Amid the build-up to the United States’ 2024 presidential elections, investors are shifting their attention beyond the political rhetoric to focus on the performance of key economic sectors, particularly the stock market.

Although the outcome of the polls and the overall impact on the stock market remain uncertain, several equities are in a prime position to benefit from the pre-election momentum and long-term policy shifts, irrespective of the eventual winner. Below are the stocks poised to soar amid the upcoming polls.

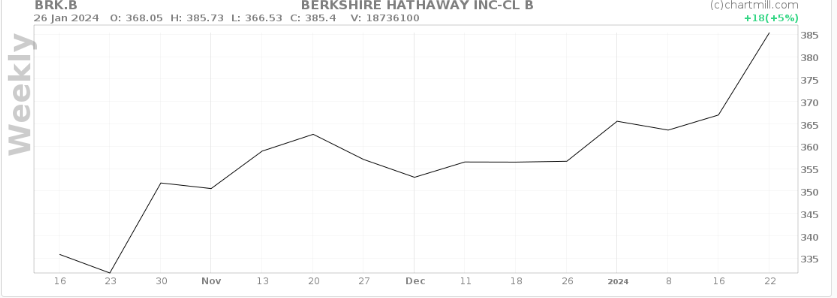

Berkshire Hathaway (NYSE: BRK.A)

The conglomerate, led by Warren Buffett, has historically thrived under pro-business policies implemented by both Democratic and Republican administrations. Key factors that could drive Berkshire’s (NYSE: BRK.A) success include tax cuts, infrastructure spending, and targeted deregulation in sectors like insurance and energy. These policies are expected to enhance profitability across Berkshire’s diverse portfolio of businesses.

Moreover, a stable and growing economy, fostered by pro-business policies, creates an ideal environment for Berkshire’s consumer-oriented subsidiaries like Geico and its insurance businesses. Additionally, the potential for a strong US dollar could further benefit Berkshire’s international investments, providing a positive outlook for investors.

One important factor is that the stock has delivered impressive capital growth over multiple decades, even during heated election cycles.

Notably, BRK.B has demonstrated growth potential, considering the stock has rallied over 25% over the past year. By press time, the stock was trading at $385.40 with YTD gains of 6%.

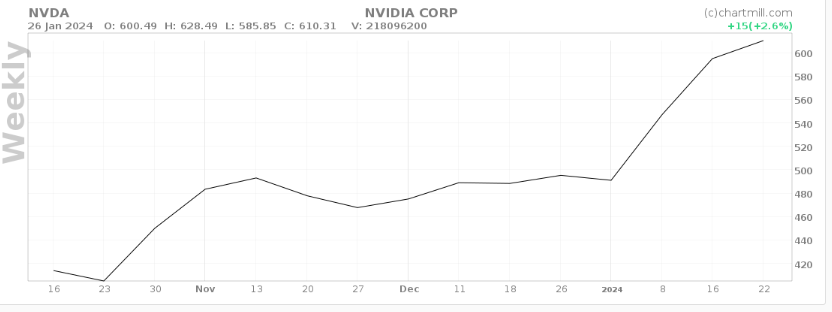

Nvidia (NASDAQ: NVDA)

The semiconductor giant Nvidia (NASDAQ: NVDA) stands to benefit from increased government spending on technology, a shared priority for both political parties. With a focus on advancements in defense, artificial intelligence (AI), and healthcare, Nvidia’s high-performance computing solutions are poised to experience a surge in demand through government contracts.

Having already achieved substantial gains over the past year, Nvidia has initiated collaborations with the government to solidify the US position as a key player in AI. Notably, the National Science Foundation (NSF) announced plans to partner with tech giants such as Nvidia, OpenAI, and Alphabet (NASDAQ: GOOGL) to launch the National Artificial Intelligence Research Resource (NAIRR) pilot program.

This development has the potential to instill confidence in investors, notwithstanding the prevailing political climate.

Furthermore, infrastructure initiatives, particularly those related to upgrading 5G networks and data centers, align with Nvidia’s expertise in providing chips and AI technology.

As of the last market close, Nvidia was trading at $610.31, extending its 2024 gains by almost 25%.

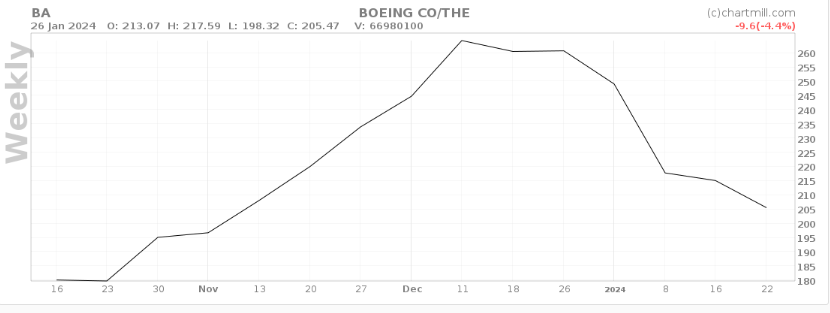

Boeing (NYSE: BA)

Regardless of the political landscape, aerospace and defense giant Boeing (NYSE: BA) will likely anticipate positive outcomes from the 2024 election. An anticipated increase in defense spending under either party is expected to drive demand for Boeing’s military aircraft, encompassing fighter jets, cargo planes, and unmanned aircraft.

Notably, political contenders are projected to address issues such as escalating geopolitical tensions, particularly in Ukraine and the Middle East. US involvement will benefit Boeing, given its longstanding track record of collaboration with government agencies.

The potential implementation of open trade policies and reduced tariffs post-election could further bolster Boeing’s exports, particularly to markets like Europe and China.

By press time, BA was trading at $205.47, reflecting a 24-hour gain of almost 2%. However, it’s noteworthy that in 2024, the stock has experienced a decline of over 18%.

As the US approaches the 2024 election, the highlighted stocks have key fundamentals likely to benefit them. However, it is worth noting that the stock’s performance is likely susceptible to overall market sentiment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.