Amid the stock market gaining traction once again, it is odd to see insiders from large financial institutions selling their holdings. This usually signals an impending market downturn or internal problems that may affect the stock’s value.

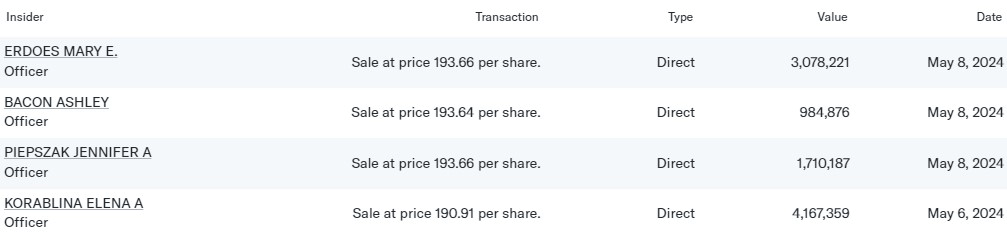

Confirming this trend, we’ve seen a surge in insider sales of JPMorgan (NYSE: JPM) stock, with insiders unloading over $10 million worth of JPM shares in just a few days.

Notable sellers include Asset & Wealth Management’s Chief Executive Officer, Mary Erdoes, its Chief Risk Officer, Ashley Bacon, its co-CEO, Jennifer Piepszak, and its Controller, Elena Korablina.

These insider sales follow reports that JPMorgan and Nomura Holdings are limiting their dealings with Simon Sadler’s Segantii Capital Management. Authorities in Hong Kong are charging the Asian hedge fund giant with insider trading.

Limiting exposure from the legal blowback

JPMorgan has stopped involvement with Segantii in new block trades and initial public offerings worldwide. Additionally, the bank will avoid opening new positions with the hedge fund or extending further financing to it.

Segantii has been a valuable client for Wall Street banks, particularly for offloading large chunks of shares in block trades and stock offerings. In March, the firm listed nine banks, including JPMorgan, Goldman Sachs, BNP Paribas, and UBS, as its prime brokers in an update to investors.

The Securities and Futures Commission of Hong Kong recently initiated criminal proceedings against Segantii, its founder Simon Sadler, and former trader Daniel La Rocca. They are accused of insider trading in shares of a locally listed company before a block trade in June 2017.

Block trades involve privately negotiated transactions off the exchange, typically dealing with substantial amounts of publicly listed shares.

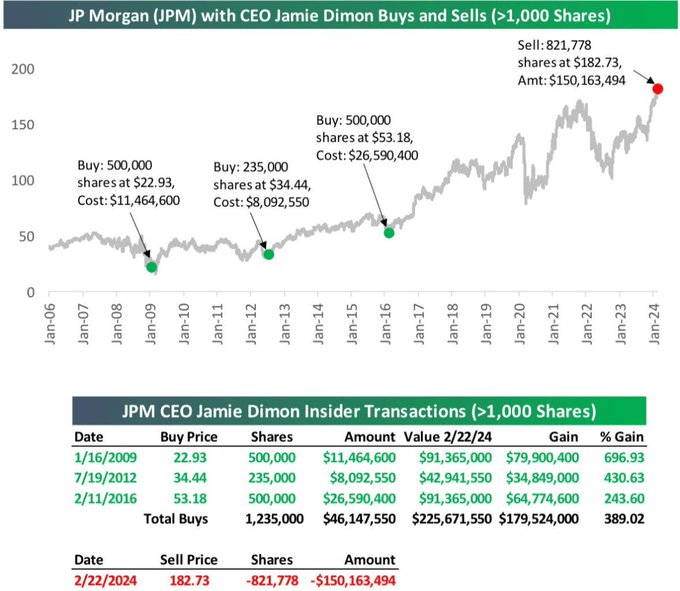

JPMorgan CEO Jamie Dimon made the most sizeable and impactful trades

Although not often active in insider trading, Jamie Dimon’s activity bears significant weight within itself, as it often forecasts considerable market shifts, where his purchases of JPM stock signaled strong market performance, and sales were preceding market downturns.

However, his latest trades involved sales totaling over $150 million on February 22 and over $32 million on April 15. These sizable transactions might be raising concerns within the trading community.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.