With Bitcoin (BTC) back above the critical price level at $60,000, several finance experts have offered their views on the next target for the flagship decentralized finance (DeFi) asset, which sees it hitting $150,000 in the long run, as recently reiterated by the $800 billion bank Standard Chartered.

As it happens, cryptocurrency investor and host Scott Melker, commodities specialist Mike McGlone, CoinRoutes chairman Dave Weisberger, and managing partner at the Bitcoin Opportunity Fund James Lavish, sat for an episode of Melker’s ‘The Wolf of All Streets’ streamed on May 6.

Discussing the potential Bitcoin target at $150,000, Melker argued that the maiden crypto asset could, indeed, hit this price, adding that the macro thought would suggest that $150,000 might be a really high target, but the “rational thought says ‘screw this, it could go higher.’”

Bearish Bitcoin price prediction

On the other hand, according to Bloomberg’s senior commodities expert McGlone:

“Everything is starting to tilt lower, Bitcoin’s potential leader, and it’s started. (…) Bitcoin has been underperforming the S&P500 NASDAQ for a couple of years now if you just look at the ratio basis and that’s a bit of a problem. (…) I want to see it really do well versus beta, but now that we’re past this perfect storm for higher prices, that’s over.”

In his view, for Bitcoin to get to $150,000, the S&P500 “needs another 30%,” but “we have to admit one thing – that’s very rare for S&P500 to sustain 20% above its 100-week moving average (MA),” although he acknowledged that the largest crypto had the “long-term definable diminishing supply, increasing demand and adoption.”

Bullish Bitcoin price prediction

At the same time, Weisberger believes that Bitcoin could go even higher than the set price, arguing that the bigger picture was more important when analyzing the asset’s future price movements, explaining that he was “almost eye-wateringly, unbelievably more bullish about Bitcoin now than ever before.”

“If we’re going to get a cycle high this time, where will it be? My answer is somewhere over $200,000 because that would literally be average based upon what it’s done in the past. (…) You have to go back at least to 2015 if you want to start drawing charts because you have to take into account these cycles.”

Finally, as he concluded, “Bitcoin is cheap, cheap, cheap compared to its fundamentals,” while also sharing his opinion that it is basically “on sale, I think it’s at a discount and that how I look at it long-term,” stressing the irony of Bitcoin not being very attractive to investors when its price is stalling.

Meanwhile, Lavish pointed out that Bitcoin going in the opposite direction would still be a good thing, as it would allow the late-comers to grow their coffers with the largest asset in the crypto market, as it would only continue to grow its price in the future:

“If Bitcoin collapses down to the $30,000 – $40,000, that’s a tremendous opportunity (…) to grab some deep value on a long-term asset that will hold its value and will continue to appreciate in long periods of time, so just give it a few years, and that’s it.

BTC price analysis

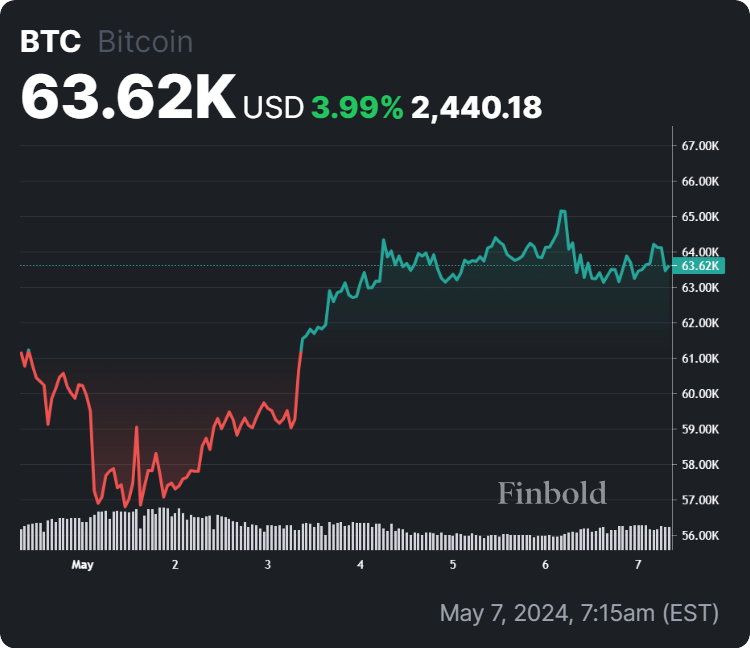

For now, Bitcoin price today stands at $63,620, recording a slight decline of 0.62% on its daily chart but, nonetheless, advancing 3.99% across the previous week as it attempts to reverse the previous losses of the accumulated 8.37% in the past month, as per data on May 7.

As a reminder, Bitcoin’s recent rally past the $60,000 price level marked a significant recovery from its drop below the $57,000 zone ahead of the recent Federal Open Market Committee (FOMC) meeting, signaling the possible end of the post-halving ‘danger zone.’

That said, things in this market can sometimes change suddenly, so making any specific Bitcoin price prediction is difficult, regardless of the technical analysis (TA) indicators and experts’ views, therefore doing one’s own research and weighing personal risks is critical.

Watch the entire video below:

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.