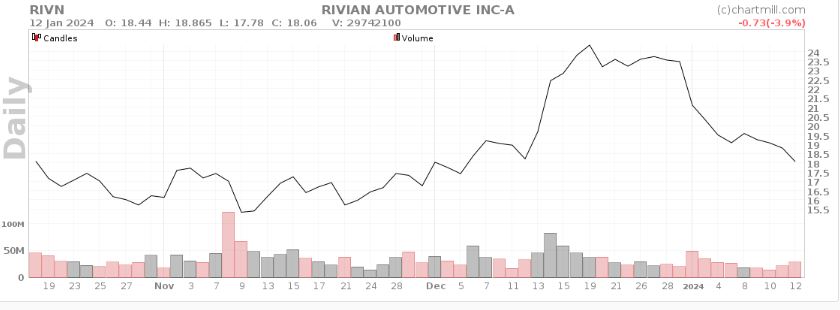

The stock price of Rivian Automotive (NASDAQ: RIVN) closed 2023 on a high note as the company navigated the highly competitive electric vehicle (EV) scene, successfully meeting most of its goals. The positive momentum was highlighted by the fact that RIVN rallied by over 30% in December 2023.

Indeed, for 2023, Rivian exhibited resilience, producing 57,232 vehicles and delivering 50,122, exceeding its production guidance of 54,000 vehicles.

It is worth noting that despite the impressive performance, Rivian is still unprofitable. However, the stock performance and delivery figures make it a company worth looking into.

Picks for you

In this context, Finbold looks at the potential of the EV manufacturer’s stock and whether investors should buy, sell, or hold it.

Why RIVN is worth buying in 2024

Rivian appears to be a promising investment option in the crowded EV market, considering factors such as stable production numbers and deliveries. Notably, American investment firm Baird endorsed the stock’s potential, labeling RIVN as the ‘best idea’ for 2024.

This endorsement is based on the ability to withstand supply chain constraints, which are anticipated to persist in 2024. In general, Baird sees RIVN trading at $30 in 2024.

At the same time, Rivian’s partnerships with notable firms will likely yield positive sentiments among investors. A noteworthy collaboration is with AT&T (NYSE: T), where Rivian vehicles are set to be piloted in AT&T’s fleet in 2024.

As part of this partnership, AT&T will be the exclusive connectivity provider for all Rivian vehicles in the U.S. and Canada. Additionally, Rivian aims to expand its customer base beyond Amazon, a key client for its commercial electric vans.

Another positive aspect is Rivian’s ability to avoid the price wars initiated by Tesla’s (NASDAQ: TSLA) constant changes. Unlike Tesla, Rivian has maintained steady vehicle pricing, mainly avoiding direct competition with Tesla due to differences in vehicle categories.

Wall Street analysts take on RIVN

Elsewhere, 20 Wall Street analysts at TipRanks believe the stock will likely rally within the next 12 months, gaining an average of $25.39, or a 40.59% growth from the current price.

According to the analysts who provided the stock forecast based on RIVN’s performance over the last three months, the stock is likely to hit a high of $40, while the lowest target was $15.

Among the analysts, 12 recommend buying Rivian Automotive.

Rivian stock price analysis

After an impressive 2023, Rivian stock has stumbled in 2024, mainly due to the bearish start of the general stock market, partly attributed to increased bond yields. As of January 12, Rivian stock closed at $18.06, reflecting year-to-date losses of approximately 14%.

The stock’s future trajectory may be influenced by overall market trends and potential supply chain disruptions due to geopolitical tensions. Rivian must prioritize customer satisfaction and attract new customers to maintain positive momentum.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.