Amid reports that Nvidia (NASDAQ: NVDA) is facing charges from the French antitrust regulator for allegedly anti-competitive practices, as well as investors starting to rotate out of the chip heavyweight, the price of the company’s stocks has started to feel their consequences.

As it happens, sources with direct knowledge on the matter have said that Nvidia was one of the targets of the French authorities’ dawn raids in the graphics cards sector back in September 2023 while, more recently, investors started abandoning the hottest artificial intelligence (AI) play of this year.

Nvidia stock price analysis

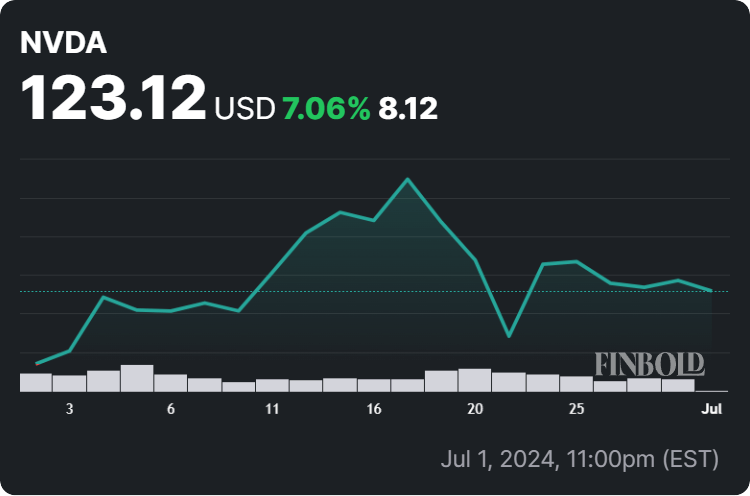

In this context, the price of NVDA shares has started to consolidate, as well as slipping by 1.42% in pre-market, at press time standing at $123.12, which also represents a 2.45% gain on the day, a decline of 1.93% across the week, and an accumulated increase of 7.06% on its monthly chart, as per data on July 2.

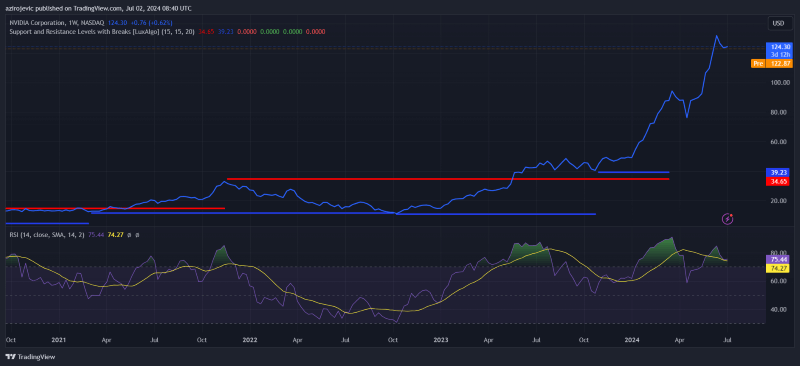

Indeed, after temporarily dethroning Microsoft (NASDAQ: MSFT) as the most valuable company, the technology giant’s stock has declined from the past month’s high of $135.58 to the current $124.30, as the stock market starts to cool down and the AI craze subsides.

Technical indicators remain strong for NVDA stock

That said, technical indicators are still strong on NVDA shares, demonstrating a consistently positive trend in the short, medium, and longer-term time frames, having outperformed 98% of all other assets in the stock market in its yearly performance and 99% of other stocks in the semiconductor sector.

On top of that, they have been demonstrating bullish hammer candlestick chart patterns on their daily and weekly charts, alongside flashing the weekly inside bar pattern, with the relative strength index (RSI) 14 currently around 75, and trading above the 5, 20, 50, and 200 simple moving average (SMA).

Are NVDA stock’s fortunes shifting?

However, some signs suggest caution, like the significantly higher trading volume in recent days and the fact that NVDA shares have been trading in the middle of the last month’s range between $112 and $140.76, which is rather wide and below their 10 SMA.

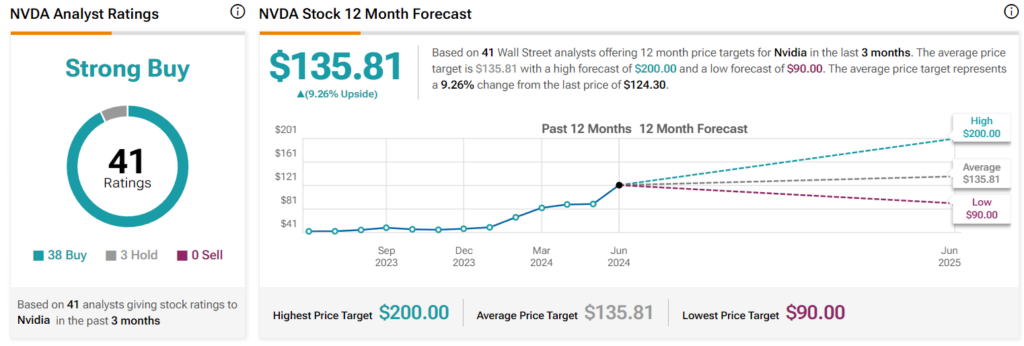

At the same time, finance experts offering their Nvidia stock price predictions in the last three months are confident about the performance of NVDA shares in next 12 months, expecting the average predicted price of $135.81 and retaining the stock’s overwhelming ‘strong buy’ score.

All things considered, Nvidia stock’s setup is still going strong and Wall Street analysts remain optimistic in its price despite the momentary hiccup. However, trends in the stock market can often shift unexpectedly, so doing one’s own research and weighing all the risks is critical when investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.