After an impressive run that has seen Nvidia (NASDAQ: NVDA) stock reach all-time highs and drastically expand its market cap to become the largest company in the world, the last few trading sessions were the worst in the previous four years.

They erased approximately $430 billion in market value and decreased the NVDA stock price by 14%.

As the decline extends in the pre-market, investors might wonder where it ends and whether the peak for NVDA stock has already been locked in.

Could Wall Street bullishness spell trouble for NVDA stock?

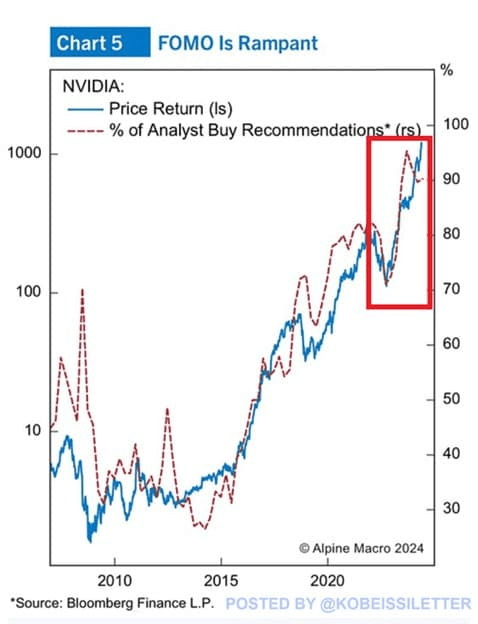

Interestingly, nearly 90% of Wall Street analysts now have a “buy” rating on Nvidia shares, a significant increase from about 30% a decade ago. This surge in buy ratings follows a remarkable 27,989% increase in the chipmaker’s share prices over the last ten years.

As the stock rally gained momentum, the number of buy ratings rose sharply. For comparison, around 70% of Wall Street firms had a buy rating on the stock in 2007, before a substantial drop caused by the Financial Crisis.

A similar pattern emerged in 2022 when the stock fell by over 60%, and analysts’ buy recommendations decreased accordingly. Wall Street’s bullish sentiment on the chipmaker has reached an all-time high, which might be a precarious development for NVDA stock.

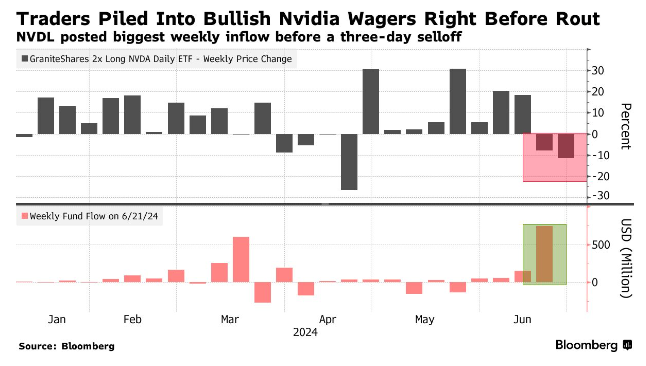

Traders that took a gamble on NVDA stock recently have lost

The Leveraged Nvidia ETF, designed to achieve daily investment results equal to 200% of the daily percentage change in Nvidia’s stock, experienced a record inflow of $743 million in the week before Nvidia’s largest three-day market cap decline in history.

This sharp drop in Nvidia’s stock value resulted in the ETF losing 20% of its value, causing investors to lose millions of dollars.

It might be hard to pinpoint why NVDA shares declined, as most recently, it has been nothing but good news for this semiconductor producer.

Perhaps too much optimism wasn’t a good thing, and recent record insider sales, which amounted to over $420 million in the past month alone, could have been a sign of trouble ahead.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.