The United States economy has displayed signs of further growth, evident in elements such as the increased number of new jobs and a cooling off in inflation.

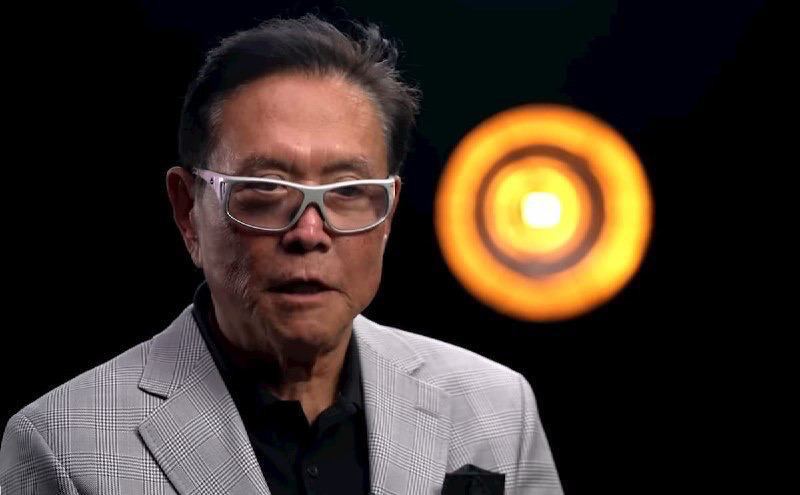

However, renowned financial educator and author Robert Kiyosaki, best known for his personal finance book ‘Rich Dad Poor Dad,’ has dismissed the notion of the economy being on a growth trajectory despite indicators like the robust stock market.

In a post on X (formerly Twitter) on February 3, Kiyosaki asserted that the true state of the economy remains questionable. He pointed out that only ‘suckers’ believe in the existence of growth, maintaining that a crash is imminent.

At the same time, Kiyosaki downplayed the strength of the “Magnificent 7,” noting that their recent growth has been sustained through what he terms as financing ‘by US government dollars.’

The Magnificent Seven refers to Meta Platforms (NASDAQ: META), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Netflix (NASDAQ: NFLX), Alphabet Inc (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA), entities that have significantly driven the stock market’s performance in recent years.

“The stock market is climbing higher and higher. Suckers actually believe the economy is strong. Don’t be fooled. The Magnificent 7 financed by US government dollars keeps the stock market up. Please be careful. Stock and bond markets are about to crash,” Kiyosaki stated.

US records strong economy data

Notably, the financial educator’s stance comes at a time when the US economy added 353,000 jobs in January, registering a stronger-than-expected gain to kick off 2024 and underscoring the resilience of the US economy in an election year.

Furthermore, the annual gross domestic product (GDP) report indicated that the economy grew at an annualized rate of 3.1% over the course of the year. At the same time, consumer price increases hit their lowest point in more than two years.

Kiyosaki, known for his contrarian views and unconventional investment strategies, has been a vocal critic of conventional financial advice. While the investor maintains a possible crash is imminent, he has advocated for investment in commodities, including gold and silver.

Featured image via Ben Shapiro’s YouTube.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.