Bitcoin (BTC) has touched a one-month low as significant outflows from digital-asset investment products and concerns over prolonged high US borrowing costs impacted the cryptocurrency market.

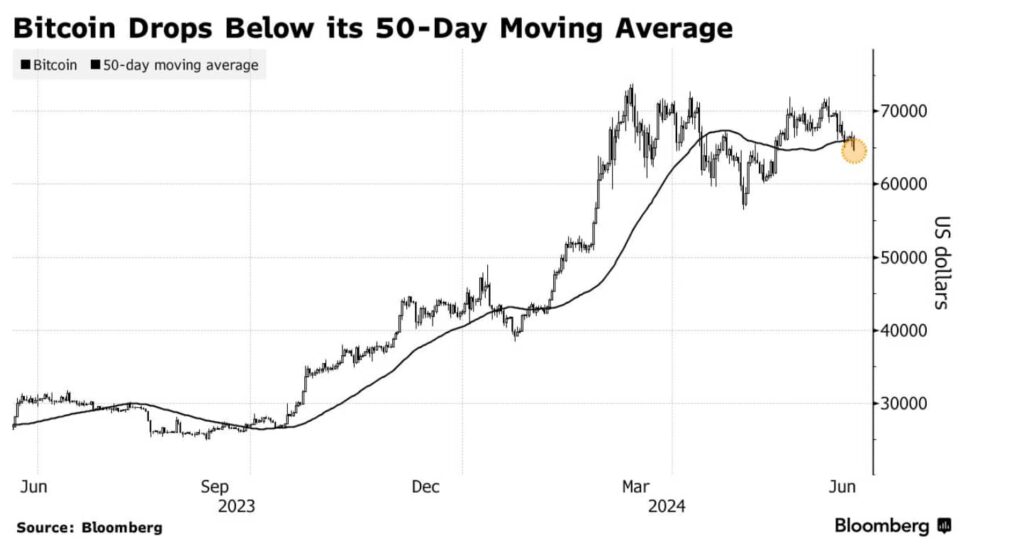

The largest digital asset dropped by as much as 2.7% on June 18, reaching a level last seen in mid-May, before recovering slightly to trade at $65,266. This decline saw Bitcoin drop to a crucial support level of the 50-day moving average, indicating a short-term downtrend in the crypto market.

In the second quarter, traditional asset classes like stocks and bonds have delivered better returns than Bitcoin, which has dropped about 5%. According to Bloomberg, global equities, fixed income, and commodities have all outperformed Bitcoin, highlighting a potential slowdown in the cryptocurrency market.

The latest CoinShares Weekly Asset Fund Flows report indicated $621 million in weekly outflows from Bitcoin investment products, while short Bitcoin funds saw $1.8 million in weekly inflows.

The report attributed the outflows to the Federal Reserve’s unexpectedly hawkish stance, which suggests maintaining high interest rates for longer, driving capital away from fixed-supply assets like Bitcoin.

Altcoins show resilience

Despite Bitcoin’s slump, altcoins showed resilience with notable inflows. Ethereum (ETH) investment products garnered $13.1 million, while Lido (LDO) and XRP Ledger (XRP) investment vehicles saw $2 million and $1.1 million in inflows, respectively.

However, these inflows into altcoins were insufficient to counteract the overall market outflows. Total digital assets under management declined from $100 billion to $94 billion during the week.

CoinShares data revealed that approximately $600 million was withdrawn from digital-asset products last week, the highest outflow since March. Persistent inflation and diminished expectations for Federal Reserve interest-rate cuts this year have posed challenges for speculative investments like cryptocurrencies.

Institutional adoption remains slow

Despite the initial buzz surrounding Bitcoin exchange-traded funds (ETFs) in the United States, institutional adoption of digital assets remains slow. All nine spot Bitcoin ETFs in the US recorded outflows of $208 million.

As per the data provided by LookonChain, Fidelity’s FBTC has recorded outflows of over $80 million, while Grayscale’s GBTC recorded outflows of over $60 million.

Blockchain analytics platform Santiment highlighted Bitcoin’s price dip below $67,000, leading to a wave of liquidations across the cryptocurrency market.

Bitcoin now sits above $64,500, raising concerns among traders and investors. Santiment also noted that this three-day decline is the most significant since before Bitcoin’s all-time high of $73,000 on March 14.

Traders, wary of further price drops, have been liquidating their holdings, contributing to Bitcoin’s sluggish performance this quarter. Yet, such corrections are part of the natural market cycle and could present a strategic entry point for long-term investors.

Conversely, Santiment reported an increase in Ethereum wallets, indicating continued bullish sentiment among investors for the second-largest cryptocurrency. Crypto bulls have lost nearly $400 million in the last 24 hours amid the market crash, with total liquidations amounting to $440.24 million.

At the press time, BTC is trading at $64,636, marking a 1% decrease on the daily chart and a 3% drop on the monthly chart, with its market cap dipping just below $1.3 trillion.

Traders and investors are closely watching these movements with cautious optimism for future recovery. Despite the current downturn, the market’s cyclical nature suggests that opportunities abound for those willing to navigate the volatility.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.