The stock market has recorded impressive gains in previous months, with the S&P 500 posting new highs and surpassing analysts’ estimates.

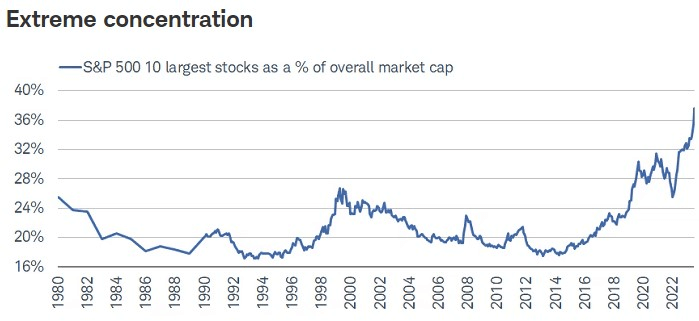

However, there is a concerning underlying weakness: the concentration of leading stocks has surpassed the levels not seen since the dot-com bubble and pre-covid crash.

This indicates that the gains the S&P 500 made were propelled by an unusually small number of stocks. The top 10 comprised five members of the information technology sector, three from utilities, and only one each from healthcare and industrials.

Picks for you

If the aforementioned sectors experience a stronger downturn, this could cause a ripple effect and affect the broader stock market.

What does history tell us about the stock market?

There haven’t been many instances of such significant divergence between breadth and price since the turn of the century.

However, the 1990s frequently experienced similar divergences, often with even weaker breadth than recently. This historical context suggests that while there might be some near-term consolidation in index performance, the outlook for the next six months remains strong.

Regarding potential near-term consolidation, it’s noteworthy that the S&P 500 has gone nearly 18 months without a 2% daily decline.

While there have been longer stretches of calm, such as the longest period from 2003 to 2007 and several others between the mid-1960s and mid-1980s, by the time these streaks reached a similar length, the index generally began to falter.

All but two of the historical streaks, as long as the current one, saw the S&P 500 trade lower two to three months later. The exceptions were the “remarkable creeper trend” of 1995 and another instance in 2004 during the longest streak in history.

Will the stock market bubble burst soon?

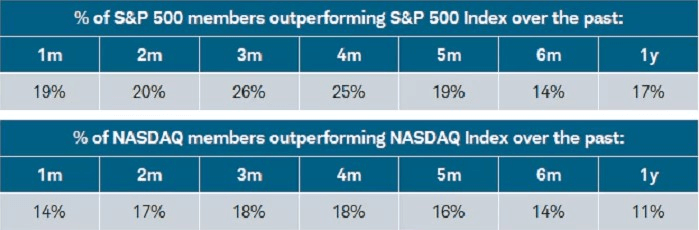

This year’s contrasting market conditions have favored passive investors primarily focusing on index-level returns.

While major indexes have avoided a correction, underlying declines have reached bear market proportions. If there is a “soft” way to experience a correction or bear market, this year has exemplified it.

However, if performance divergences continue into the second half of the year, there are rising risks of consolidation at the index level. Although these divergences do not threaten the bull market imminently, broader participation is necessary to sustain the current momentum.