After Nvidia (NASDAQ: NVDA) announced a plethora of new features and products aimed at accelerating humanoid robotics development and generative artificial intelligence (AI) utility by a wider variety of businesses, the price of the company’s stocks might start feeling the effect.

Indeed, Nvidia has launched a score of services and tools to help the world’s leading robot manufacturers, AI model developers, and software makers develop, train, and build the next generation of humanoid robotics, as Nvidia CEO Jensen Huang announced at the SIGGRAPH 2024 conference. According to him:

“The next wave of AI is robotics, and one of the most exciting developments is humanoid robots. (…) We’re advancing the entire NVIDIA robotics stack, opening access for worldwide humanoid developers and companies to use the platforms, acceleration libraries, and AI models best suited for their needs.”

Additionally, it has introduced many updates to its software offerings to make generative AI use easier for more businesses, which include Nvidia inference micro services (NIMs) – software packages that address logistical issues involved in using AI for a specific purpose, Bloomberg reported on July 29.

Nvidia stock price analysis

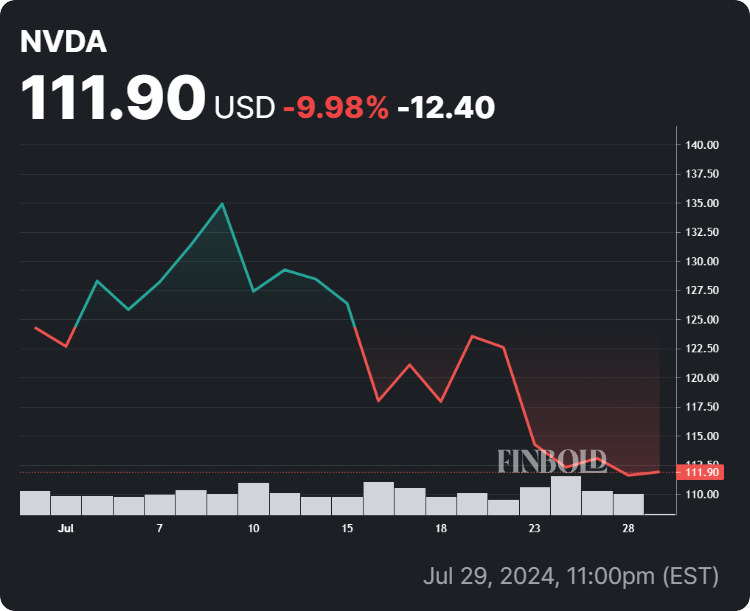

That said, the price of Nvidia stock is yet to reflect the recent announcements amid its recent weakness, which has seen NVDA stock decline 5.93% across the week and 9.98% in the last month after a successful first half of 2024 and a 131.82% gain year-to-date (YTD), as per data on July 30.

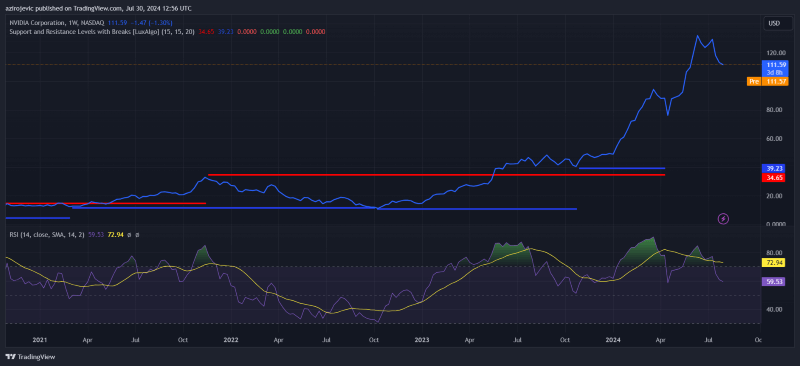

As it happens, NVDA shares had lots of success in the past period, including hitting a new all-time high (ATH) in mid-June, but it seems that this record has marked the top for the technology titan, at least according to the research company founded by renowned investor and analyst Puru Saxena.

Nvidia stock price technical indicators are mixed

That said, Nvidia stock is currently demonstrating good technical rating, although it does not offer a high quality setup considering the volatility of its price movements, with support zone at $111.58 and resistance at $123, formed by a combination of multiple trend lines in multiple time frames.

Furthermore, its short-term (5, 10, and 20) simple moving average (SMA) are all moving in the negative direction, albeit the 50, 100, and 200 SMA are still in the green, and its relative strength index (RSI) 14 is at 39.61 points, according to the most recent technical analysis.

What’s next for NVDA stock?

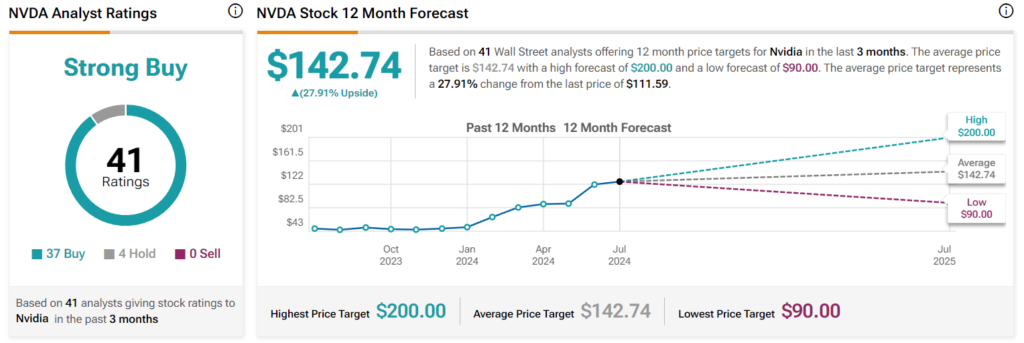

At the same time, finance experts providing Nvidia stock price predictions in the last three months are still confident that NVDA shares would recover and trade at an average of $142.74 in the next 12 months, as well as retaining their ‘strong buy’ rating for Nvidia, with four experts suggesting to ‘hold.’

Interestingly, Jim Cramer, the host of CNBC’s Mad Money, has been exceptionally bullish on Nvidia, opining back in 2021, after he had paid a visit to the company’s headquarters in Silicon Valley and talked to Huang, that Nvidia “may be a $10 trillion stock.”

Moreover, in June this year, shortly before the 10-for-1 NVDA stock split date, Beth Kindig, the I/O Fund CEO, said Nvidia could be a $10 trillion company by 2030, citing rapid development of new AI chips, a durable economic moat stemming from Compute Unified Device Architecture (CUDA), and other areas of the AI economy.

Ultimately, the situation concerning Nvidia shares is not entirely clear at this moment, and only time will tell whether the stock market recognizes the recent positive movements in the Nvidia ecosystem as bullish and rewards the NVDA stock price.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.