The Sui Network (SUI) will unlock over $200 million in tokens this Sunday, December 1, as part of its schedule. This will be Sui’s largest cliff unlock (in nominal value) to date, creating significant supply inflation and dilution, affecting investors.

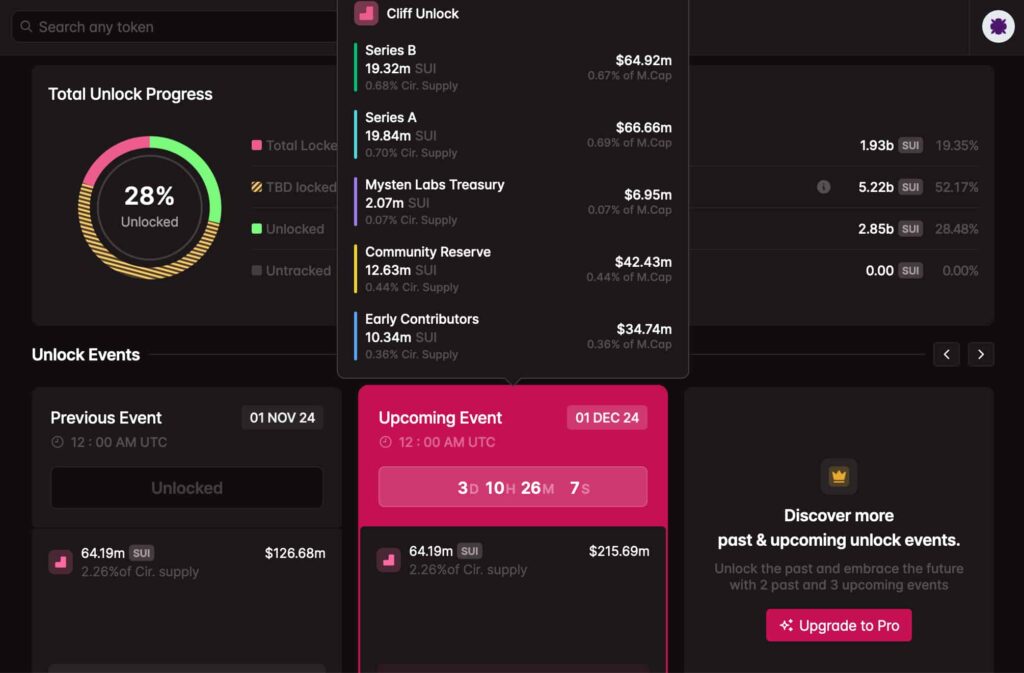

Every month, on day one, Sui unlocks 64.19 million tokens from vested contracts, distributed to five pre-defined categories. Finbold gathered data from Tokenomist on November 27, looking at details for the previous and upcoming events.

Private Series A and B investors receive the most, getting over 19 million SUI each, for 61% of the total. Mysten Labs gets the remaining 25.03 million, reserving 12.63 million for the community, 10.34 million for early contributors, and 2.07 million for its treasury.

At current prices, Sunday’s unlock will be worth $215.69 million as SUI changes hands by $3.36 per token. This is nearly twice as much as the cliff unlock from November 1, worth $126.68 million at $1.97. In October, the project unlocked the same amount of tokens worth $105 million, as Finbold reported.

Sui token unlocks and tokenomics

So far, the Sui Network has already unlocked 28% of its maximum capped supply of 10 billion SUI. At $3.36 per token, the “Solana-killer” has a fully diluted value (FDV) of $33.60 billion. This is a similar value to Cardano’s (ADA) circulating market cap by press time.

With 2.87 billion SUI in circulation, its current market cap is $9.64 billion, giving Sui the 18th position. Notably, each time the network unlocks more tokens, it increases the potential selling pressure and artificially inflates the market cap.

An increasing supply requires a similar, or better, increased demand to sustain its prices, according to the laws of economics. This is why Sui’s largest cliff unlock to date represents a first-moment threat to SUI investors, diluting their holdings’ value.

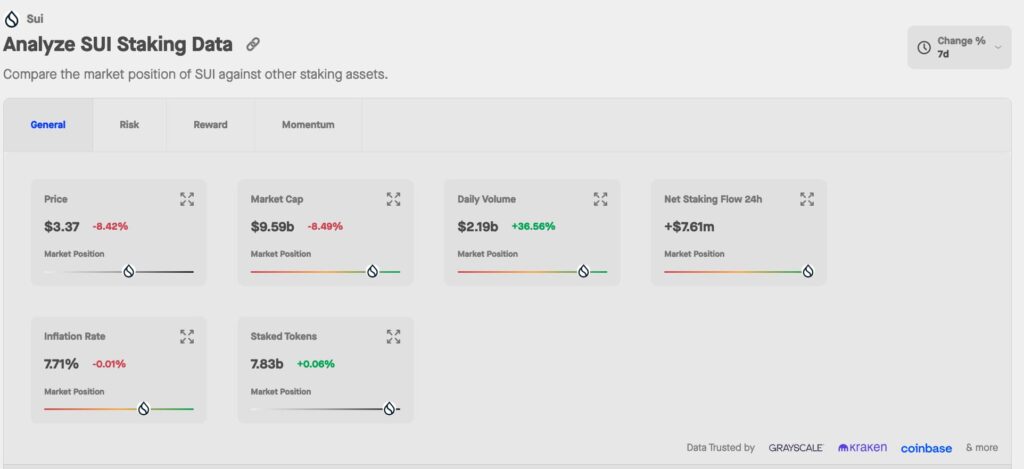

Interestingly, Sui has a unique tokenomics, which allows Mysten Labs and Series A/B investors to stake their locked tokens. These positions generate asymmetric liquid rewards against other staking investors, allowing these entities to sell these rewards or compound their staking positions over time.

According to Staking Rewards, there are 7.83 billion SUI in staking, totaling $26.38 billion staking market cap. Because of that, Sui’s tokenomics have raised concerns among experts, giving higher importance to SUI’s FDV instead of its capitalization.

Nevertheless, the massive upcoming unlock of over $225 million could create significant selling pressure in the following days. Traders and investors should closely monitor SUI’s price action, in particular, looking at onchain movements and exchange deposits.

Featured image from Shutterstock.