Robert Kiyosaki, the author of the personal finance book ‘Rich Dad, Poor Dad’ has delved into the current state of the cryptocurrency market as the effects of the FTX exchange saga continue to manifest. The crisis has resulted in assets like Bitcoin (BTC) failing to hold critical positions while facing a threat of further correction.

However, Kiyosaki believes that a possible Bitcoin drop to about $10,000 should be exciting while noting that he is ‘not worried’ with the current price trajectory, he said in a tweet on November 11.

At the same time, the author hailed gold and silver as stand-out assets to invest in while hitting out at the Federal Reserve and the Treasury policies.

“BITCOIN? WORRIED? No. I am a Bitcoin investor as I am an investor in physical gold, silver, & real estate. I am NOT A TRADER or flipper. When BITCOIN hits new bottom, $10 to $12 k? I will get EXCITED, not worried. I bet against the Fed, Treasury, Biden, & bet on G,S, & Bitcoin,” Kiyosaki said.

Kiyosaki’s support for Bitcoin

Notably, Kiyosaki has emerged as a long-term supporter of Bitcoin despite the asset operating in an extended bear market. The author has previously warned of an upcoming market crash while stressing that Bitcoin can be a cushion in such an environment.

As reported by Finbold, Kiyosaki asserted that Bitcoin could protect wealth but stressed that the asset does not guarantee safety for incomes.

According to Kiyosaki, a potential crash would result from the central bank’s policies to handle the skyrocketing inflation.

Bitcoin bears remain in control

Despite Kiyosaki’s bullish stand on Bitcoin, the asset’s possible price bottom took a hit following the FTX crypto exchange liquidity crunch. Notably, Bitcoin has breached the $20,000 level correcting to $16,000. By press time, the flagship cryptocurrency was trading at $16,800.

Bitcoin has continued to sustain high selling pressure, as witnessed by the significant capital outflow. In particular, by press time on November 11, Bitcoin had a market cap of $323.38 billion, representing a loss of $85.32 billion from the $408.7 billion recorded on November 5.

Bitcoin technical analysis

Elsewhere, Bitcoin technicals are predominantly negative, with a summary aligning with ‘sell’ at 14. For moving averages, they point to a ‘strong sell’ at 13, while oscillators are neutral at eight.

Although Bitcoin had found some relief following the slight drop in the U.S. inflation rate, the bears are still battling to take control. In this line, as per a Finbold report, Jeffrey Tucker, the founder of Brownstone Institute, suggested that Bitcoin could retest the $10,000 level while projecting the bear market might extend further.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

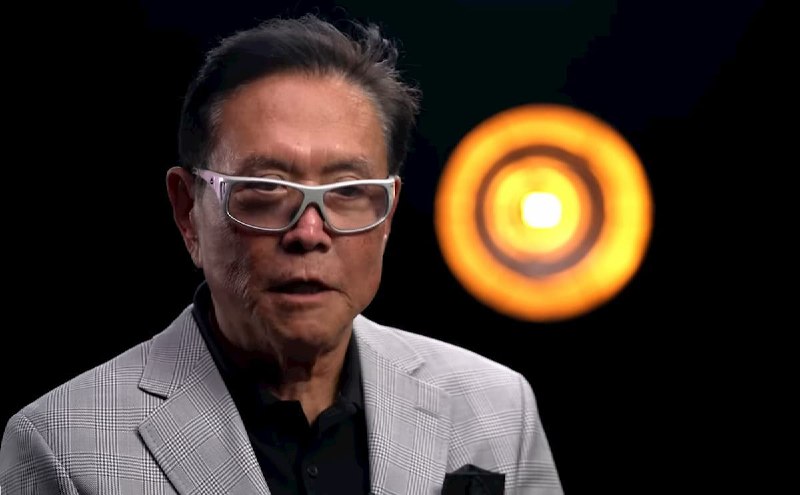

Featured image via Ben Shapiro’s YouTube.