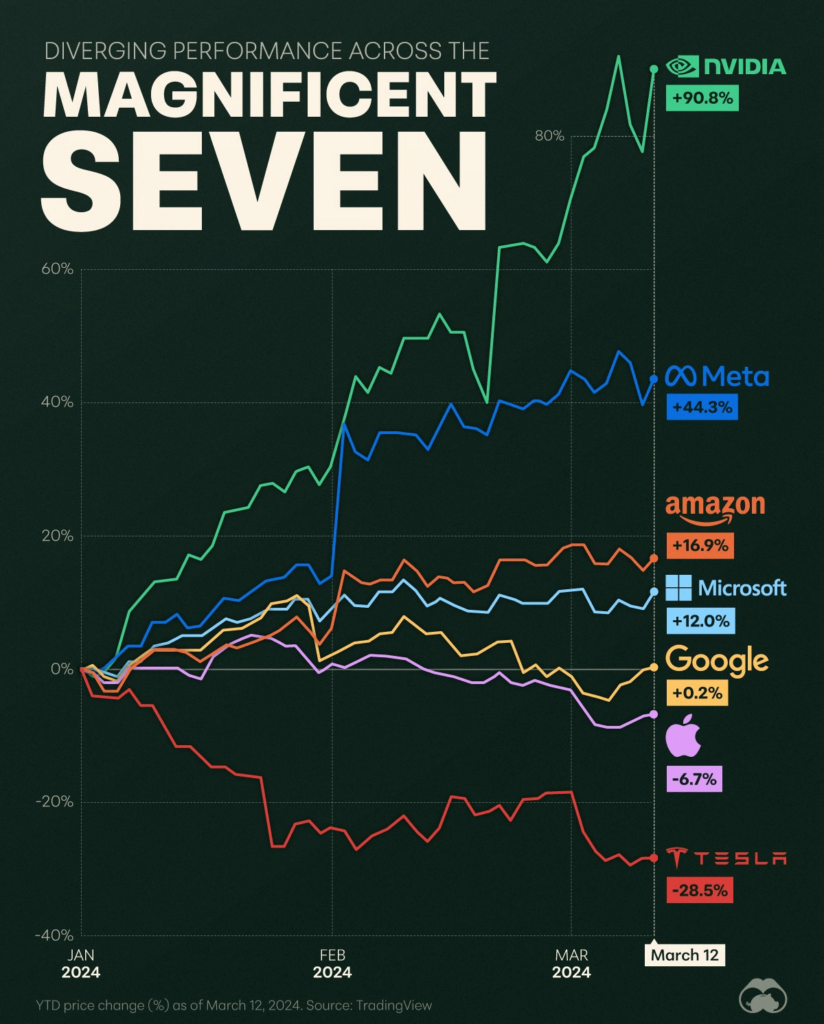

Although most of the ‘magnificent seven’ had a great start to 2024, Tesla (NASDAQ: TSLA) is an exception. The overall downturn in the electric vehicle (EV) industry has prompted investors to question their decisions, and insider sales certainly haven’t bolstered confidence in the company.

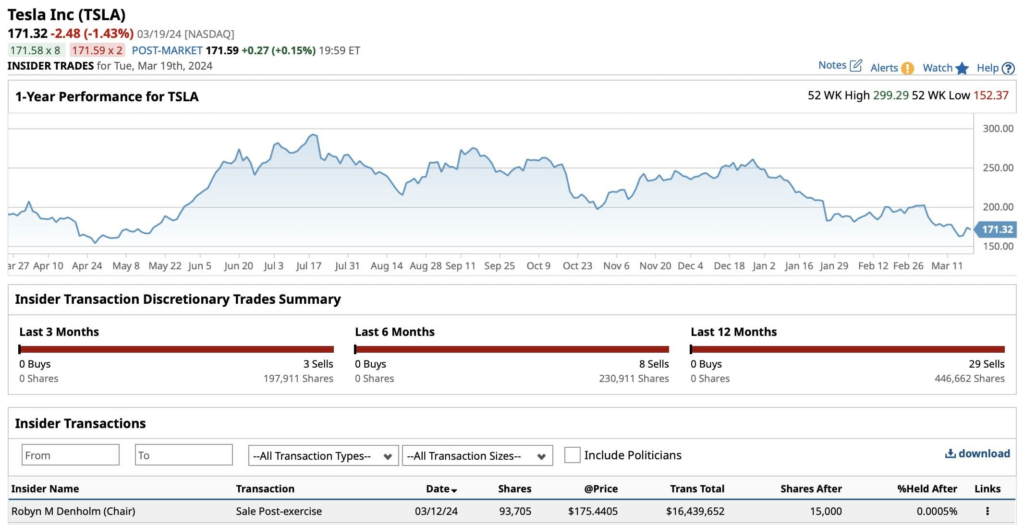

On March 12, Tesla’s Chair, Robyn Denholm, sold 93,705 TSLA shares at an average price of $175.4 per share, totaling $16,439,532. This transaction effectively reduced her stake in TSLA stock to just 15,000 shares remaining.

It’s difficult to discern the exact reasons behind this sale—whether it’s driven by personal motives, profit-taking, or potentially concerning factors regarding TSLA’s price. However, the timing seems unfavorable, particularly given Tesla’s performance in the market and the price at which the shares were sold.

Lackluster beginning of 2024 for TSLA stock

While other members of the prestigious ‘magnificent seven’ club are doing well, except for Apple (NASDAQ: AAPL), which is down -5.15% year-to-date, Tesla’s performance has been considerably worse with a -31% decline.

This decline has pushed Tesla out of the top 10 companies by market capitalization, placing it in 15th position, and trailing behind giants like JPMorgan (NYSE: JPM) and Visa (NYSE: V).

TSLA stock price chart

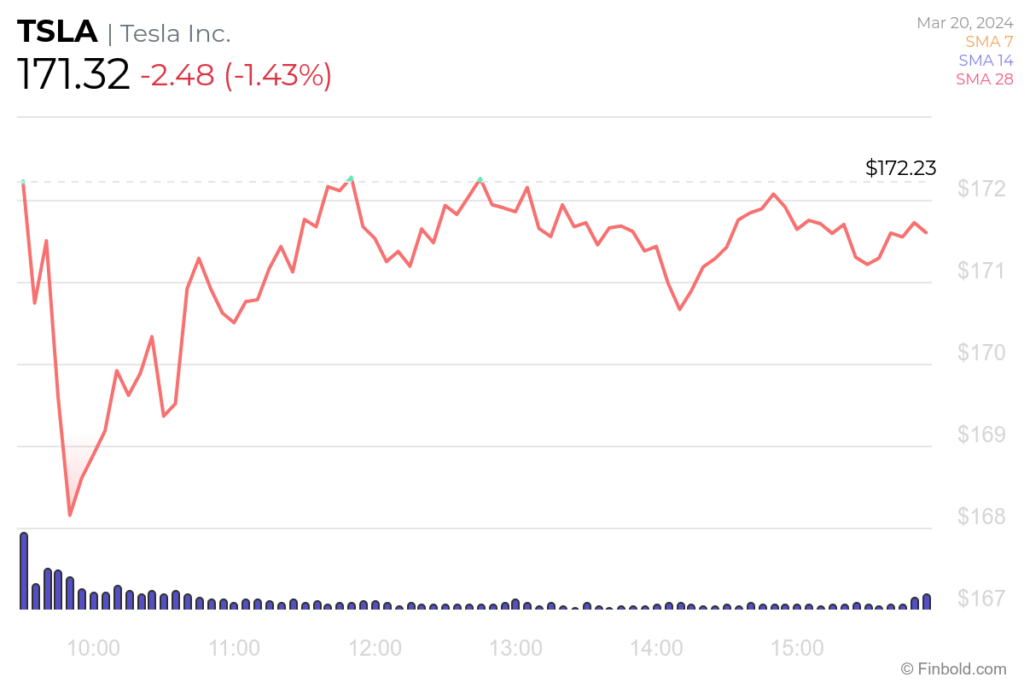

At the previous closing, TSLA stock was priced at $171.32, reflecting a loss of -1.43% during the last trading session. Over the past five trading sessions, TSLA shares have continued to decline, dropping by -1.06%.

The monthly chart also indicates a downward trend, with a significant decrease of -11.58%.

Tesla stock is nearing its closest resistance zone set at $173.81, with $163.56 serving as its nearest support level. If it successfully breaks out, the next resistance is expected at the $184 threshold.

Amidst a prevailing trend of heavy selling, Tesla insiders have collectively sold 197,911 shares of this EV automaker since the beginning of the year.

If this ongoing bearish trend continues, it could further jeopardize the future performance of TSLA stock, potentially driving it below levels observed almost a year ago when its shares dropped to a valuation of $153.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.