Finance & crypto platform

Finbold delivers the latest crypto and finance news, comprehensive guides and state-of-the-art features to empower your informed financial decision-making.

Insider Trading

Get companies’ trading activity

Price Alerts

Set up stocks & crypto price alerts

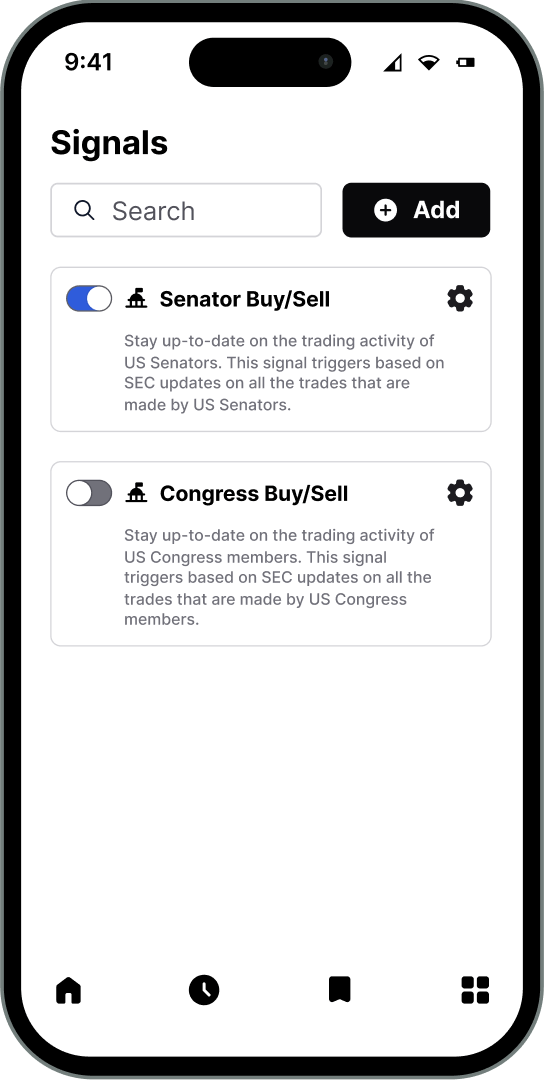

Trading Signals

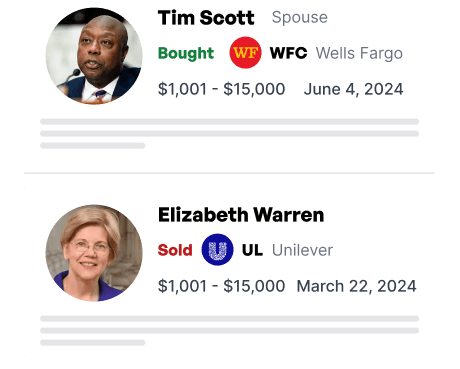

Track US politician stock trades

Watchlist

Monitor relevant stocks & crypto

Stock News

Latest stock market news

Crypto News

Actionable cryptocurrency news

AI Price Prediction News

Analysis of latest AI predictions

ML Price Prediction News

Machine-learning price analysis

Latest news

Features

Receive stock trading activity of US Senators and Members of Congress with disclosed trade amounts, transaction dates, and price change since. Learn more about US politician trading signals.

Free

- 3 alerts

- 3 watched assets

- 1 signal /month

Finbold+

- 25 alerts

- 25 watched assets

- 25 signals /month

Crypto news

Press Releases

Stock news

Stocks

Sponsored

Finance Digest

Uphold is the easiest way to buy and sell cryptocurrency.

Unlike any other platform, we allow you to trade in just one step between any supported asset.

IMPORTANT NOTICE

Finbold is a news and information website. This Site may contain sponsored content, advertisements, and third-party materials, for which Finbold expressly disclaims any liability.

RISK WARNING: Cryptocurrencies are high-risk investments and you should not expect to be protected if something goes wrong. Don’t invest unless you’re prepared to lose all the money you invest. (Click here to learn more about cryptocurrency risks.)

By accessing this Site, you acknowledge that you understand these risks and that Finbold bears no responsibility for any losses, damages, or consequences resulting from your use of the Site or reliance on its content. Click here to learn more.