In light of Nvidia’s (NASDAQ: NVDA) impressive performance over the past decade, financial and cryptocurrency experts now anticipate a significant shift, predicting that the tech giant has “near zero chance” of outperforming Bitcoin (BTC) in the upcoming decade.

This forecast is part of a wider discussion on the evolving dynamics between traditional high-growth tech stocks like Nvidia and growing digital currencies such as Bitcoin.

Nvidia, a leader in the semiconductor industry, recently celebrated a remarkable milestone with its stock price soaring following the latest earnings report.

This surge contributed to an overall return of 21,558% from May 2014 to May 2024, a growth significantly fueled by the company’s pioneering efforts in artificial intelligence (AI) and gaming technologies.

An X post from The Kobeissi Letter on May 25 highlighted this extraordinary performance:

“$NVDA has officially joined the exclusive club of 250,000%+ in all-time returns. $10,000 invested in Nvidia in 1999 is worth $25.3 million today.”

Despite these impressive gains, Bitcoin has emerged as a formidable competitor. It has returned 13,048% over the same period, with recent trends suggesting even greater potential.

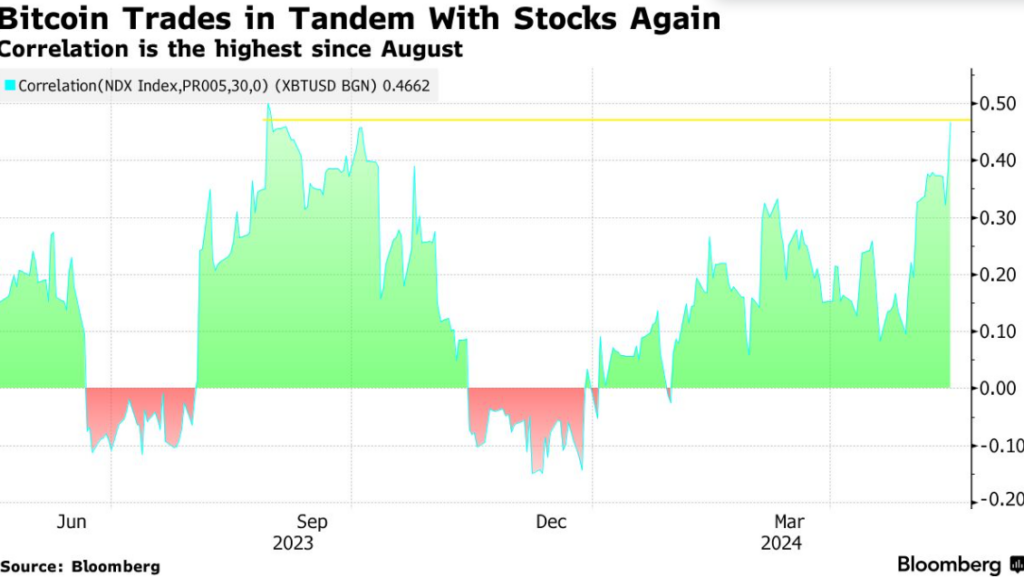

Notably, the 90-day correlation coefficient between Bitcoin and the Nasdaq 100 index rose to 0.46 last week, marking the highest level since late August.

This reflects Bitcoin’s increasing alignment with mainstream financial markets, a trend further evidenced by its comparison with high-growth tech stocks.

Correlation index. Source: Bloomberg

Cory Klippsten, CEO of Swan Bitcoin, and Lyn Alden, a noted investment strategist, have expressed skepticism about Nvidia’s capacity to replicate its past decade’s success.

They highlight Bitcoin’s advantages, such as its integration into mainstream financial products, including the recently approved Bitcoin ETFs, and its potential to outpace traditional assets due to its decentralized nature and extensive network effects.

Recent performance and market trends

The recent approval of spot Bitcoin ETFs on January 10 was a significant milestone that further legitimized Bitcoin as a mainstream investment option, boosting its returns to 31.7% since then.

This slight edge over Nvidia’s 30.2% in the same period underscores growing investor confidence in Bitcoin, aligning it with the growth trajectories typically associated with high-growth tech stocks.

Daniel Sempere Pico and Sina from 21st.capital have commented on the potential for Bitcoin’s financial networks and widespread adoption to drive more sustainable long-term growth compared to Nvidia’s AI-driven advancements.

They argue that while Nvidia’s innovations in AI are impactful, the broader applications of Bitcoin in global financial systems present a more compelling investment narrative, suggesting that the future of investment may tilt increasingly towards digital currencies over traditional tech giants.

Nvidia and BTC analysis: A comparative look at market performance

From January 1, 2024, to May 25, 2024, BTC-USD and NVIDIA demonstrated distinct trading patterns and growth trajectories, reflecting their unique market positions and investor sentiments.

Bitcoin exhibited significant volatility, with prices ranging from approximately $39,450 to $73,750, leading to a 63% YTD increase.

This volatility, highlighted by frequent relative strength index (RSI) signals of overvaluation and undervaluation, underscores the speculative nature of Bitcoin, influenced by diverse investor behaviors and market dynamics.

In contrast, NVIDIA displayed strong growth, with its stock price increasing from $475 to $1,064, marking a YTD rise of about 115%.

The stability in NVIDIA’s RSI suggests consistent market sentiment and fewer fluctuations attributed to its ongoing advancements in AI and the semiconductor sectors, which are vital for technological innovation and impact across various industries.

As Bitcoin increasingly competes with major tech stocks, its transformative role in the investment landscape is becoming more pronounced.

With broader adoption and alignment with financial markets, digital currencies are poised to dominate future growth, potentially overshadowing even the most established tech giants

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.