Retail investors have been instrumental in elevating semiconductor giant Nvidia (NASDAQ: NVDA) to emerge as the world’s most valuable company in terms of market capitalization.

However, amid the rally, there are now signs of uncertainty regarding the sustainability of NVDA stock. Data indicates a dramatic surge in retail investment inflows, while insider selling activity has simultaneously hit unprecedented levels.

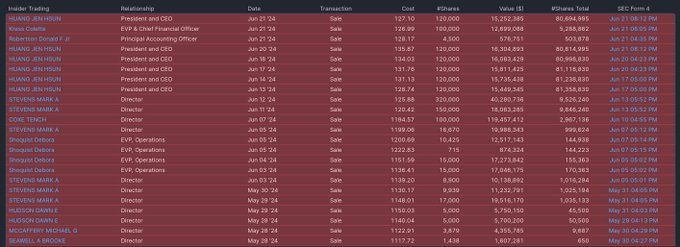

Particularly, a post shared by Market & Mayhem on X post on June 23 indicates that Nvidia insiders are offloading their shares at the ‘fastest pace seen in years’, raising questions about the stock’s future trajectory.

Notably, in 2024 alone, Nvidia insiders have sold $796 million of NVDA stock.

Nvidia’s contrasting insider selling and retail inflows

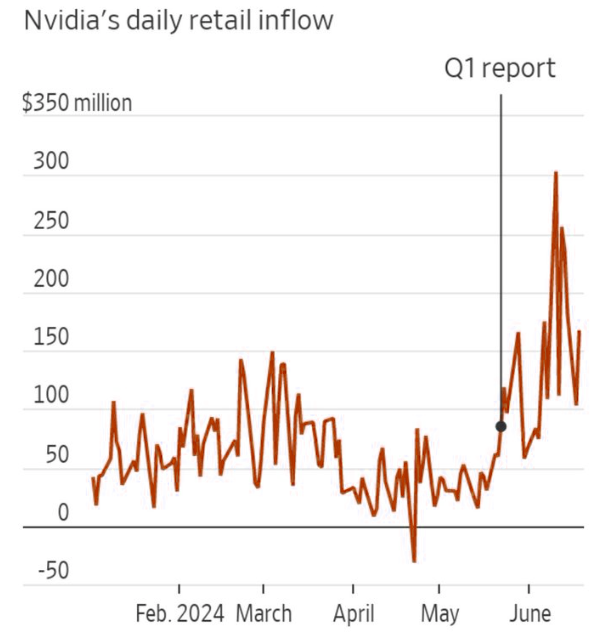

Nvidia’s daily retail inflows recorded a significant uptick from early May 2024, peaking around the company’s Q1 report release. The inflows surged to nearly $350 million in a single day. This sharp increase follows a period of relatively stable inflows ranging from $0 to $150 million from February to April 2024.

The firm reported revenue of $26.0 billion in Q1, up 18% from the previous quarter and 262% from a year ago. This appears to have been a major catalyst for this influx of retail investments. At the same time, Nvidia’s recent stock split 10-for-1 made the equity available to a wide range of investors.

Contrasting with retail investor optimism, Nvidia insiders, including top executives and directors, have aggressively sold their shares. Some individuals include President and CEO Jensen Huang, CFO Colette Kress, and multiple directors.

For instance, Huang sold over 120,000 shares across multiple transactions in June, totaling more than $15 million per transaction. Similarly, Kress executed sales exceeding 10,000 shares, translating to millions of dollars in each instance.

The frequency and volume of these sales signal a potential lack of confidence among insiders about the stock’s continued upward momentum.

Overall, Nvidia’s strong market position could be driving retail enthusiasm. On the other hand, aggressive insider selling might suggest that those with intimate knowledge of the company’s operations believe the stock is approaching or has reached a peak valuation.

This scenario could be a warning sign for retail investors. Insider sales are often viewed as a bearish indicator because they can imply that those most familiar with the company’s prospects are looking to capitalize on current high prices.

NVDA share price analysis

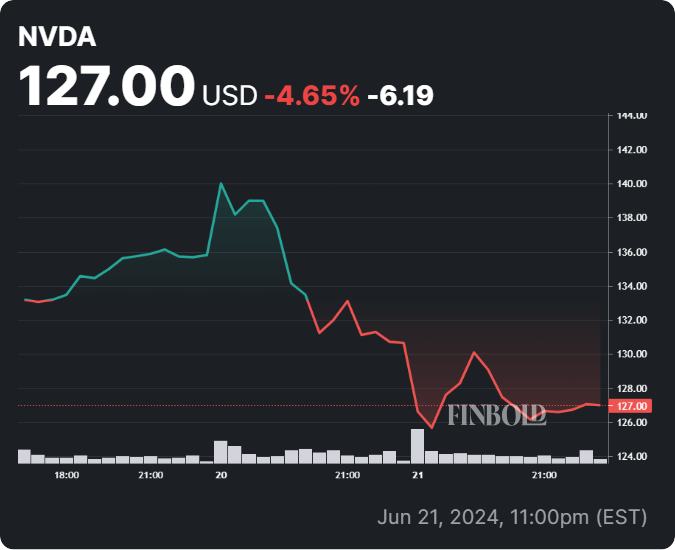

In the meantime, Nvidia stock is facing bearish sentiments in the short term. By the close of markets on June 21, the equity was valued at $127, reflecting a 24-hour correction of over 4%. Despite this, the stock remains green, gaining over 160% year-to-date.

In general, the equity has been flashing signs of a potential sell-off. For instance, as reported by Finbold, Nvidia consistently recorded a relative strength index (RSI) above 70, signaling a possible overbought scenario.

Finally, if Nvidia crashes, the stock could trigger a potential artificial intelligence (AI) bubble burst, as the company is the sector’s leader.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.