The global pandemic has profoundly reshaped the retail stock market. Due to movement restrictions and safety measures, customers avoided going to stores and turned to e-commerce instead. Furthermore, shopping patterns also changed, and companies had to adapt or face downturns.

Although the pandemic is gone, we still live in the post-pandemic era. Witnessing the benefits of e-commerce, consumers are reluctant to go back to old habits. This retail stock made use of these changed circumstances to beat the odds of the afflicted market and deliver returns. Today’s historical success story is about Shopify (NYSE: SHOP).

The shifted retail market

As COVID-19 turned tourism and entertainment virtually inaccessible, the consumer spending pattern drastically changed, and demand for certain products skyrocketed. Coupled with logistics issues, most retail industries struggled to produce and deliver their goods.

Then, when the pandemic ended and restrictions were lifted, the opposite happened. Product demand wound down and proceeded to plummet due to rising inflation and recession fears. While the first phase of the shift hit conventional retail, the second hit companies with excess inventory.

Only the most agile retail companies adapted to the swing in the circumstances, and the retail’s hidden champion is still beating the odds.

Best retail stock to buy now: Shopify beating the odds

The company has had a surprisingly successful 2023, with the Shopify stock price going more than double what it had been at its start. The surge even beat the big e-commerce players like eBay (NASDAQ: EBAY) and Amazon (NASDAQ: AMZN), despite Shopify having a fraction of their sales.

One of the advantages that gave Shopify an edge was its scalable, comprehensive e-commerce platform and the point-of-sale system. The integration provides more value to the merchants, which was reflected in an increase in total sales of 26% in 2023.

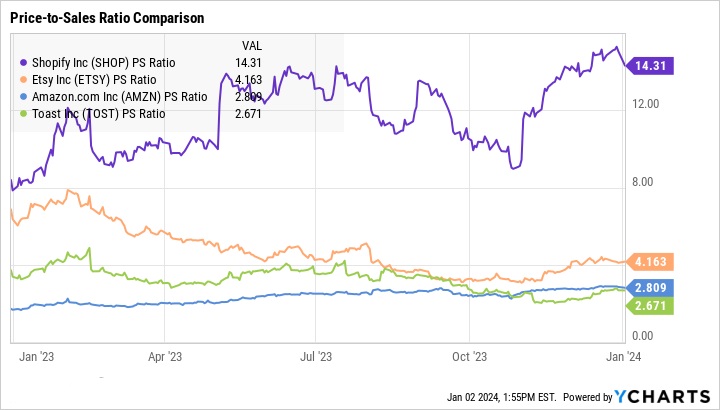

However, the company’s operating loss of $1.4 billion is not its proudest moment of the year. On the other hand, its 11% adjusted operating margin outperforms Etsy (NASDAQ: ETSY) with 10%, Amazon‘s 6%, and Walmart (NYSE: WMT) with 4%.

Considering everything, the upward trend in Shopify’s profitability should continue and solve any profitability issues the company had before. Also, as the company detached from its logistics department, the impairment charges won’t happen again in 2024, which is a green flag for both Wall Street analysts and growth investors.

Shopify stock price today

Is Shopify stock overvalued?

The 2023 annual financial report and the growth of this retail company have not gone unnoticed by investors, who have propped up the price of the stock. It currently stands at 14 times yearly sales, which is much more than 10 times the sales at the beginning of 2023 and much more expensive than most of Shopify’s competitors.

However, Shopify stock is still potentially lucrative if you plan to hold it and let it grow. It has an enviable rate of growth and all the necessary conditions to keep expanding. To highlight this, the company has estimated its 2024 sales to be almost 30% higher than in 2023.

About Shopify

Founded in 2006 and headquartered in Ottawa, Canada, Shopify provides businesses with its online platform in more than 175 countries. Some of the brands using the platform include Allbirds, Kylie Cosmetics, Gymshark, Staples, Heinz, Red Bull, and PepsiCo (NASDAQ: PEP).

Shopify uses a user-friendly and customizable interface to enhance inventory management and provide streamlined payment processing. Supporting enterprises of all sizes, Shopify handles 10% of the total US e-commerce and $444 billion of assets globally.

Shopify’s stock is an S&P/TSX 60 component. It trades on the TSX and NYSE under the SHOP ticker.

What is the prediction for Shopify stock?

Although the stock has a very high face value, everything indicates that its trend of success and expansion will continue into the near future. Therefore, the risk does not seem to be whether Shopify will remain profitable but whether you will pay too high a price if you buy it now.

For long-term investors, Shopify can be an excellent investment. Its growing sales and shrinking expenses project an even better outcome for 2024 than its stellar 2023 performance. Although much smaller than some other retail heavyweights, Shopify is poised to beat the odds and punch higher than its size.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.