Bitcoin (BTC) fees skyrocketed to their highest level, above $100, as the halving occurred, racking up over $2.4 million in mining fees. As a result, users, enthusiasts, and investors may turn to low-fee cryptocurrencies for efficient alternatives, potentially increasing their market demand.

The 12,000-followers cypherpunk influencer, who goes by the alias Untraceable on X (formerly Twitter), believes an extended high-fee period for BTC can drive the cryptocurrency market focus to altcoins, possibly igniting an altseason.

In this context, one particular cryptocurrency shines with a unique approach to transaction fees in permissionless payment networks. The currently $1 Nano (XNO) has developed a feeless protocol using alternative data prioritization methods.

Picks for you

Why Nano has no fees?

Simply put, nano’s lack of fees is due to an open-source software design decision. Nano has no fees because it was designed that way.

However, the decentralized servers (or nodes) still have the usual infrastructure costs to run the network. Furthermore, they need to generate a small proof-of-work – similar to Adam Back’s hashcash, for emails – for sending and receiving transactions. The network has been running with this incentive model for over eight years at the time of writing.

Colin LeMahieu created and introduced Nano (formerly Raiblocks) in 2015 on the prominent BitcoinTalk forum. It uses a new technology called block-lattice, which creates a more efficient and scalable process for confirming transactions asynchronously (DAG).

“Hey everyone, I designed a system which, for lack of a better term, is called a block lattice.

The idea is each account in the system has a block chain that is controlled only by them, all chains are replicated to all peers in the network.

The advantage of doing this is each account can order their own transactions meaning no proof besides a digital signature is needed.

I think this goes a long way toward scalability by removing block intervals, mining, transaction fees etc and wondered what everyone thought.”

– Colin LeMahieu

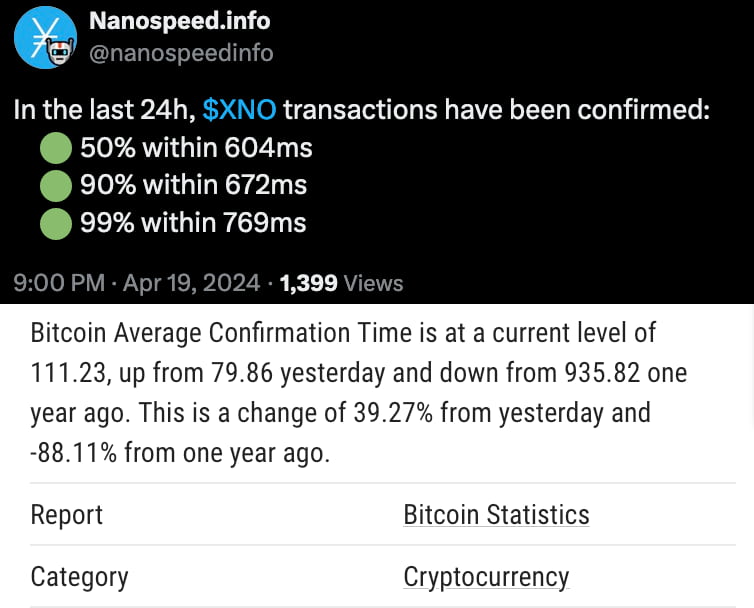

Besides the lack of fees, the block-lattice technology also allows blocks to confirm with deterministic finality in less than one second, as reported by Nanospeed.info. Meanwhile, Bitcoin’s average confirmation time is 111 minutes, according to yCharts data.

Is the Nano feeless network vulnerable to spam?

Interestingly, the feeless design decision has received much criticism over the years from competing cryptocurrency supporters and services. Some believe fees are crucial to prevent spam attacks and prioritize “legit transactions.” On that note, LeMahieu explained that this makes Bitcoin fees volatile while mentioning XNO’s unique methods of handling prioritization.

Over the years, open-source developers have implemented alternative prioritization mechanisms to the nano-node. Mira Hurley partially explained these solutions in a thread on X, published in December 2022. In short, transactions are prioritized based on an account’s activity frequency and how much XNO it holds.

This was recently tested during a spam attack that the network successfully managed despite some users reporting occasional delays of more than one minute for finality.

$1 cryptocurrency opportunity? Nano (XNO) price analysis

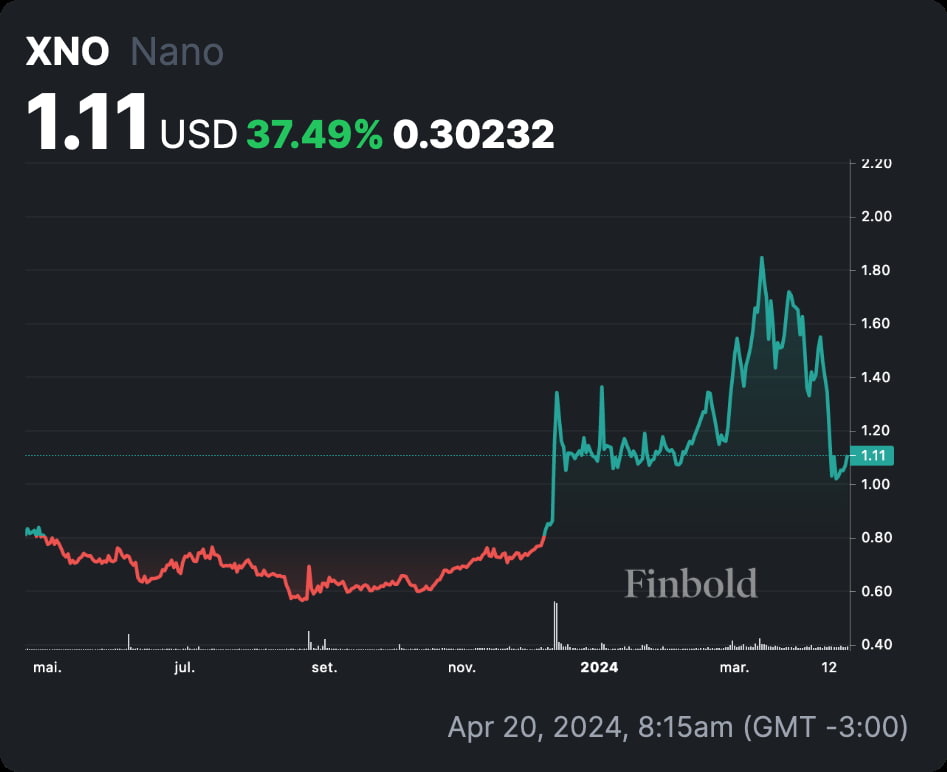

As of writing, XNO trades slightly above the $1 psychological level, at $1.11, up 37.49% year-over-year. The zero-fee cryptocurrency reached a yearly high of $1.85 in March, according to the Finbold index.

With a fully circulating supply of 133.24 million XNO, nano has a small market cap of nearly $150 million. This positions the digital commodity outside of the 300 most valuable cryptocurrencies.

The currently low capitalization means XNO holds high risks from an investment perspective. Thus, investors must do their due diligence and properly measure the risk-reward ratio before making significant financial decisions.

Low-cap cryptocurrencies are prone to higher volatility than the crypto market’s usual price fluctuations and require extra caution when trading.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.