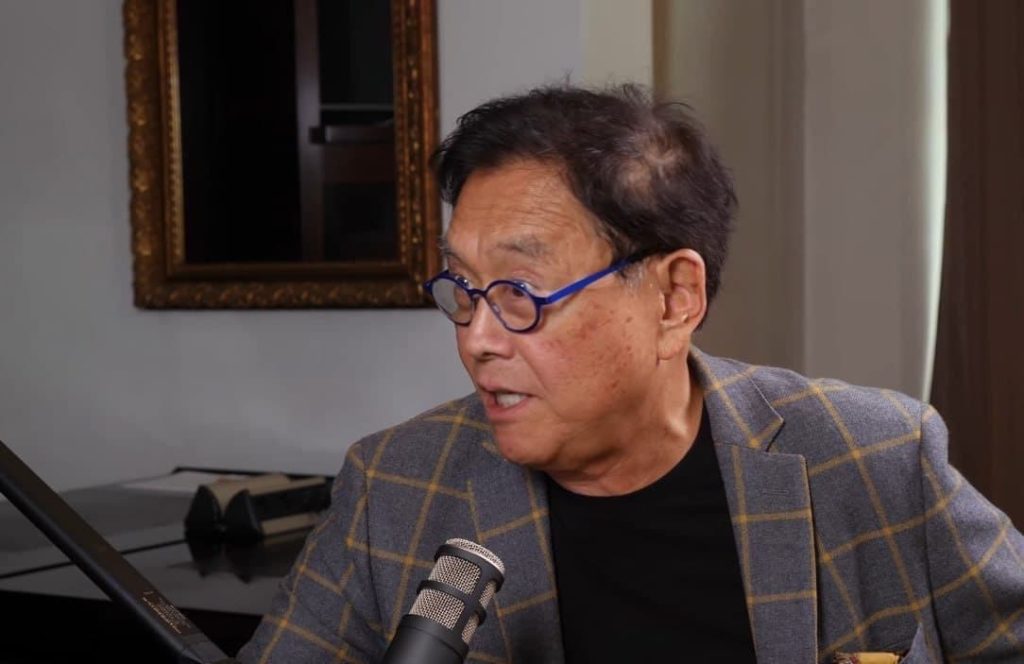

Renowned investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has once again called for readiness ahead of what he termed the ‘giant market collapse.’

In an X (formerly Twitter) post on December 1, Kiyosaki warned of an imminent market collapse and the possibility of the next Great Depression. He emphasized that buying gold, silver, and Bitcoin (BTC) is the best defense against a potential collapse.

The author pointed to what he termed the “3 stooges” running the White House, US Treasury, and the Federal Reserve as indicators of an impending crisis.

“Afraid giant market collapse is here because 3 Stooges running White House, US Treasury, and Fed. Possible next Great Depression. Possibly war. For millions, really hard times are ahead. For those in the right mindset and prepared, the next Great Depression will be the best time of their lives. Please prepare. Please take care. Buy gold, silver, Bitcoin,” he said.

Government mistrust

It is noteworthy that while Kiyosaki offers advice on accumulating assets, he has long accused the government and its associated agencies of failing to manage the economy effectively.

Kiyosaki has in the past expressed scathing criticism and mistrust for the Federal Reserve and other components of the country’s government, labeling them as “the Adams family” and “cartoons killing the economy.” He has asserted that the economy is “in serious trouble” and that these entities are “not our friend.”

As reported by Finbold, the financial educator expressed his perspective that governments exhibit a lack of concern for ordinary citizens.

He suggested that the sole method to safeguard oneself and loved ones is by working diligently, spending judiciously, and investing in assets such as gold, silver, and Bitcoin.

Criticism of conventional investment products

Furthermore, Kiyosaki has been an outspoken critic of conventional financial wisdom and a proponent of financial education to achieve wealth and success.

His latest warning and advice on navigating the potential challenges of a Great Depression echo his previous take on financial intelligence and strategic investment, where he advocated for the three asset classes.

Indeed, Kiyosaki has cautioned against accumulating traditional investment products, which, in his perspective, are assets he deems worthless. These include paper money, stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

He maintained that these are the very investments that the poor and middle classes often engage in, working diligently at jobs that provide taxable “fake” income, and promise a consistent paycheck, but offer no job security.