For several quarters, fears of the US economy slipping into recession have persisted, with attention focused on the Federal Reserve’s monetary policy decisions.

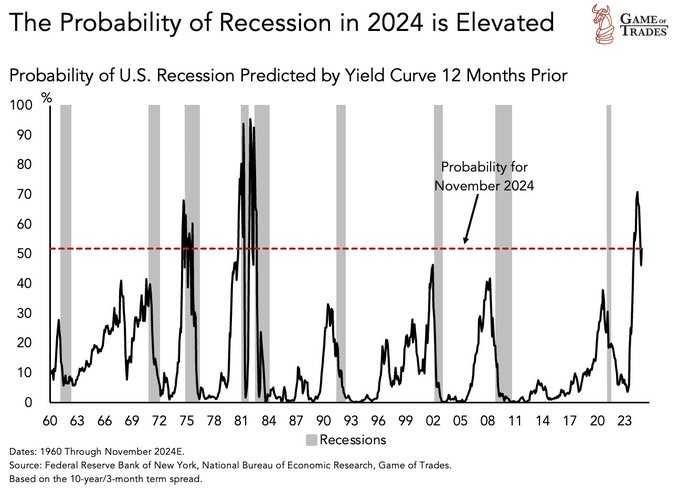

However, data shared by Game of Trades, a data-driven investment research platform, in an X (formerly Twitter) post on April 28th indicated that market participants should brace themselves, warning that the chances of a recession are peaking.

Of particular concern is the steepening of the yield curve, often regarded as a signal of economic trouble. Game of Trades suggested that this development will reveal the true extent of the damage to the Federal Reserve’s tightening measures.

Furthermore, the platform noted that the probability of a recession later this year remains “extremely elevated,” projecting November as the possible moment when the recession hits.

“The yield curve steepening is when we’ll see the real damage that was done from the tightening. Probability of a recession later this year is still extremely elevated,” the platform said.

The yield curve, tracking the difference between short-term and long-term interest rates on government bonds, can provide insights into investor sentiment and expectations about the economy’s future performance.

Other economic indicators raise concerns

According to the platform, recession fears resonate with concerns echoed by many financial analysts, suggesting that the Fed’s efforts to engineer a soft landing for the economy may not be succeeding as hoped.

Other economic indicators, in addition to the yield curve, have raised concerns about the health of the US economy. For instance, when measured annually, the real gross domestic product (GDP) for the first quarter of 2024 showed a 1.6% increase compared to the fourth quarter of 2023.

However, this expansion was at its slowest pace since the second quarter of 2022, reflecting a significant slowdown from 2023’s surprising rapid recovery.

Interestingly, following the release of the GDP data, some market players believe the economy is already in trouble. As reported by Finbold, Robert Kiyosaki, author of the renowned book “Rich Dad Poor Dad,” pointed out that the GDP data signals the economy is already in depression.

Additionally, US inflation rose to 2.7% in the year to March, another sign that price pressures remain stubbornly high. This complicates the Federal Reserve’s plan to cut interest rates this year. The unexpected rise will likely increase doubts about the Fed’s potential decision to lower interest rates later this year.