Tether, the issuer of the largest dollar stablecoin, minted another $1 billion USDT on Tron (TRX). These tokens are not yet circulating and, thus, not fully backed by the company’s reserves. Justin Sun celebrated a new milestone of over $60 billion USDT issued on the Tron Network.

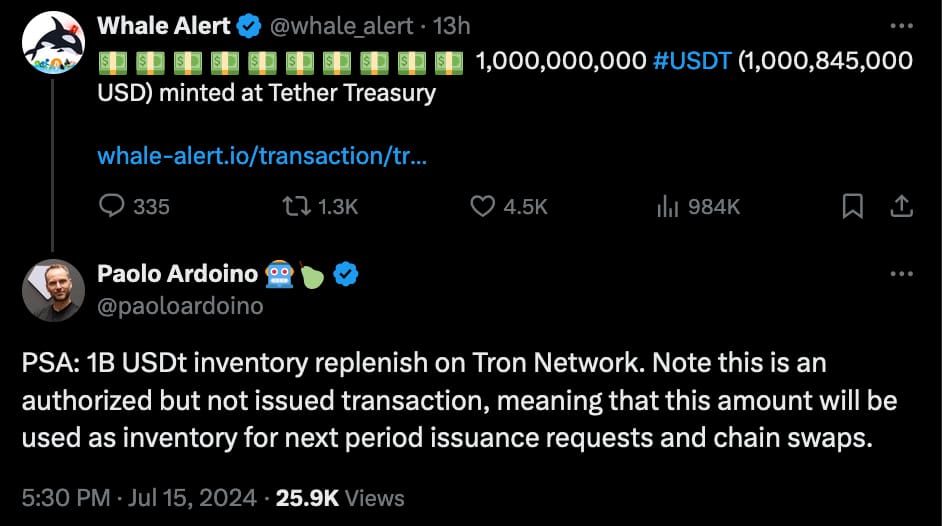

On July 15, the WhaleAlert account on X reported the recent mint spotted on the Tether Treasury wallet address. Notably, Tether CEO Paolo Ardoino explained it is an “inventory replenish on Tron Network,” an “authorized but not issued transaction.”

These are preparation mints when the stablecoin controller expects an increased demand for the token. The cryptocurrency market usually sees these movements as a signal that cryptocurrencies will soon rally.

Tether USDT $1 billion unbacked mints for ‘inventory replenish’

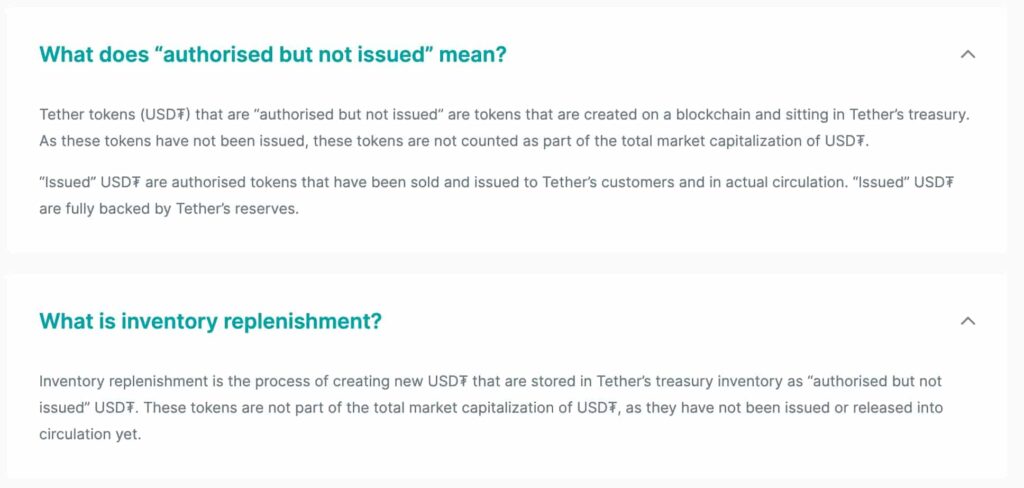

According to Tether’s website, minted USDT for “inventory replenishment” that is “authorized but not issued” means that these tokens are not fully backed by real reserves like the U.S. dollar, U.S. bonds, or other collateral assets Tether allegedly uses to guarantee the legitimacy and redeemability of issued USDT.

“Tether tokens (USD₮) that are “authorised but not issued” are tokens that are created on a blockchain and sitting in Tether’s treasury. As these tokens have not been issued, these tokens are not counted as part of the total market capitalization of USD₮.

“Issued” USD₮ are authorised tokens that have been sold and issued to Tether’s customers and in actual circulation. “Issued” USD₮ are fully backed by Tether’s reserves.”

– Tether’s FAQ

Justin Sun celebrates the USDT $60 billion milestone on Tron

Interestingly, Justin Sun, founder of Tron and known crypto entrepreneur, celebrated the issuance of over $60 billion USDT on Tron. According to Sun, his network has become the first blockchain to surpass this milestone for a single stablecoin.

Both the Tron Network and Tether’s USDT represent a significant share of the cryptocurrency market’s total volume, capitalization, and liquidity. However, both have also raised concerns from investors and regulators from all over the world, requiring caution.

For example, BlackRock (NYSE: BLK) mentioned significant risks related to the crypto market’s high exposure to USDT on its ETF filings. Furthermore, Circle, the USDC issuer, in partnership with Coinbase, publicly encouraged the U.S. Congress to “go after” Tether.

The market now watches if this $1 billion USDT mint will reflect in foreshadowing crypto’s next bull rally.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.