The artificial intelligence (AI) revolution is reshaping the technology landscape, driving immense growth, and creating substantial market opportunities. At the forefront of this transformation is Nvidia (NASDAQ: NVDA), a company that has pioneered AI technology and briefly became the world’s most valuable company by market capitalization.

On June 18, 2024, Nvidia’s market cap reached an impressive $3.3 trillion, surpassing industry giants such as Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL). The rapid market advancements have left investors wondering which company offers the better investment opportunity in this rapidly evolving sector.

To address this question, Finbold asked ChatGPT-4o which company, Nvidia or Microsoft, is poised to be the best performer.

Picks for you

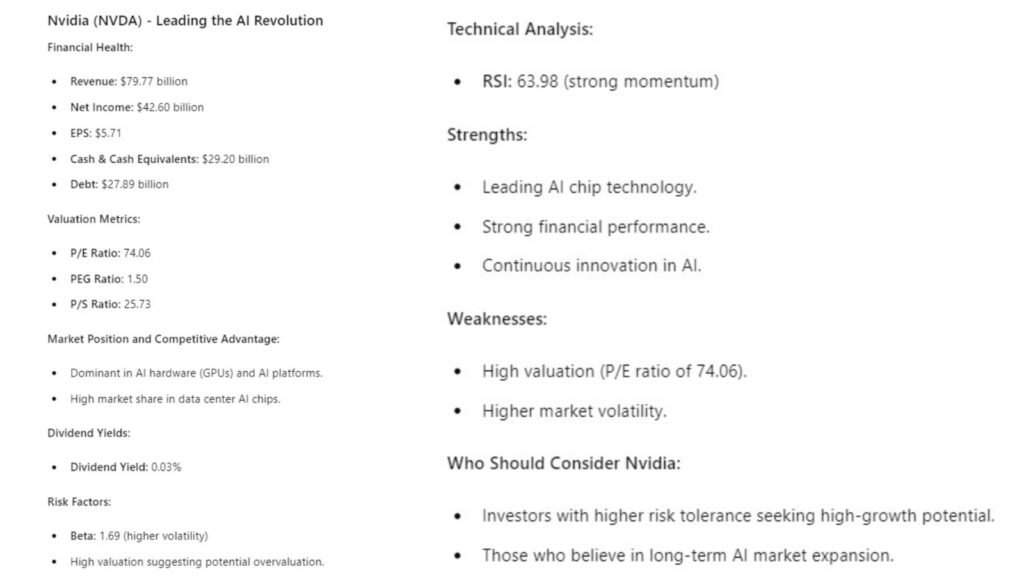

Nvidia (NVDA) – Leading the AI revolution

Nvidia has positioned itself at the cutting edge of AI technology, driving innovation with its advanced GPUs and AI platforms. On June 18, 2024, Nvidia’s market cap surged to $3.3 trillion, reflecting the market’s confidence in its AI-driven growth trajectory.

The upcoming Blackwell chips, set to roll out in 2026, promise significant enhancements in processing speeds and efficiency. Strategic partnerships, such as the collaboration with Foxconn, expand Nvidia’s reach into autonomous driving and electric vehicles.

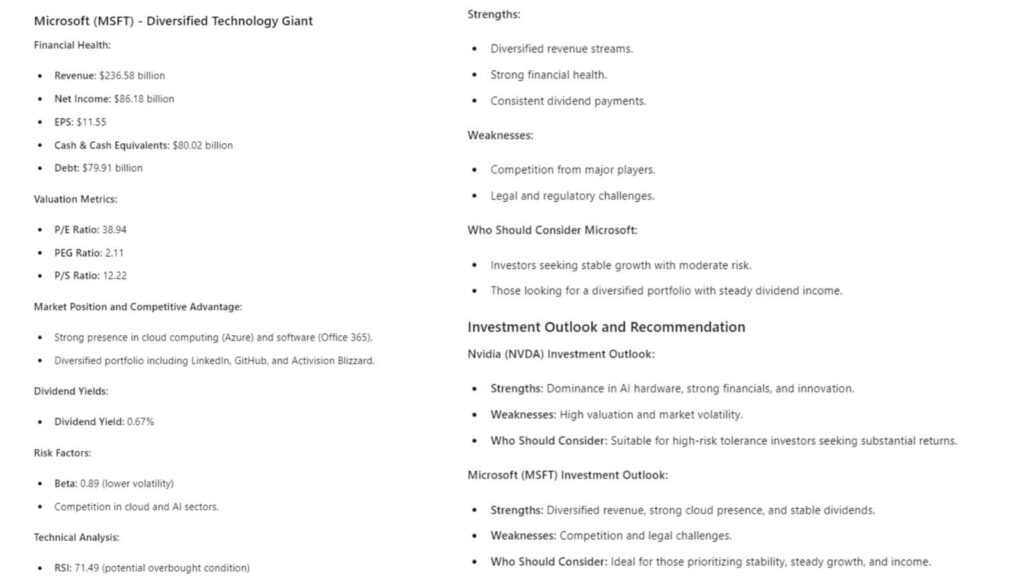

Microsoft (MSFT) – Diversified technology giant

Microsoft continues to integrate AI across its product suite, enhancing its cloud and software offerings. Its partnership with OpenAI has enabled the embedding of AI into the Office 365 suite and the launch of AI-powered tools like Microsoft 365 Copilot.

The Azure cloud platform, holding a 25% market share, is a significant contributor to Microsoft’s AI and cloud services expansion. The recent acquisition of Activision Blizzard has brought popular game franchises into Microsoft’s portfolio, further diversifying its revenue streams.

ChatGPT-4o investment outlook

According to ChatGPT-4o, Nvidia’s investment outlook is highly promising, driven by its leadership in AI hardware and continuous innovation in AI technologies. With significant advancements like the upcoming Blackwell chips and strategic partnerships expanding its market reach, Nvidia stands poised for substantial growth.

However, investors must consider the high valuation (P/E ratio of 74.06) and market volatility (beta of 1.69), making it suitable for those with a higher risk tolerance seeking significant returns from the rapidly growing AI sector.

On the other hand, Microsoft offers a stable and balanced investment outlook with its diversified revenue streams, strong presence in cloud computing (Azure), and robust financial health.

With a lower P/E ratio of 38.94 and a consistent dividend yield of 0.67%, Microsoft is ideal for investors seeking steady growth and income with moderate risk. The company’s strong financial performance and diversified portfolio make it a reliable choice for long-term value.

Conclusion

While Nvidia offers high-growth potential, it comes with higher risks due to its valuation and volatility. Microsoft, with its diversified revenue streams, strong financial health, and consistent performance, provides a more balanced investment option.

Microsoft is the overall better option for most investors, providing a blend of growth and stability with lower risk compared to Nvidia. This makes Microsoft a more prudent choice for long-term investment, especially for those who value steady returns and robust financial health.

Diversifying investments between both assets could also be a prudent strategy to mitigate risks and capitalize on the strengths of each company.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.