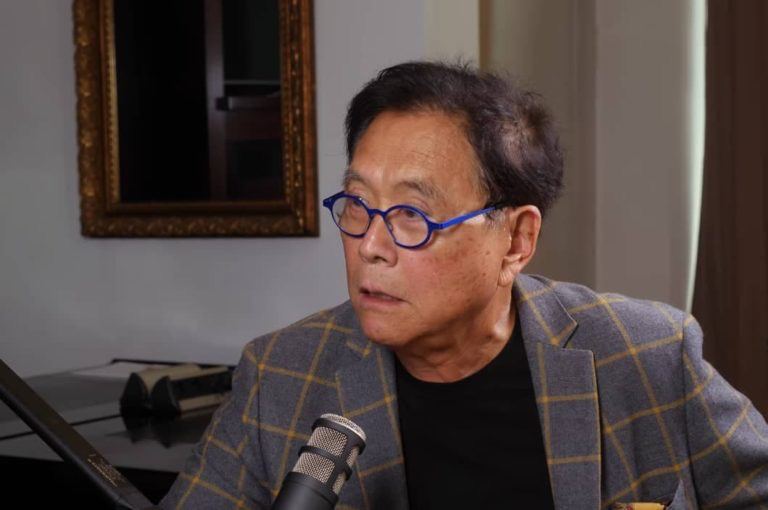

Amid repeated warnings of the possible financial crisis, particularly following the collapses of multiple banking giants, Robert Kiyosaki, the author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ has alerted his viewers of the perils of holding their money in regional banks.

As it happens, Kiyosaki was discussing the importance of investors understanding where they hold their money and the potential risks involved, with his guest Andy Schectman, the CEO of Miles Franklin Precious Metals Investments, in the latest ‘The Rich Dad Channel’ emergency podcast premiered on May 24.

According to the financial educator, small, regional banks could follow their larger counterparts in collapses but without the prospect of bailouts by the government, unlike the national banks that are under the government’s protection due to their systemic risk to the global economy.

As Kiyosaki explained, this could have wide-reaching consequences because:

“If a regional bank in your area goes down, your town goes down with it ‘cause there’s no more credit going into the market. And when that happens, it goes to depression. And that’s where we’re sitting. We’re sitting on the edge of not a recession, but a possible great depression.”

National versus regional banks

According to Schectman, national banks are bailed out “because they’re so systemically tied to each other” and “too big to fail,” their “balance sheets so intertwined with one another systemically that if they fail, it would have ramifications for the entire global financial system.”

“These large, too-big-to-fail commercial banks are (…) guaranteed by the Federal Reserve, while the rest of the banks, as we were told by Janet Yellen, if they’re not too systemically large (as the majority of them are not), they won’t be bailed out. They’ll be bailed in where the depositors are general creditors of the bank, and the money that you deposit really belongs to the bank and not to you.”

Specifically, he was referring to the United States Senate testimony by the Treasury Secretary on the 2024 budget and her reply to Oklahoma Senator James Lankford regarding the application of uninsured deposit thresholds in making the depositors whole.

Indeed, Yellen admitted that not all depositors would receive protection over the Federal Deposit Insurance Corporation (FDIC) limits of $250,000 per account and that government refunds of uninsured deposits would not extend to every bank that fails but only to those that present a systemic risk to the financial system.

What can one do?

Asked by Kiyosaki what a person can do to protect themselves against losing their money in case their regional bank crashes, Schectman has suggested investing in gold and silver, as well as removing oneself from the banking system altogether:

“If you have the ability to own some precious metals, do so because (…) it is an asset that is not simultaneously someone else’s liability. (…) So removal of counterparty risk, removal of variable rate debt, removal from the system best you can is where you start.”

In mid-March, Kiyosaki had commented on the collapses of major banks, stating that they “went WOKE and went BROKE” and advising his followers to invest in gold, silver, and Bitcoin (BTC) as a way to protect themselves against the crisis that was “just starting,” as well as the risks of losing their pensions, individual retirement accounts, and 401(k) plans.

Watch the entire video below: