While the overall global economy continuously expands, some markets do better, much better than others. This industry rapidly outperforms the rest, fervently pushing its numbers to become the next trillion-dollar market. Does it sound familiar? Yes, we are talking about the accelerating artificial intelligence market. This article will explain the influx of smart money into AI and how fast it can reach $1 trillion in size.

Artificial intelligence – the next trillion-dollar market

With the advent of generative AI breakthroughs in recent years, investors have once again turned their eyes and wallets toward the technology sector. In fact, the AI market, despite being among the youngest, has been expanding at an unmatched pace.

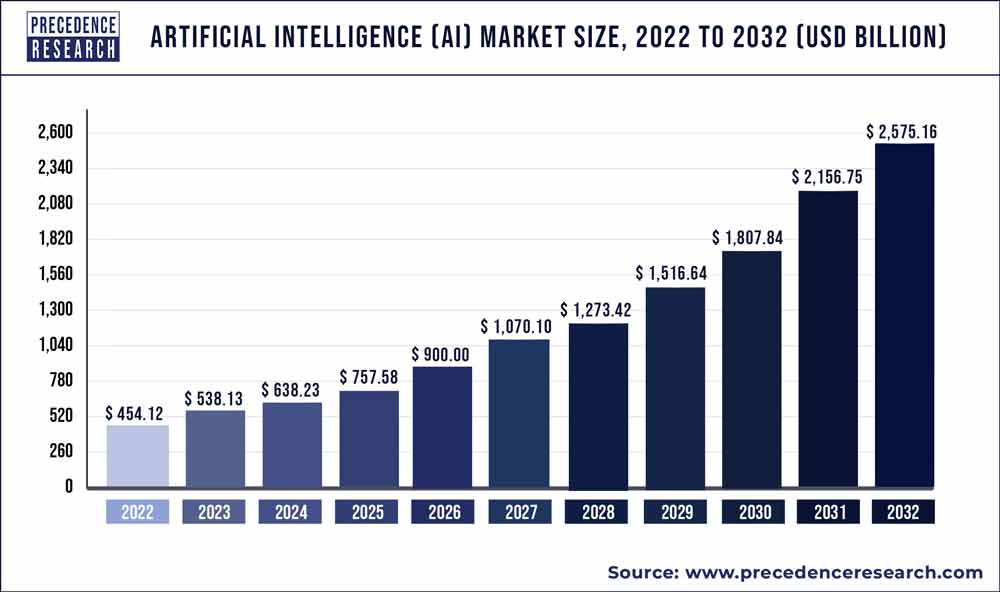

With an estimated market valuation of $196 billion in 2024, artificial intelligence is poised to reach $1.3 trillion by 2032, with an estimated CAGR of 37.3% between 2023 and 2023. How can we explain such a growth rate? Well, ongoing research and advancements by technology conglomerates have led to widespread AI adoption in virtually all branches of industry, including car manufacturing (autonomous driving), healthcare (novel proteins), and retail (automation).

Furthermore, generative AI apps like ChatGPT and Midjourney ushered in a new era of large language model-assisted creativity and ubiquitous utility. The broad application of generative AI apps has sparked debates about copyrights and monetizing AI-generated products, such as text, music, visual media, and digital arts. If a positive consensus is reached, the industry as a whole will undergo a revolution.

Even though the market became prominent within the last couple of years, it has already substantially impacted other novel branches of technology, including robotics, quantum computing, and the Internet of Things (IoT).

Should I invest in artificial intelligence?

Whether you should invest in artificial intelligence is a complex question with multiple layers.

While artificial intelligence stocks are currently trending in the investing public, this market is marked with volatility due to its penetrating influence. Also, the AI sector is marked by rapid advancement and innovation, as well as massive investments into research and development that can either hit the jackpot or end up wasting resources.

The industry has both established players and emerging startups vying for their piece of the market. Both tend to have high market valuations based on their growth potential, but current earnings and monetization methods may still be lacking. Therefore, as the majority of AI shares are growth stocks with higher volatility, they are suited for capital appreciation.

Most prominent AI stocks

Currently, some of the best stocks in the AI market are Nvidia, Meta, and AMD.

Nvidia (NVDA)

Nvidia (NASDAQ: NVDA) is currently the most valuable semiconductor company, and its smart chips are critical to the AI market’s continued growth.

As of now, it produces the best chips on the market, which shows in its financials. Furthermore, Wall Street analysts believe the stock will continue growing a year from now, potentially climbing more than 8% in value. This is impressive, especially if you consider its price has surged more than 215% since this time last year.

Nvidia stock price

Meta (META)

Aftera pretty bad 2022, Meta Platforms (NASDAQ: META) surged in 2023 to become the second most valuable stock in the S&P 500 index. In January 2024, Meta passed the trillion-dollar market cap mark and con tinued pushing towards generative AI, augmented and virtual reality, and its metaverse project.

Its Q1 2024 reports were better than expected, but the stock price still dropped about 15% due to a slightly underwhelming forecast. Regarding its AI projects, Mark Zuckerberg stated: “On the upside, once our new AI services reach scale, we have a strong track record of monetizing them effectively.”

Nevertheless, analysts forecast continued growth for Meta stock in 2025, with an average expected growth reaching 13.4%.

Meta stock price

AMD (AMD)

Advanced Micro Devices, or AMD (NASDAQ: AMD) is Nvidia’s competitor that has suffered some cutbacks in the semiconductor segment, but continues to reap revenue from other AI-related sectors, including client, data center, gaming, and embedded.

AMD’s data center segment witnessed an 80% growth, carried by its AI-enabled MI300X GPU model. Furthermore, its client segment saw an 85% hike. Therefore, experts have forecast AMD stock price in 2025 to climb a significant 24.87% due to surging AI chip demand, especially in the specialized data and server segment.

AMD stock price

The next trillion-dollar market – the bottom line

Wall Street analysts, experts, and the average investor agree that the artificial intelligence market will continue its rapid growth. In the process, it will likely transform all industries it touches for the better.

With such a massive potential for the future, the surging demand for some of the best AI stocks is reasonable. Most prominent artificial intelligence companies represent growth stocks with bright futures in front of them. The only drawback? High valuation and a bit of volatility. Weigh in those factors and come up with the decision of whether you should board the AI train for yourself.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.