Following the Federal Reserve’s July 31 decision to leave interest rates unchanged, a number of cryptocurrencies saw drastic losses.

Among them was SPX6900 (SPX), BlackRock’s third-largest holding sitting behind only Bitcoin (BTC) and Ethereum (ETH).

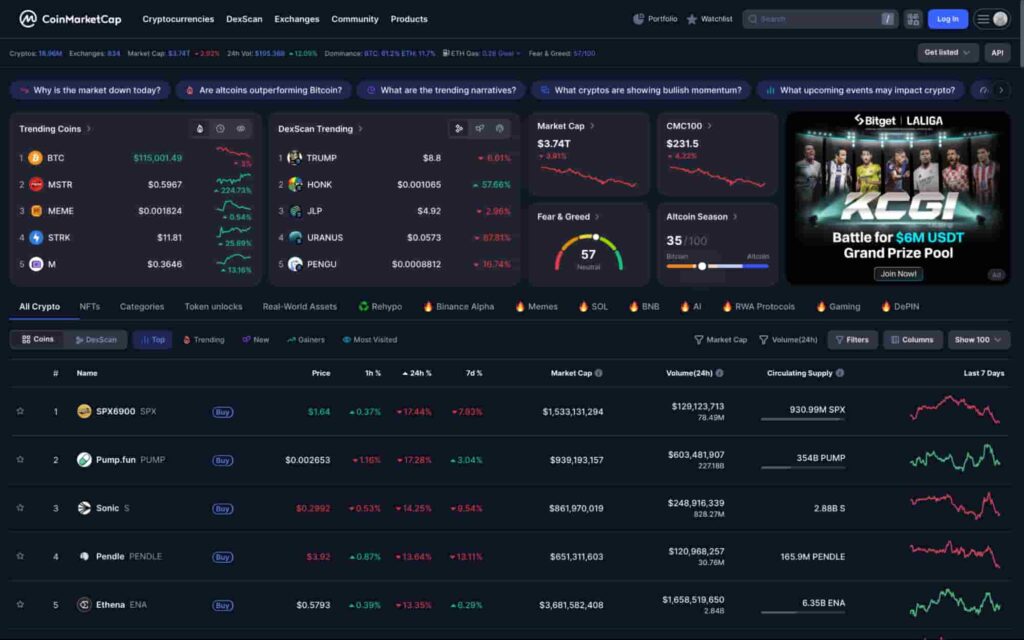

Namely, the meme coin plunged by 17.44% within 24 hours of the announcement, a few days after being declared the best-performing coin in the past three months.

As a result SPX6900 is now the biggest loser among the top 100 cryptocurrencies by market capitalisation in the last day.

At press time, SPX which was likely transferred to the BlackRock account was trading at $1.64, with a market cap of around $1.54 billion and a daily trading volume of approximately $129.1 million.

Why is SPX down?

The recent pullback follows a staggering 204% rally over the past 90 days, making the coin especially vulnerable to correction pressure.

Technical signals turned decisively bearish on August 1, with SPX6900 breaking below a rising wedge formation, which suggests a trend reversal.

Widened Bollinger Bands (BB) likewise accompanied the breakdown, with the price slipping below the middle band. In the meantime, the moving average convergence divergence (MACD) histogram flipped into negative territory for the first time since mid-July.

As mentioned, the SPX situation is not isolated. The crypto markets bled $150 billion in total in the wake of new tariff discussions, its market cap falling from $3.89 trillion to $3.74 trillion.

Altcoins, however, suffered the most. Indeed, the Altcoin Season Index dropped sharply to 34, and SPX’s 30-day correlation with BTC rose to 0.82.

Featured image via Shutterstock