The underperformance of Lucid (NASDAQ: LCID) is a matter of concern not just for institutional investors but also for individual traders who have invested their hard-earned money. The recent quarterly earnings report revealed a decline in vehicle production and delivery, which has left many wondering if Lucid can reverse its fortunes.

In its 2021 investor presentation, Lucid projected to deliver 90,000 vehicles and generate $9.9 billion in revenue for 2024. However, these estimates are far from reality. In its Q1 earnings, Lucid reiterated its 2024 production guidance of just 9,000 vehicles.

Analysts expect Lucid to generate only $733 million in revenue this year, significantly short of the projected $9.9 billion.

Hedge funds have mixed opinions about Lucid

The fundamentals, crucial for hedge fund decisions on investing in a specific company, do not look promising for Lucid.

As a result, many well-known financial institutions are either reducing their holdings of LCID stock or seizing the opportunity to acquire additional shares, hoping for a brighter future for this EV maker.

Two prominent hedge funds, Vanguard and Morgan Stanley, increased their holdings of LCID stock by an additional 489,187 (total 83.74 million shares) and 8.68 million shares (total 17.42 million shares) during Q1, respectively.

On the other hand, BlackRock and State Street reduced their stake by 8.51 million (total 40.83 million shares) and 4.63 million shares (total 15.19 million shares) each in the same period.

However, Lucid’s biggest believer and supporter remains the Saudi Arabia Public Investment Fund (PIF), which has 1.65 billion LCID shares.

Furthermore, Ayar, a subsidiary of PIF, agreed to invest $1 billion in the company during Q1, providing much-needed financial liquidity for the company to continue operating.

The stage is set for Lucid’s short squeeze

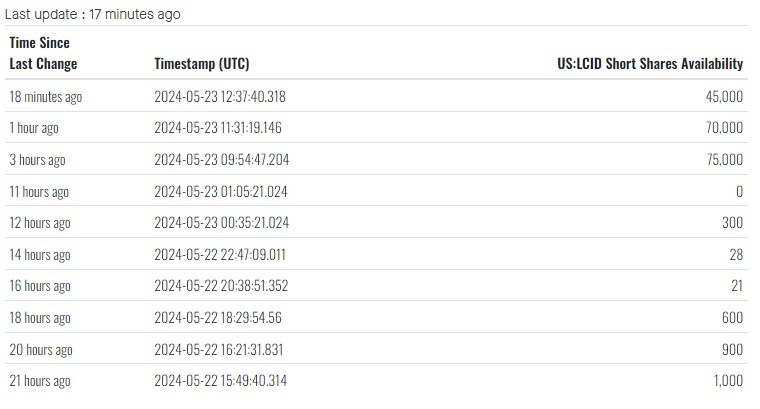

With an exceptionally high level of short interest in Lucid stock, which goes above 31%, and the rapidly decreasing availability of LCID short shares, which at one point in the previous 24 hours reached 0 and is again decreasing, the conditions for a Lucid stock short squeeze seem ideal.

The recent positive performance, which saw LCID stock add 14.68% in the previous month, may continue in the upcoming sessions. This would effectively liquidate most of the short-interest positions, which have an average of 48.21 days to cover, starting a short squeeze.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.