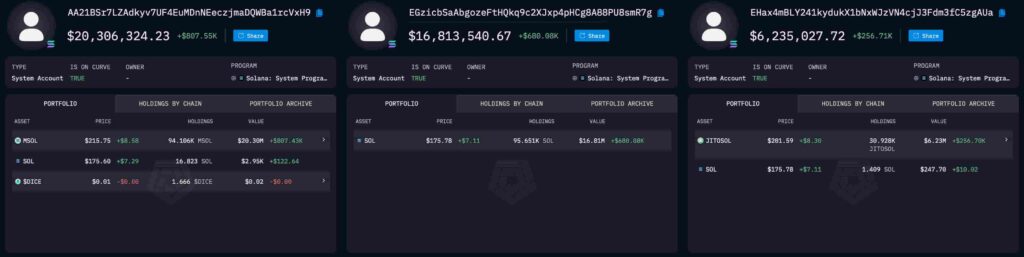

Three whale addresses stood out with their purchases, followed by staking the tokens to earn passive income, as Lookonchain posted. By purchasing, withdrawing to self-custody, and staking the SOL, these millionaire investors have shown intention to hold mid to long-term positions.

This is a notably different behavior than the one recently observed as predominant, which eyes short-term, highly speculative gains. Many millionaire Solana addresses were using SOL to buy and bet on memecoins, mostly made of rug pulls, according to signals Finbold highlighted.

Furthermore, Finbold retrieved data from Arkham Intelligence on October 27, adding up to Lookonchain findings this weekend.

Bullish: 3 millionaire Solana investors buy and stake SOL

First, the ‘AA21BSr(…)‘ address withdrew 153,511 SOL from Binance in the past six days, worth $26.4 million. The millionaire investor then staked most of these holdings through Marinade Finance’s liquid staking, acquiring MSOL tokens.

Second, ‘EGzicbS(…)’ just added 13,000 SOL to a 95,651 SOL position, totaling $16.83 million. This position, however, was kept liquid in the native token without staking and could be sol at any moment.

Finally, ‘EHax4mB(…)’ bought and withdrew $6.12 million worth of 35,498 SOL from Binance and Kraken in three days. This millionaire investor also opted for Solana’s liquid staking, this time on the Jito Network, acquiring JITOSOL.

The liquid staking is a feature that, while representing mid- to long-term investment intentions, still allows the investors to remain liquid and put their assets to work in decentralized finance (DeFi) protocols, including the ones for yield farming.

Solana price analysis

Meanwhile, Solana is trading at nearly $175 per token, forming a seven-month downtrend despite its positive year-to-date (YTD) performance. In summary, SOL has accumulated 72.66% gains in YTD while making its third consecutive lower high since March.

As the downtrend consolidates, the renowned cryptocurrency trader and analyst Alan Santana bets in his “last short” SOL premium trade.

The controversial stances and investment decisions are what make the market possible, with bulls and bears standing their ground. Now, millionaire investors and traders await to see what the last two months of 2024 reserve for Solana and cryptocurrencies.