Commodities such as oil tend to increase when there are geopolitical tensions, especially in the Middle East region, as they could affect the supply chains and further elevate the price of black gold.

According to sources within the market citing figures from the American Petroleum Institute (API), U.S. crude oil inventories increased last week, while fuel stockpiles experienced declines.

The API data indicated a rise of 8.52 million barrels in crude stocks for the week ending February 9. Gasoline inventories decreased by 7.23 million barrels, while distillate stocks saw a decline of 4.02 million barrels.

Due to this disparity, commodity prices are expected to stay elevated in the short term, prompting Finbold to highlight oil stocks that could benefit from this occurrence.

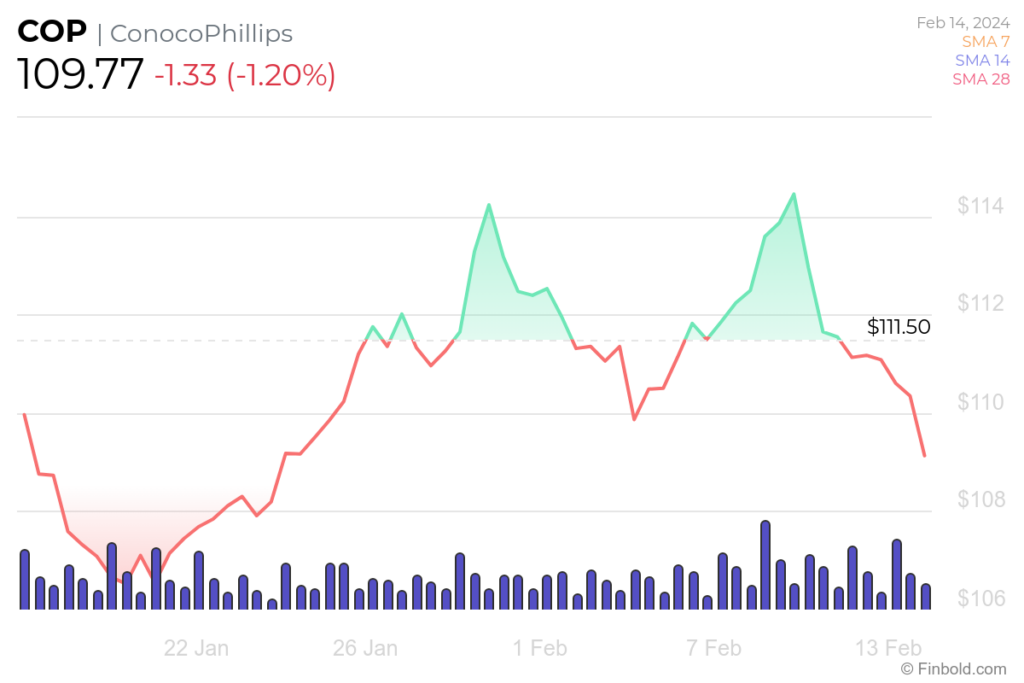

ConocoPhillips (NYSE: COP)

ConocoPhillips (NYSE: COP) is one of the world’s largest companies focused on exploration and production (E&P). With expertise in oil and natural gas discovery and extraction, it operates globally across over a dozen countries.

COP leverages its scale and access to some of the most cost-effective oil reservoirs worldwide, notably the Permian Basin. The company maintains profitability across various market conditions, with average production costs of around $40 per barrel and some resources even more economical. This advantageous position enables ConocoPhillips to generate substantial cash flow consistently.

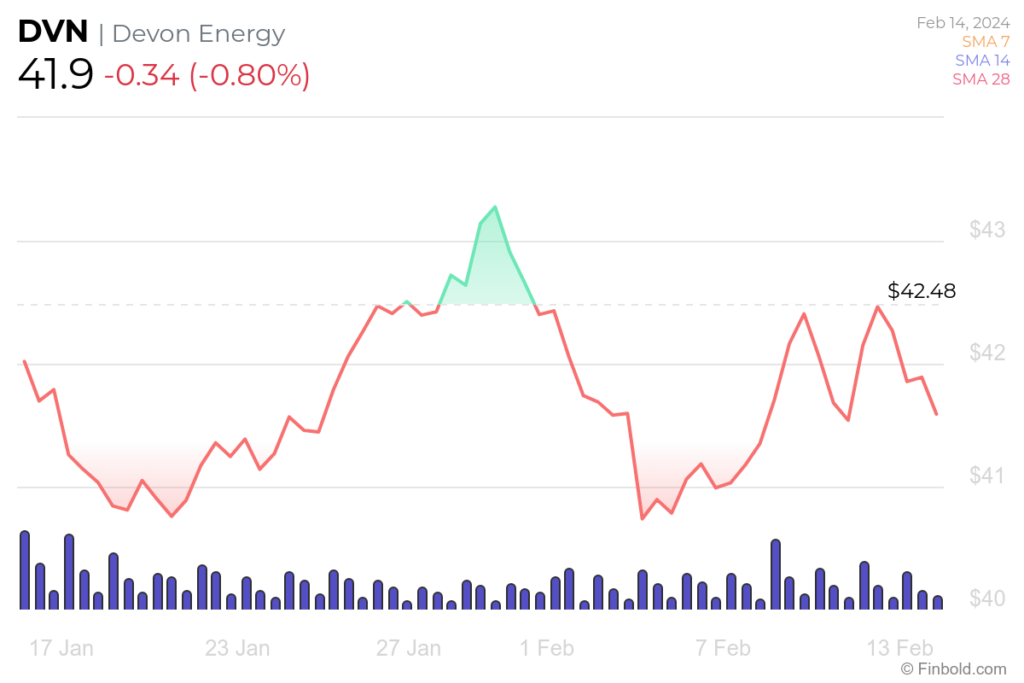

Devon Energy (NYSE: DVN)

Devon Energy (NYSE: DVN) is a leading E&P company primarily focusing on the United States. Its operational footprint encompasses diverse assets across several economically favorable, oil-rich basins.

Notably, in 2021, the company introduced an innovative fixed-plus-variable dividend framework, a first in the industry. Under this framework, Devon allocates up to 50% of its surplus cash flow each quarter through variable dividend payments, following the fulfillment of its fixed base dividend and capital expenditure obligations.

The remaining surplus cash is strategically utilized to bolster the company’s financial position and execute share repurchases, contributing to long-term value creation for shareholders.

Enbridge (NYSE: ENB)

Enbridge (NYSE: ENB) oversees one of the largest oil pipeline networks globally, facilitating the transportation of approximately 30% of the oil production across North America. Additionally, the company boasts an expansive natural gas pipeline system, a robust natural gas utility business, and a growing presence in renewable energy operations.

The pipeline segment of Enbridge’s operations yields stable cash flows, supported by long-term contractual agreements and government-regulated rates. This financial stability enables the company to maintain a high-yield dividend for its investors while allocating funds to expand its energy infrastructure portfolio.

Enbridge has prioritized strategic investments recently, particularly on infrastructure projects promoting cleaner energy sources.

With the projections of OPEC that demand for oil and its derivatives is expected to remain unchanged in most of 2024 and 2025, companies based in the industry seem set to continue with the gains, especially considering their profit margins and the price of production.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.