The Securities and Exchange Commission (SEC) approved, on May 23, securities exchanges’ listing of Ethereum (ETH) spot exchange-traded funds (ETFs). ETH’s price surged following the news as related keywords started dominating the cryptocurrency space.

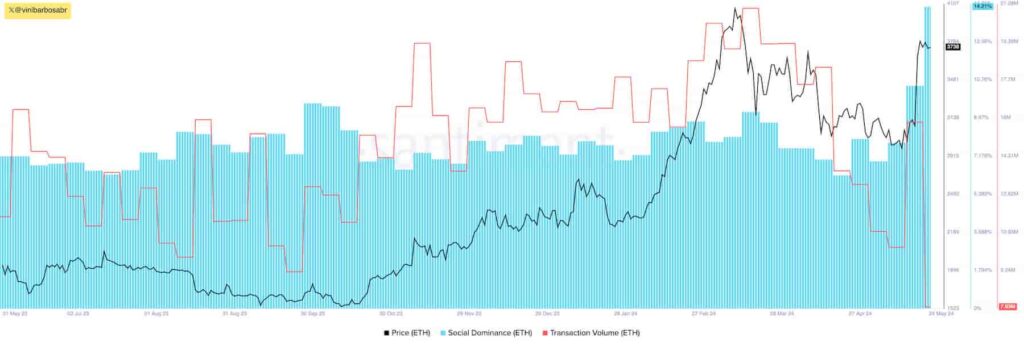

However, Vini Barbosa spotted divergent data on Santiment’s Sanbase Pro charts, suggesting retail traders currently dominate the Ethereum market.

In particular, Ethereum’s social dominance reached year-over-year highs at 14.21%, strongly dominating other cryptocurrencies in social indicators. This index alone usually suggests retail traders are the protagonists in the current action, and whales have previously opened positions.

Additionally, a key on-chain metric of network activity made one-year lows, showing divergence with the price and social indicators. Ethereum registered a weekly $7.63 million in on-chain transaction volume, which validates retail traders’ protagonism with lower relative volume.

Retail traders navigate Ethereum ETF news

From another perspective, Finbold also gathered data from Santiment that reveals the keywords “Ethereum,” or “ETH” dominated social context together with “ETF” on May 23 with 563 mentions on social platforms and a 4.05% dominance over other trending keywords.

Interestingly, most media outlets and influencers covered the SEC’s first-step approval of Ethereum ETFs, which the crowd replicated in groups. This could have fueled retail’s ‘fear of missing out’ (FOMO), driving ETH price upwards on crypto exchanges.

Yet, it is important to understand that the ETFs still need further approvals from the regulatory agency to start trading. The SEC currently only approved NASDAQ, CBOE, and NYSE to list the assets, but not the assets’ issuers themselves.

ETH price analysis

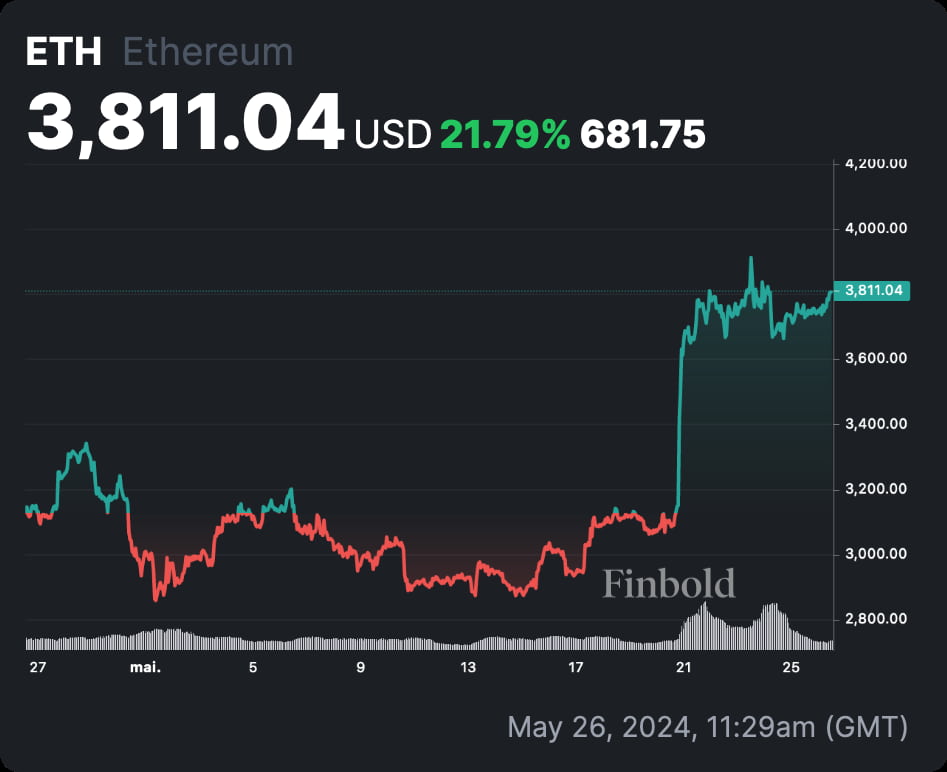

As of this writing, Ethereum was trading at $3,811, up 1% over its price on May 23. Moreover, ETH has nearly 22% accumulated gains month-over-month, suggesting institutional traders were already previously pricing the ETF news.

Now, ETH must be able to keep its momentum despite the drop in related social indicators and network activity. This will be challenging, and a weaker momentum with retail traders’ dominance could foreshadow a price correction before further surges.

Investors must remain cautious and avoid opening positions under FOMO, making rational and thoughtful decisions moving forward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.