Solana (SOL) continues to stand out as one of the top performers in the current crypto bull run, showcasing its strength and outpacing the broader market despite short-term correction.

However, amidst Solana’s impressive growth, the network faces ongoing challenges with network outages. Over the past two days, the Solana blockchain has encountered significant issues and congestion problems that have long been synonymous with the network.

The congestion issues can largely be attributed to the increasing number of users and their on-chain activity, particularly with the rise of meme coins and transactions on decentralized exchanges (DEXes).

While heightened network activity may drive up the value of the associated token, it unfortunately results in a poor user experience marked by unsuccessful transactions.

Recent setbacks in the blockchain have hindered its progress. In recent weeks, up to 70% of non-voting transactions on the network have failed, indicating a notable increase in transaction failures.

Notably, Solana has a history of recurrent downtime incidents, including a significant outage in early February 2024, where block production halts led to over five hours of network inactivity.

Since January 2022, Solana has experienced about six major outages and 15 days of partial or complete network disruption. Anza, a Solana-focused software development firm, issued a postmortem report on the February 9 outage, identifying a bug in Solana’s Just-in-Time (JIT) compilation cache.

Will SOL collapse?

As the network seeks solutions, investors are scrutinizing SOL’s price trajectory. Currently, SOL is showing signs of resilience in the short term, maintaining its price above $170, having gained about 2% in the last 24 hours. With network issues back in focus, the lingering question is whether SOL can maintain its current momentum.

It is worth noting that the congestion may erode confidence in its network’s performance. Persistent congestion without effective solutions could trigger negative sentiment and a decline in SOL’s price.

Examining the next trajectory for Solana’s price, crypto analyst Rekt Capital noted that for Solana to sustain its bullish run, it must maintain support above the $184 mark. However, the analyst also noted that some downside volatility, potentially wicking into $173, is acceptable as long as SOL generally stays above the bull flag bottom of $184.

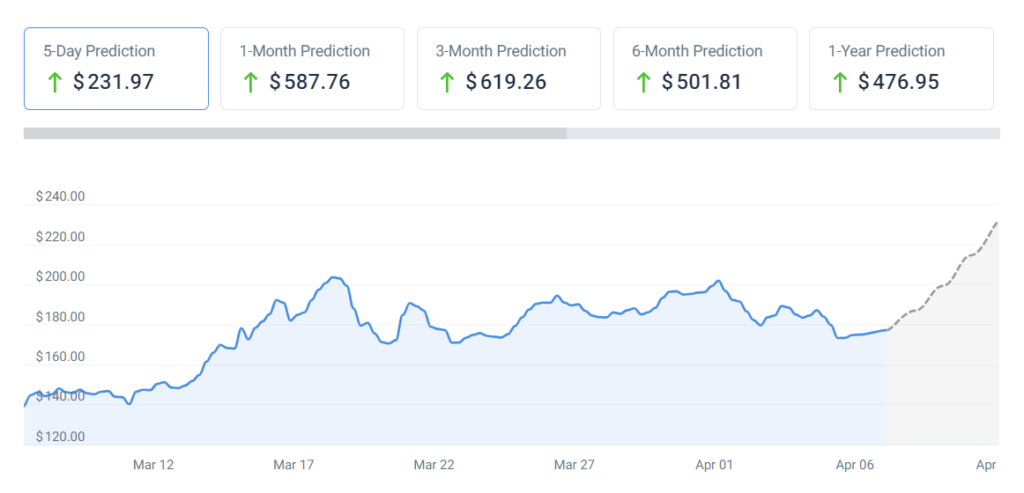

Interestingly, the crypto price prediction platform CoinCodex, leveraging artificial intelligence (AI), foresees bullish sentiments for SOL in the short term. According to the tool, SOL is likely to surpass the $200 mark and trade around $230 by April 11.

By press time, SOL was trading at $174 with weekly losses of over 10%.

Overall, the long-term effects of the congestion on SOL’s price remain to be seen, considering the asset has risen despite the network outages. Additionally, the price trajectory will depend on broader market sentiment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.