After weeks of positive performance and a dominating bullish sentiment, the crypto market shifted to a slightly bearish short-term stance. Bitcoin (BTC) has led the movement, with a retracement down below the previous all-time high support line at $69,000.

This activity has also changed the open interest (OI) landscape in the derivatives market with recent massive liquidations. Previously, long positions were dominating all cryptocurrencies, which is now happening with short positions.

Essentially, crypto traders experienced a long squeeze against their positions, driving prices at lower levels. Therefore, the scenario currently favors short squeezes, expected to happen if short-sellers get liquidated, driving prices upwards.

In particular, Finbold spotted two cryptocurrencies on CoinGlass with a higher short-squeeze potential that could pump next week.

Short squeeze alert for Ethereum (ETH)

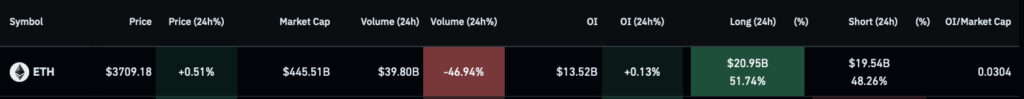

First, Ethereum (ETH) is trading at $3,709 with neutral price action less nearly 47% of its daily volume. This lower volume reflects on long positions dominating the past 24 hours by 51.74%.

However, the remaining open interest in larger time frames is still dominated by shorts. Considering the past 24 hours only represents 0.13% of Ethereum’s entire OI.

The ETH weekly liquidation heatmap evidences that, with cumulative short liquidations in the $4,100 zone. Market makers could hunt this zone through a short squeeze, pumping the price into this liquidity pool and above.

Litecoin (LTC)

Second, Litecoin (LTC) is trading at $89.93, slightly up 2.72% in the last 24 hours following the ‘Payments’ crypto narrative.

Similarly, LTC has a meaningful liquidity pool to the upside, the fruit of a short position dominance in Litecoin’s OI. Particularly, the heatmap shows three of these pools in the $100 psychological resistance zone. Thus, a likely target for a potential short squeeze next week.

In summary, a short squeeze rally to the potential zones would represent 10.5% and 11.2% gains for ETH and LTC, respectively. Nevertheless, cryptocurrencies are volatile and unpredictable assets. Traders must open positions carefully while applying proper risk management to avoid liquidation.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.