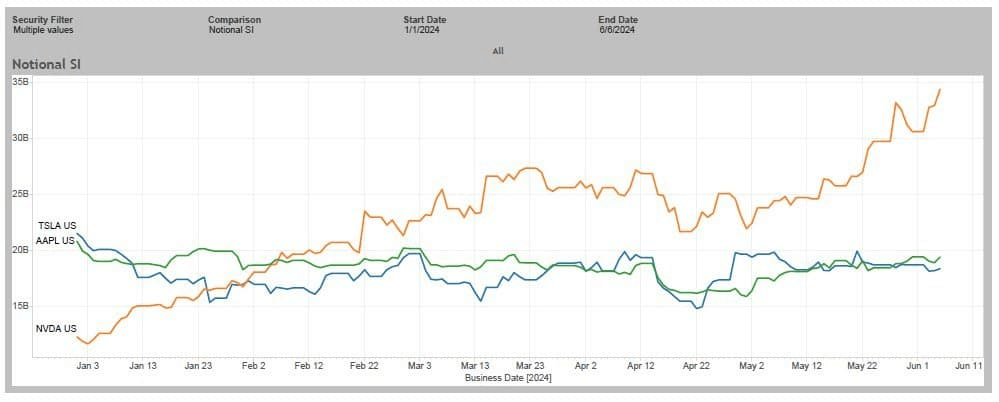

Short sellers are betting significantly more against Nvidia (NASDAQ: NVDA) stock than against Apple (NASDAQ: AAPL) and Tesla (NASDAQ: TSLA) shares, with outstanding short bets totaling $34 billion—nearly double the $18 billion and $19 billion short bets against Apple and Tesla stocks, respectively.

Outstanding short bets against Nvidia total $34.4 billion notional value as per Matthew Unterman of S3 Partners.

Reasons for the potential decline of Nvidia stock

There are reasons to believe that Nvidia’s stock price might decline from its current high levels. The AI chipmaker’s shares have surged over 200% from last year due to skyrocketing demand from Big Tech for its semiconductors, like the Blackwell and Hopper GPUs.

Nvidia has consistently exceeded Wall Street’s expectations, both from bulls and bears. Its stock price soared past $1,000 after reporting record-breaking first-quarter earnings.

The company even recently surpassed Apple as the world’s second-most valuable company. However, skeptics worry that the stock market is in an AI bubble that could burst, causing Nvidia’s shares to plummet.

Additionally, Nvidia’s highly concentrated customer base is working to develop its own AI chips.

Regulatory scrutiny and its impact on Nvidia shares

Nvidia’s dominance is also under scrutiny from federal regulators. The Department of Justice and the Federal Trade Commission have reportedly agreed to investigate Nvidia, Microsoft (NASDAQ: MSFT), and OpenAI for potential anti-competitive behavior in the AI sector.

While this investigation might not lead to lawsuits, legal challenges could divert resources from developing innovative AI hardware. However, experts believe a case against Nvidia would be preemptive and unlikely to succeed.

Despite mounting short bets against Nvidia, they still account for only about 1% of the company’s market value.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.