Palantir Technologies (NYSE: PLTR) is on the verge of crossing the $40 threshold, driven by strong, sustained momentum and a large degree of investor enthusiasm.

At press time, the stock is trading at $39.58 — while it recorded a minor 0.47% loss on the daily chart, this is almost certainly a temporary setback.

PLTR share price has increased by 8.68% over the course of the week, 29.41% on a monthly basis, and the stock is currently up 138.51% year-to-date (YTD).

Will PLTR break through?

Over the course of the past month, PLTR stock has traded in the $29.50 — $39.29 range and is currently near the high of that range.

Palantir’s strong revenue growth, coupled with a seemingly unstoppable appetite for AI solutions has led to strong price action over the course of 2024. So strong, in fact, that even CEO and founder Peter Thiel’s recent sale of $600 million in PLTR shares has had no discernible effect on the stock’s price.

All in all, Thiel has offloaded more than $1 billion in Palantir stock — although these sales were pursuant to SEC rule 10b5-1, and as such, planned in advance.

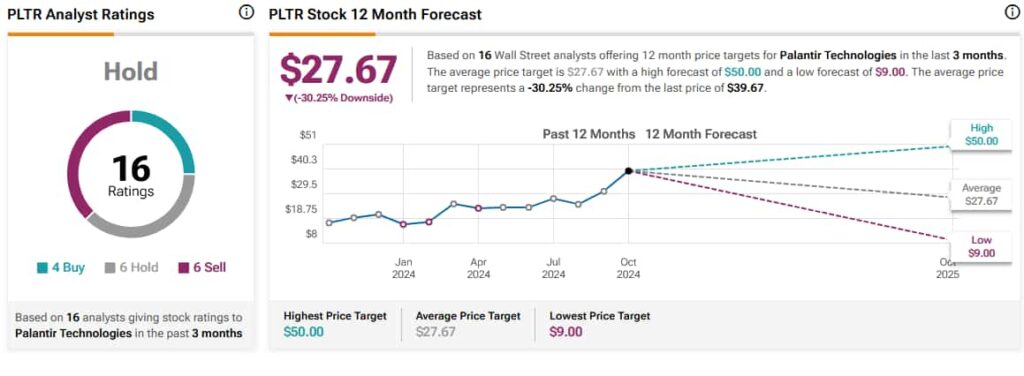

One of the strongest bullish signals that can currently be observed is analyst price targets. Bank of America’s (NYSE: BAC) Mariana Perez Mora recently added PLTR to the company’s exclusive U.S. 1 List while raising her price target from the previous $30 to $50. Per TipRanks, Perez Mora enjoys a 91% success rate, while her ratings result in average returns of 39%.

The equity analyst’s reevaluation is far from a lone sentiment — Dan Ives of Wedbush, a vocal PLTR bull, has reiterated his ‘Buy’ rating while increasing his price target from $38 to $45.

Bearish arguments for Palantir

While the stock’s performance over the course of 2024 is very impressive, and short-term outlooks are positive, investors and traders should always mind counterthesis.

PLTR’s high valuation has been a perennial concern among institutional investors, although the consensus seems to be softening a bit. In addition, the company’s efforts to diversify revenue streams away from government contracts toward the private sector have been slightly underwhelming, losing momentum quarter over quarter.

Concerns are also present that Palantir stock prices being as high as they are could lead to massive profit-taking on the part of institutional investors, an event that would doubtlessly see a sharp turn to the downside.

Palantir’s future prospects aren’t universally held to be bullish — the company ranks high on Wall Street for ‘Sell’ ratings. Plenty of analysts are bearish on the stock, with the average of price targets currently standing at $27.67, a figure that would amount to a 30.25% decrease in stock price.

To conclude — while PLTR is overwhelmingly likely to cross the $40 threshold in short order, significant concerns still abound as to whether the stock has the potential to sustain such high price levels in the long term.