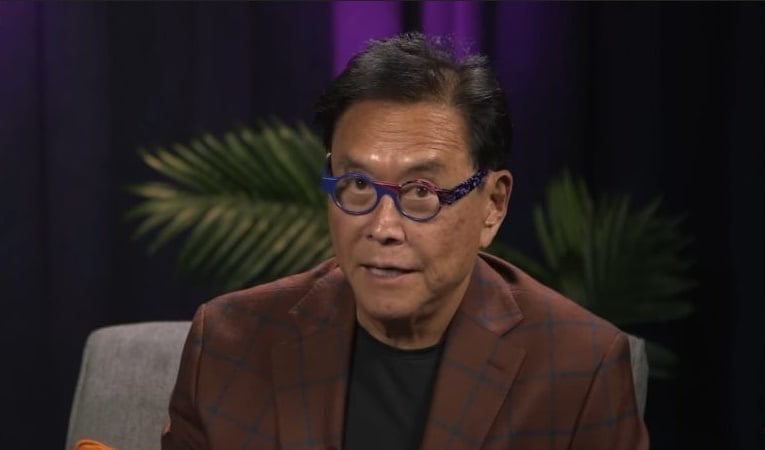

Renowned author and financial educator Robert Kiyosaki has accused American financial planners of dishonesty, citing their involvement in promoting conventional strategy that has guided investors for years.

Kiyosaki, also the author of the best-selling personal finance book “Rich Dad Poor Dad,” challenged the effectiveness of the 60/40 strategy, which advocates maintaining a diversified portfolio with 60% in stocks and 40% in bonds.

In a video published on The Rich Dad Channel on December 20, he suggested that this once-reliable strategy advocated by financial planners may no longer be suitable in the current economic climate.

“I got into a lot of trouble with American financial planners, and I don’t want to disparage a profession, but they’re liars. They talked about the billions of the 60/40 – 60% stocks, 40% bonds, and any idiot following the financial planner’s mantra of 60/40 is being crushed today,” said Kiyosaki.

According to Kiyosaki, the rule is ineffective, especially considering the devaluation of the dollar, which he believes is destined to fail. He recommended exploring alternative investment products.

Preferred investment products

In addition to his critique of the conventional investment strategy, Kiyosaki emphasized his preference for alternative assets.

“I save gold and silver; they’re God’s money. I also save Bitcoin, but I’m not an expert on Bitcoin. I’m just outside the system,” he stated.

The author’s latest insight is consistent with his criticism of the traditional financial system and the associated investment advice.

Kiyosaki’s emphasis on precious metals like gold and silver as ‘God’s money’ aligns with his longstanding belief in tangible assets as a hedge against economic downturns.

As reported by Finbold back in October, Kiyosaki suggested that investors adhering to the 60/40 rule are likely to be losers. To this end, the author shared what he termed as the best mix to survive a financial downturn. It is worth noting that Kiyosaki has long predicted an impending financial crisis that might evolve into a depression.

“Forever and ever financial experts have promoted the idea “Smart Investors invest in 60/40 60% bonds 40% stocks. In 2024 60/40 investor will be biggest losers. Before going down with the ship consider a shift to 75% Gold, Silver, Bitcoin 25% real estate/oil stocks. This mix may allow you to survive the greatest crash in world history,” he said.

Bitcoin could hit $120k

From his perspective, precious metals alongside Bitcoin (BTC) are well-positioned to withstand crisis and are poised for future price growth. For instance, he has maintained that Bitcoin will likely reach a new all-time high of $120,000 in 2024, citing it as the preferred investment choice as America grapples with high inflation.

Interestingly, the financial educator has suggested that the valuation of these three assets in 2023 can be viewed as a bargain.