The stock price of American information technology giant Super Micro Computer (NASDAQ: SMCI) is experiencing a free fall as the company faces questions regarding its accounting practices.

Indeed, the accusations have resulted in an adverse investor reaction, considering that they call into question its overall financial stability.

By press time, SMCI was trading at $409, having corrected over 25% in the last 24 hours. On the weekly chart, the stock is down almost 35%. Notably, SMCI’s inroads into the artificial intelligence (AI) sector have helped the equity sustain gains of over 43% year to date.

Picks for you

Why SMCI stock price is crashing

The significant short-term drop occurred after the company announced a delay in filing its 10-K report for fiscal year 2024 (FY2024), citing the need for additional time to “complete an assessment of its internal controls over financial reporting.”

This delay follows a scathing report by Hindenburg Research, which accused Super Micro of accounting manipulation and various governance issues. According to the report, Super Micro has engaged in deceptive accounting practices, sibling self-dealing, and even sanctions evasion.

These allegations have fueled investor concerns about the company’s financial statements’ integrity and ability to manage compliance effectively. Hindenburg disclosed a short position in SMCI, further exacerbating market skepticism and leading to a sharp sell-off in the stock.

In addition to the accounting issues, the report highlighted several operational challenges faced by Super Micro, including poor after-sales service that undermines customer retention and increased competition in the AI server market from established giants like Dell Technologies and Hewlett-Packard. This competitive landscape and alleged internal issues paint a troubling picture for the company moving forward.

SMCI stock price prediction

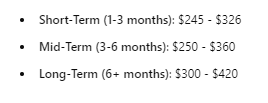

To determine the stock’s next trajectory, Finbold used OpenAI’s ChatGPT-4o to forecast SMCI’s stock performance amid recent accounting concerns. In the short term (one to three months), the AI model suggests that if these concerns are perceived as minor or quickly resolvable, SMCI’s stock could decline by 20-30%, landing between $286 and $326.

However, if the market views the issues as severe or indicative of deeper problems, a more substantial decline of 30-40% could occur, pushing the stock to $245-$286.

Looking at the mid-term (three to six months), the AI noted that the stock’s recovery will hinge on SMCI’s ability to manage the situation. If the company effectively addresses the accounting problems and regains investor trust, the stock could recover by 10-20% from its new base.

For instance, after a moderate drop to around $300, a recovery could bring the price back up to $330-$360. Conversely, if uncertainty persists or new negative information emerges, the stock might either remain flat or decline further, potentially hovering around $250-$300.

In a scenario where SMCI fully resolves the issues and retains strong fundamentals, ChatGPT-4o suggested that the stock could climb back to its previous levels of $380-$420. However, if the accounting concerns have a lasting impact on the company’s reputation or operations, the stock may stabilize at a lower range, possibly between $300 and $350.

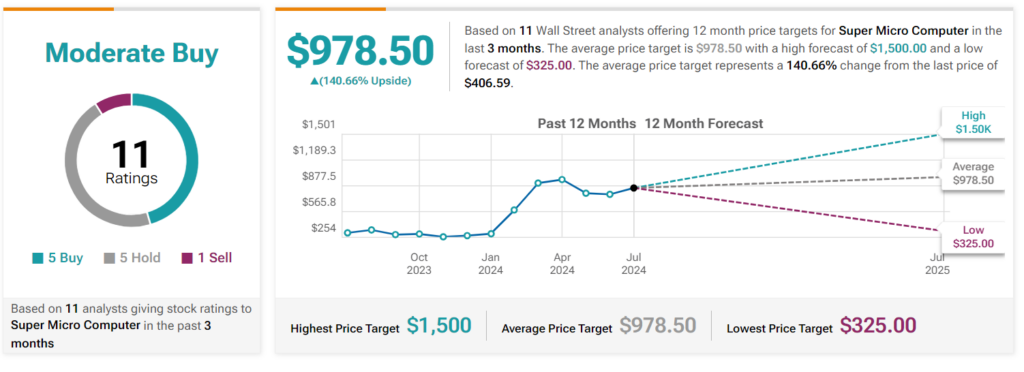

On the other hand, despite the short-term bearish sentiment, 11 Wall Street analysts at TipRanks forecast that the equity will maintain bullish momentum over the next 12 months. The analysts have predicted that SMCI will likely trade at an average price of $978.50 in the next 12 months. The high forecast is $1,500, while the low forecast is $325.

Overall, as things stand, SMCI will need to rectify the concerns around its accounting to salvage the stock, with maintaining support at $400 being the main task.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.