With gains that have made Nvidia (NASDAQ: NVDA) stock out of reach for many investors as it passed the $1,000 threshold (at least until June 7, when the 10-1 stock split takes effect).

Therefore, Finbold conducted an analysis and found potential gainers that could mirror some of the gains NVDA stock had this year.

The answer is pretty simple: other semiconductor and AI stocks, such as Super Micro Computer (NASDAQ: SMCI) and Advanced Micro Devices (NASDAQ: AMD), have experienced a recent drawback, which has brought about a favorable ‘buy the dip’ opportunity for the two stocks.

Notably, SMCI had positive year-to-date (YTD) gains. SMCI shares added an impressive 196% to their valuation in the first half of 2024, while AMD stock’s gain of 53% was more extensive in the previous 365 days.

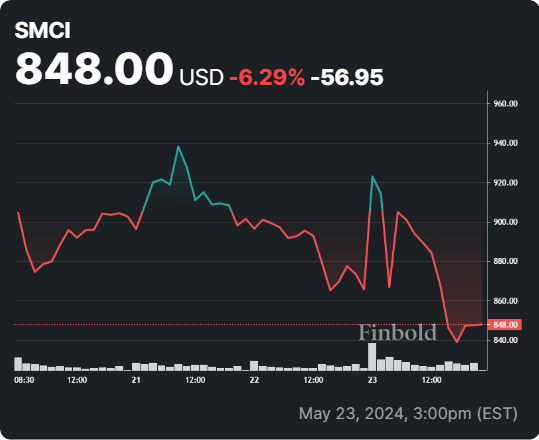

SMCI stock erased over $100 in the previous 24 hours

With a negative trading session that saw SMCI stock at one point losing more than $100 from its valuation and falling more than 10% before recovering to losses of just 2.96%, SMCI still offers investors the ‘buy the dip’ opportunity.

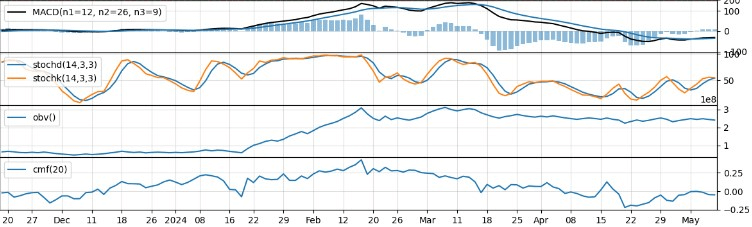

Based on an analysis of the technical indicators, SMCI stock is currently exhibiting sideways movement with bearish tendencies. The absence of a clear trend direction, combined with neutral to bearish momentum and declining volume indicators, suggests a potential consolidation phase or further downside movement in the stock price in the coming days.

Given the overall technical outlook, exercising caution when trading SMCI in the short term is advisable. Traders might consider waiting for a clearer trend direction or implementing risk management strategies to navigate potential volatility and downside risk. Long-term investors should monitor the stock closely for a more favorable entry point.

AMD’s accessible price and modest gains present a nice entry point

2024 was a year of modest gains for AMD stock so far, with only 16.58% added, which is minor compared to other semiconductor stocks, and the general rise in valuation of technology stocks.

This context makes AMD’s recent expansion into the data center GPU market beneficial for Supermicro. In late 2023, AMD launched its newest MI300 Instinct GPUs, manufactured using Taiwan Semiconductor Manufacturing Company’s (NYSE: TSM) 5nm and 6nm process nodes.

According to several industry benchmarks, AMD’s high-end MI300X outperformed Nvidia’s H100 regarding raw processing power and memory usage. This development is a significant concern for Nvidia, as the H100, despite facing ongoing supply chain constraints, still costs about four times as much as the MI300.

It remains to be seen whether the pairing manages to profit and capture most of this opportunity’s profits. However, one thing is sure: they will face heavy competition from the industry leader, Nvidia.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.