Bloomberg Intelligence’s senior commodity strategist Mike McGlone has warned that Bitcoin’s (BTC) recent underperformance could deepen in the coming months, potentially sending the cryptocurrency tumbling toward $50,000.

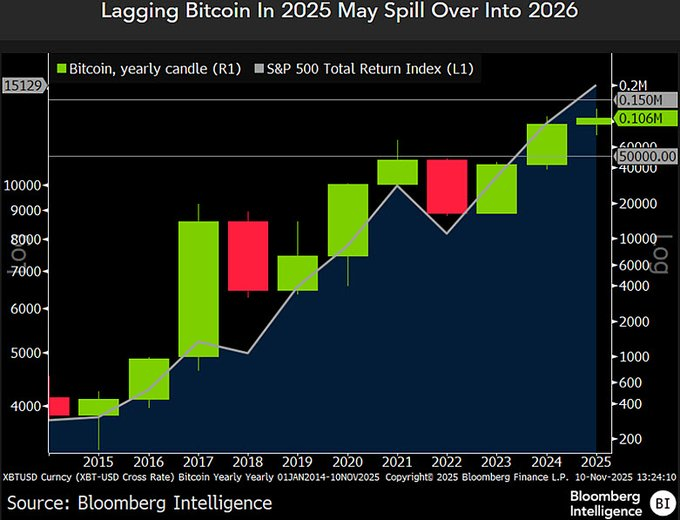

McGlone noted that Bitcoin has lagged behind the S&P 500 Total Return Index in 2025, rising only 13% compared to the stock index’s 17% gain through November 10.

This weakness, he explained, comes despite strong ETF inflows and Bitcoin’s typically higher volatility, suggesting that the cryptocurrency’s bull market may be running out of steam, according to an X post shared on November 11.

Notably, Bloomberg Intelligence data supports McGlone’s warning, showing Bitcoin’s yearly candle still positive but losing momentum as it approaches the end of 2025.

According to his analysis, Bitcoin’s fading momentum relative to traditional “beta” assets could carry reversion risks into next year.

He cautioned that the pattern mirrors previous cycles where late-stage Bitcoin rallies gave way to sharp corrections, hinting at a possible trading range between $50,000 and $150,000 in 2026.

Cooling high risks assets

The investor also linked Bitcoin’s weakness to broader signs of cooling in high-risk assets such as copper, which saw its record-setting 2025 performance fall back in line with the S&P 500 after tariff-related fears subsided in July.

McGlone suggested this may signal a shift toward a more deflationary environment, putting further pressure on speculative assets like Bitcoin.

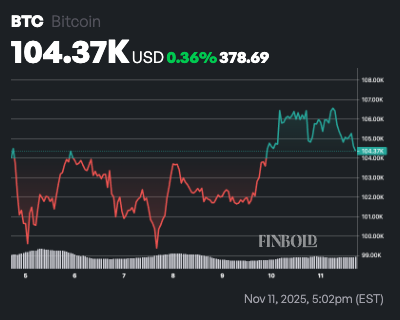

His warning comes as Bitcoin struggles to hold above the $105,000 support level. Notably, after dropping below $100,000, Bitcoin made a slight recovery following reports of a possible U.S. government reopening, but momentum has since stalled.

Bitcoin price analysis

At press time, Bitcoin was trading at $104,366, having fallen almost 2% in the past 24 hours. On the weekly timeline, the cryptocurrency is up a modest 0.36%.

At the current price, Bitcoin is pinned against its 200-day simple moving average (SMA) at $105,751. The price sits $7,900 below the 50-day SMA of $112,216, confirming short-term bearish control and a clear downtrend since mid-October.

The 14-day RSI at 47.76 is neutral but cooling rapidly from overbought levels, signaling easing sell-off pressure and nearing zones (below 40) where rebounds typically ignite.

A sustained hold above $105,751 would keep the macro bull trend intact, targeting a potential snapback to $112,216–$113,264. However, a daily close below this level would flip sentiment bearish, opening the door to a retest of $100,000.

Featured image via Shutterstock