The stock market has started 2024 on a low note, witnessing a sell-off for most equities despite underlying fundamentals such as the possible interest rate cuts by the Federal Reserve.

Despite the bearish sentiment, investors are actively seeking money-making opportunities that may arise with short squeezes of select equities standing out as a possible strategy to navigate the current environment.

The short squeeze approach has gained popularity as an investment strategy, where numerous traders betting against a stock are compelled to exit positions, leading to a surge in the stock price.

In this context, Finbold examines two prospective stocks with the potential for a short squeeze.

CarMax (NYSE: KMX)

Over the past year, CarMax (NYSE: KMX), the used vehicle retailer, has predominantly experienced positive stock performance, securing modest gains of nearly 4% amid initiatives to build its valuations.

For instance, CarMax reinstated its stock buyback plan in late 2023, acquiring 648,500 shares for $41.9 million. As of the end of November, the company reported that $2.41 billion remained available for repurchase under the existing authorization.

At the same time, the company achieved notable profitability, especially in the fiscal third quarter ending November 30, where net earnings more than doubled year-over-year to $82 million, or $0.52 per share, surpassing Wall Street’s estimated revenues of $0.41 per share.

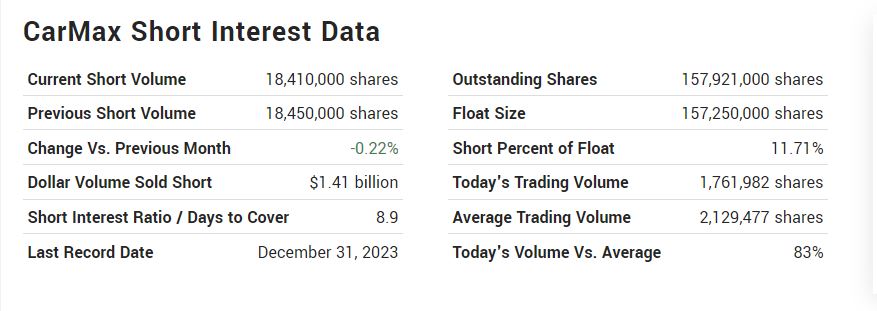

Notably, these elements offer potential ground for short squeezing, with the current harboring an 11% short interest relative to its float.

On another front, 10 Wall Street analysts at TipRanks have expressed optimism about CarMax’s outlook. Based on the stock’s last three months’ performance, the analysts offering a 12-month forecast believe KMX is likely to trade at an average price of $77.22, with a high estimate of $105 and a low forecast of $44. Four analysts recommend selling, while two suggest holding.

In the meantime, CarMax may encounter challenges ahead, considering the potential waning interest in the used car market due to rising auto loan delinquency rates and substantial depreciation in wholesale values.

Currently priced at $69.62, the stock has declined over 8% year-to-date.

MicroStrategy (NASDAQ: MSTR)

MicroStrategy (NASDAQ: MSTR) has been considered one of the most promising companies with links to the cryptocurrency space for years. However, it now faces challenges as its stock price has predominantly turned red, coinciding with the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States.

Before the ETF approval, MSTR was viewed as an ideal proxy investment for those not wanting to hold actual Bitcoin (BTC). Now, with multiple established ETF options available, investors have alternative means to gain exposure to the asset.

Despite the challenges, MicroStrategy continues to accumulate Bitcoin, holding almost 190,000 BTC, with Executive Chairman Michael Saylor actively promoting the cryptocurrency.

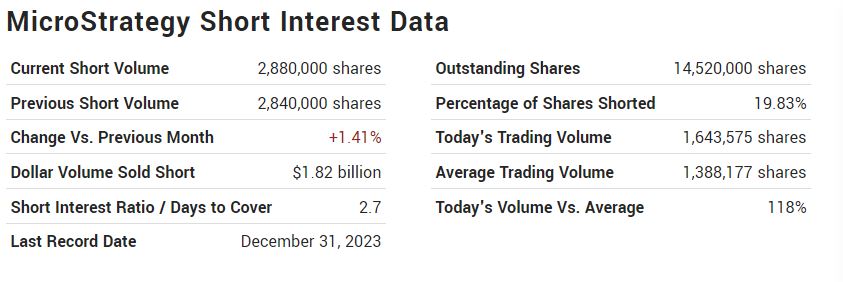

Examining the potential for a MicroStrategy short squeeze, the current percentage of shares shorted is 19.83%, representing over 2.8 million shares. MSTR is likely to witness a revival in the event the value of Bitcoin begins to surge again.

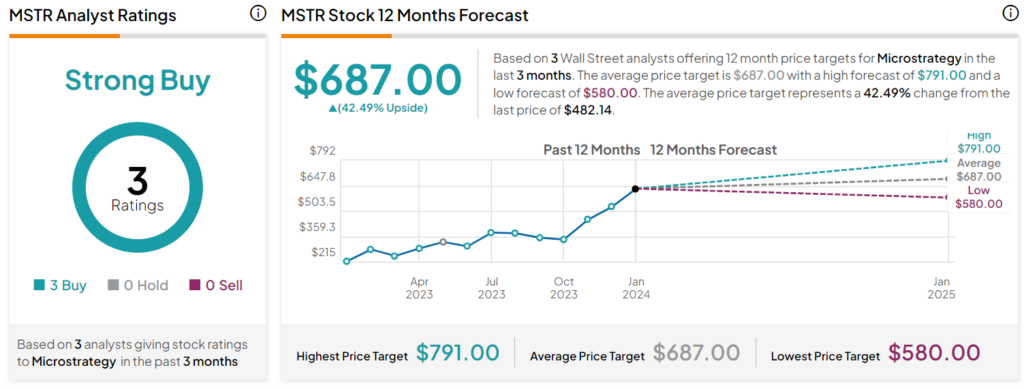

On the other hand, based on the stock’s performance over the last three months, three Wall Street analysts offer a 12-month forecast for MicroStrategy. They project an average price target of $687, with a high forecast of $791 and a low forecast of $580. The average price target represents a 42.49% change from the last price of $482.14.

Currently, the stock is down almost 30% in 2024, trading at $482.14.

In conclusion, while these highlighted stocks have short squeeze potential, predicting the pattern remains challenging as overall market sentiments significantly influence them.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.