The stock market has been turbulent lately, facing challenges like geopolitical tensions, the underperformance of key players, and the possibility of no interest rate cuts this year, according to FED chair Jerome Powell.

Amidst this uncertainty, Super Micro Computer (NASDAQ: SMCI) stands out as a beacon of hope.

Analysts from Loop Capital are optimistic about SMCI stock, believing it still has room to grow. They’ve set a $1,500 price target for SMCI shares and maintained a ‘buy’ rating, suggesting a potential 70% surge.

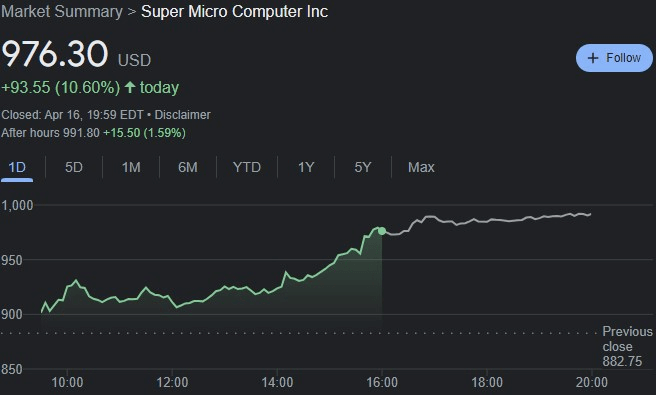

This news caused SMCI stock to jump by 10% in just one day, bolstering the case for its future gains.

What prompted the $1,500 target for SMCI shares?

Super Micro Computer is gaining confidence in its position as a leader in the generative AI server industry. Loop Capital believes that despite discussions about its valuation (P/E ratio), a P/E ratio of 20x to 30x is sustainable if its fundamental thesis holds.

Loop Capital’s analysis indicates that SMCI’s business remains strong, with expectations of robust results for the March quarter and a positive outlook for June. They also believe that the long-term revenue potential of the company is not fully recognized.

Moreover, now that SMCI is part of the S&P 500, it engages in conversations with large long-term investors who see the logic in valuing a leading player in the growing Gen AI sector at 20x to 30x earnings.

Other analysts are also bullish on SMCI stock

Barclays analysts are optimistic about SMCI’s upcoming results and anticipate strong guidance, which they believe will surpass market expectations. They specifically highlight the potential strength in June-quarter guidance, driven by factors like Tesla (NASDAQ: TSLA) and Tier 2 Cloud.

Additionally, JPMorgan initiated coverage on SMCI with an ‘Overweight’ rating, emphasizing its leadership in the AI computing market. They underscore the increasing demand for AI-related workloads, including model training and inferencing, particularly from Tier 2 cloud service providers (CSPs) and enterprises.

Belief in the SMCI stock is bolstered by its impressive 242.02% rally since 2024 started. This makes it one of the top performers in the stock market and shows huge potential for further growth.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.