Bitcoin’s (BTC) robust start to 2024 has hit turbulence, raising concerns about a potential slowdown in the cryptocurrency market.

After reaching an all-time high of $74,000 earlier this year, driven by the approval of spot Bitcoin exchange-traded funds (ETFs), Bitcoin’s performance in the second quarter has been underwhelming, particularly following the recent Bitcoin halving event.

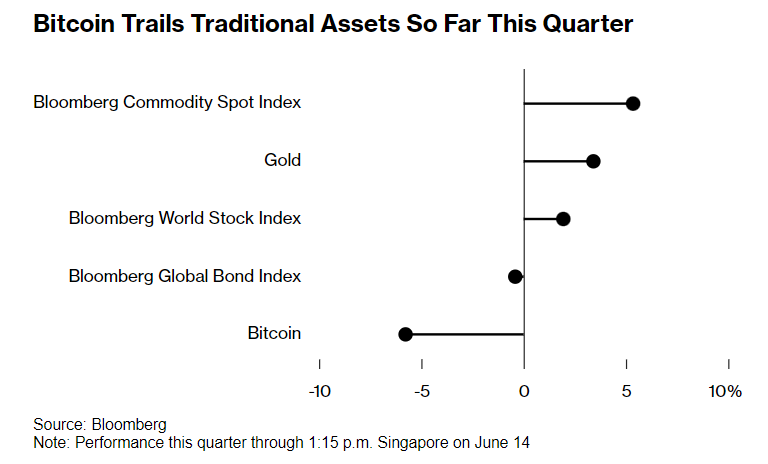

In the second quarter, traditional asset classes such as stocks and bonds have delivered better returns than Bitcoin. According to Bloomberg, global equities, fixed income, and commodities have all outperformed Bitcoin, which has dropped about 5%.

This performance disparity suggests a potential slowdown in the cryptocurrency market, as traditional assets post positive returns while Bitcoin struggles.

Despite hitting a record high of $73,798 in March, Bitcoin has failed to sustain its momentum. Repeated attempts to rally back to its peak have fallen short.

Factors that once fueled enthusiasm, such as inflows into U.S. Bitcoin ETFs and optimism over potential Federal Reserve interest rate cuts, no longer seem to be boosting the cryptocurrency’s performance.

Shift in Bitcoin demand and market predictions

Noelle Acheson, author of the “Crypto Is Macro Now” newsletter, points out that a significant portion of subscriptions to the new U.S. Bitcoin ETFs may be from existing Bitcoin holders. This implies that not all ETF inflows represent new money entering the market, which is necessary to move the price.

JPMorgan Chase (NYSE: JPM) strategists, led by Nikolaos Panigirtzoglou, have examined the demand for Bitcoin products. Bloomberg reports that these products have attracted about $15 billion in net inflows to date

The strategists observed a significant shift from digital wallets on exchanges to the new spot-Bitcoin ETFs. Excluding this shift, they estimate this year’s net flow into cryptocurrency at $12 billion, which is significantly lower than the $45 billion in 2021 and $40 billion in 2022. They expressed skepticism about the pace of inflows continuing for the rest of 2024.

Analysts take on the prolonged consolidation

Crypto market analysts predict another three months of underperformance before Bitcoin resumes its uptrend. Bitcoin has been in its longest period of consolidation now for 92 days and counting. Analysts believe the extended steadiness could be setting the asset up for a massive upside rally.

Strong Bitcoin miner capitulation has been one of the major reasons that the BTC price has been struggling to surge past the strong resistance of $69,000-$70,000.

Recently, Bitcoin miners’ revenue in U.S. dollars (USD) has dropped to a six-month low, slightly above $30 million. This decline in miner revenue highlights the financial pressure on miners and their potential impact on Bitcoin’s price dynamics.

Analyst Rekt Capital observed that Bitcoin has been consolidating within this range for three months now, zig-zagging between $60,600 and $71,500 in a sinusoidal manner. He suggests this consolidation could go on for another three months, followed by an upward rally.

At press time, Bitcoin is currently trading at just under $66,283, with a one-day decrease of 1.09%. While traditional assets continue to outperform Bitcoin, the extended consolidation period and miner capitulation present a mixed outlook for the cryptocurrency.

Analysts remain divided, but some foresee a potentially massive rally once Bitcoin breaks out of its current range.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.