The United States economic landscape continues to draw attention amid concerns about an imminent recession.

In this regard, analysts are pointing out several indicators signaling tough times ahead, raising concerns about the economy’s future.

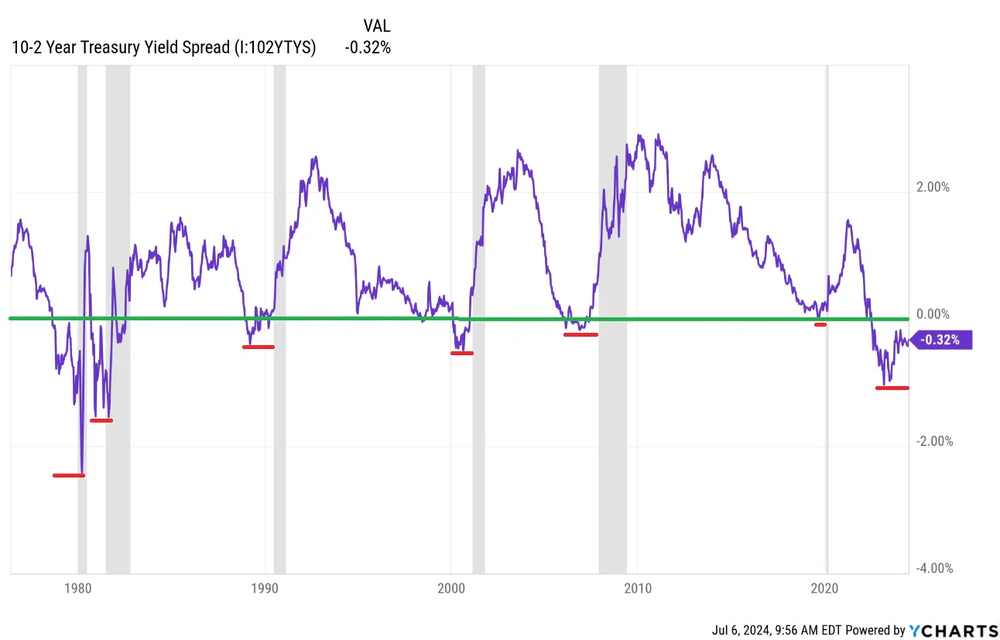

In one of the latest assessments, experts at Verified Investing reported that the 10-2 Year Treasury Yield Spread has inverted and persisted at alarming levels, surpassing even the durations seen before the Great Depression.

The yield curve, which typically measures the difference between 2-year and 10-year Treasury yields, normally shows higher yields for long-term bonds than short-term bonds, compensating investors for increased risk over time. However, when short-term yields exceed long-term yields—known as a yield curve inversion—it signals underlying economic troubles.

“Even when comparing the yield curve inversion prior to the Great Depression, it was not inverted for this long. This is an ominous signal for the future of the United States and much of the world. Investors beware,” the experts noted.

Yield curve’s longest inversion

The yield curve has been inverted since July 2022, marking the longest inversion on record. Historically, such inversions reliably predict upcoming recessions, though the actual downturn usually follows when the yield curve returns to normal.

Data shared by the experts in a July 6 blog post indicate that the current inversion, which has persisted longer than any previous instance, has a negative spread of -0.32%.

Verified Investing’s experts explained that longer bond durations typically command higher interest rates to compensate for a normal economy’s extended investment period. However, the current inversion indicates systemic issues.

They emphasized that every previous yield curve inversion has heralded an impending recession, cautioning that while the inversion warns of trouble, the recession typically follows the return to a normal yield curve.

More recession indicators

Overall, this is not the first time the yield curve has been cited as a key indicator of recession. According to an April Finbold report, data-driven investment research platform Game of Trades noted that the 10-year/3-month US Treasury curve implied a time lag between its inversion and the onset of a recession.

In the meantime, it remains to be seen how the economic landscape will evolve, with most attention focused on the Federal Reserve’s next monetary policy.

Indeed, part of the market anticipates that the economy’s trajectory might alter once the Fed implements a rate cut.