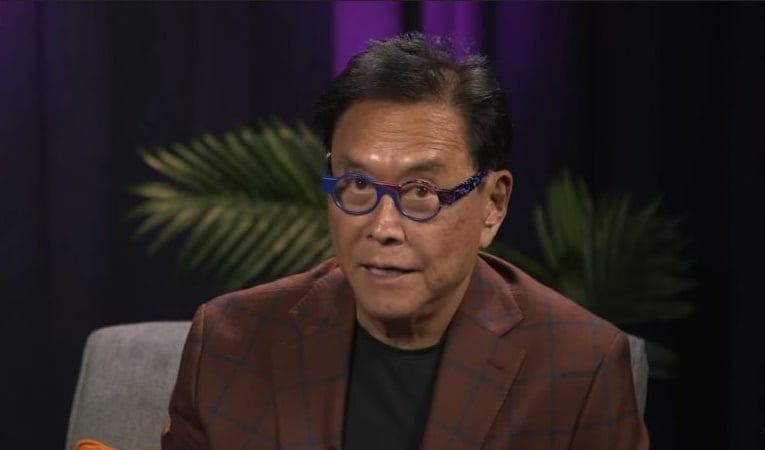

Businessman and author of the personal finance book “Rich Dad Poor Dad,” Robert Kiyosaki, has once again echoed his support for Bitcoin (BTC), noting that the cryptocurrency has the potential to act as an alternative to the current fiat system.

Kiyosaki labeled Bitcoin among the three ‘hottest subjects on earth’ alongside precious metals due to the deteriorating value of the United States dollar, he said during The Rich Dad Radio Show session on February 2.

“The hottest subject on the market today, and it’s not real estate. What it is here is this is gold, and this is silver, and of course, there’s Bitcoin. So those are the three things. And the reason they’re the hottest subjects on the earth right now is because our money is fake.”

Bitcoin is ‘people’s money’

Based on the potential posed by Bitcoin, Kiyosaki went ahead to term the asset as ‘people’s money. Although the best-selling author acknowledged that he does not know much about Bitcoin, he was glad to purchase the asset while still valued at $6,000.

Furthermore, Kiyosaki appeared to hail Bitcoin’s decentralized nature, stating that the current financial system is fake and characterized by theft.

“And this whole system is fake right now. <…> I’ve been saying this for years, this is God’s money. This is fake money. I like Bitcoin. I call it people’s money. Now I don’t know much about Bitcoin, but I’m just glad I bought it at $6,00. That’s all I know right now,” Kiyosaki said.

Bitcoin holders to get rich

Notably, the investor has termed the dollar ‘fake,’ stressing that the currency continues to be devalued by the increasing printing by the Federal Reserve. Consequently, he has blamed the Fed for failing to contain inflation resulting in a deteriorating economic outlook.

In this line, Kiyosaki had earlier projected that the Fed policies are likely to trigger a surge in Bitcoin’’s value in return, making holders rich. Indeed, Kiyosaki has maintained that Bitcoin is likely to stand out as regulators crush other assets classified as securities.

Finally, it’s worth pointing out that at the end of January, as reported by Finbold, the financial education advocate observed that the global economy was already in a recession while projecting a rough landing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.