Although criticism is growing regarding the ethics and fairness of individuals trading stocks of companies in which they have extensive insider information, such a practice continues, with one of the recent examples including a former Tesla (NASDAQ: TSLA) top engineering executive.

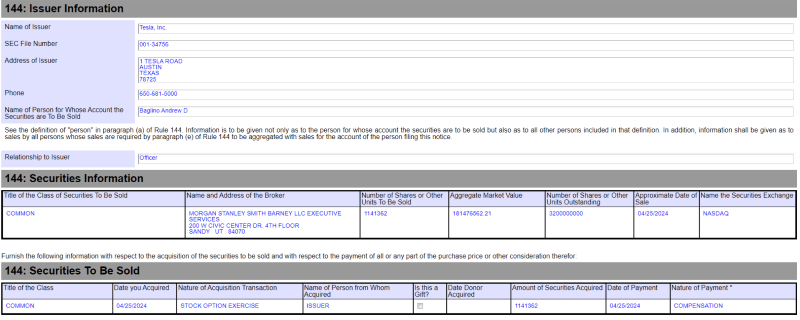

Specifically, Andrew Baglino, who resigned from his position as the senior vice president of powertrain and energy engineering at Tesla a couple of weeks ago, has sold over 1.1 million TSLA shares worth about $181.4 million, according to the information shared by markets analyst Barchart in an X post on April 26.

That said, as some of the commenters pointed out, Baglino’s TSLA stock sale could be part of his compensation package, under which he had 90 days to liquidate his vested incentive stock options or lose them, and he “exercised these stock options today,” according to Tesla investor Sawyer Merritt.

As a reminder, earlier in April, Baglino announced his departure from the company after 18 years in what he described as a “difficult decision” after Tesla CEO Elon Musk sent an internal memo revealing the planned layoff of about 10% of TSLA’s global workforce of approximately 140,000 people.

According to a Finbold report at the time, Tesla’s now former top executive had sold 10,500 TSLA shares two weeks before his departure, at a price of $176.2 per share, earning around $1.9 million whereas, previously, on February 29, he sold the same number of shares at $204.17, for a profit of $2.1 million.

In March, Robyn Denholm, Tesla’s board of directors chairwoman, sold nearly 94,000 of her TSLA shares at an average price of $175.4 per share, totaling around $16.5 million, reflecting her poor confidence in the price of TSLA stock amid its lackluster performance since the year’s turn.

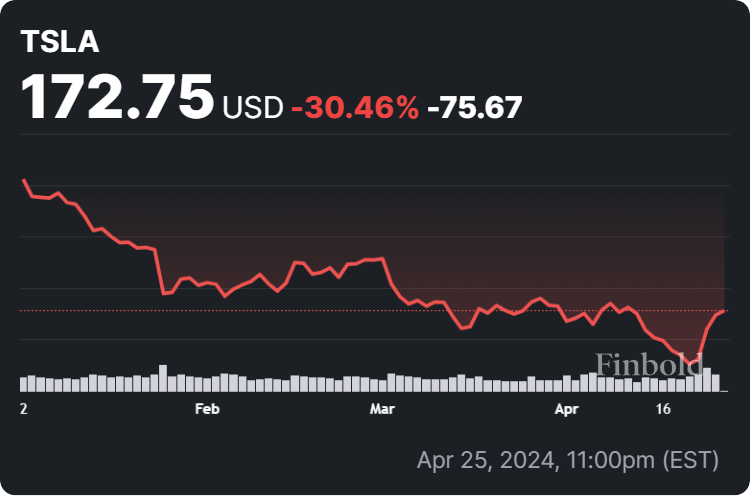

TSLA stock price analysis

Indeed, the price of Tesla stock at press time stood at $172.75, recording a 30.46% decline since January 1, 2024, and accumulating a loss of 3.94% in the last month. However, its more recent price movements reflect an increase of 7% on the day and a more significant gain of 20.18% across the week.

TSLA stock price prediction

In this context, experts have revised their price targets and expectations for TSLA stock in 2024, including Bank of America (NYSE: BAC) analyst John Murphy, who warned about weaker electric vehicle (EV) fundamentals and sentiment, with investors focusing on demand and future growth plans.

Furthermore, UBS (NYSE: UBS) lowered Tesla’s price target to $147 from $160 but maintained a neutral rating, noting better-than-expected Q1 auto gross margin but cautioning about Tesla’s focus on autonomy, as Finbold reported on April 24.

Elsewhere, Truist (NYSE: TFC) cut the TSLA target to $162 from $176, keeping a hold rating as it highlighted slightly below-consensus Q1 results but noted positive surprises in new auto products and artificial intelligence (AI) advances while expressing concerns about price cuts and management shakeups.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.