The cryptocurrency market crashed in the last 24 hours, led by Bitcoin (BTC), as fear, uncertainty, and doubt (FUD) dominated. Meanwhile, MultiversX (EGLD) and Monero (XMR) displayed signs of strength, while most other cryptocurrencies showed weakness.

In summary, Bitcoin broke down from a four-month price range, trading as low as $53,540 on July 5. As Finbold reported, this price action ended Bitcoin’s all-time “longest winning streak” of 427 days without retracing more than 25%.

At the same time as BTC made a “well overdue correction,” in Charles Edwards’s words, crypto traders lost over $600 million in liquidations due to a massive long squeeze. Most projects displayed double-digit losses in the first days of July, shifting the overall sentiment to bearish.

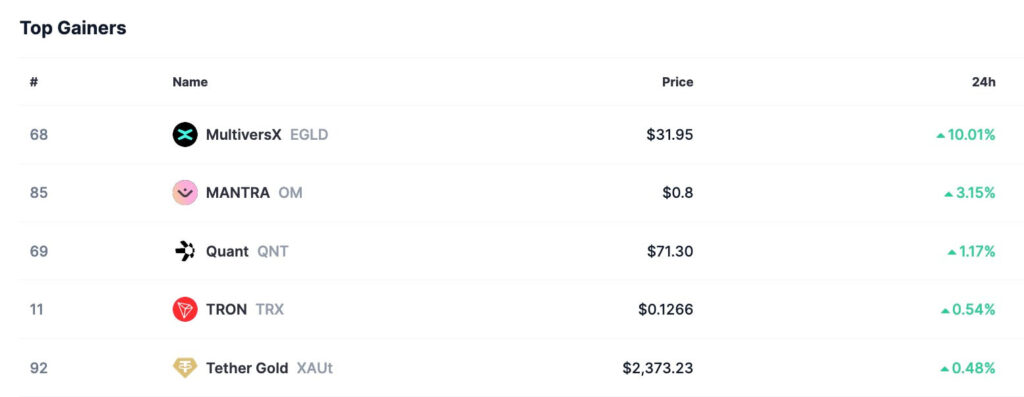

MultiversX (EGLD) top gainer of the day amid crypto crash

However, not all cryptocurrencies are losing. MultiversX, a promising $880 million market cap Solana competitor, is Friday’s 24-hour top gainer, with impressive 10% gains. As of this writing, EGLD trades at $31.95 per token and shows strength amid the overall weakness.

Notably, MultiversX has solid fundamentals to deliver one of the most scalable Web3 and decentralized finance (DeFi) networks with sharding. The project is the only one with the sharding technology fully implemented for its state, network, and transactions.

Monero (XMR) trades with a premium on the ‘street’

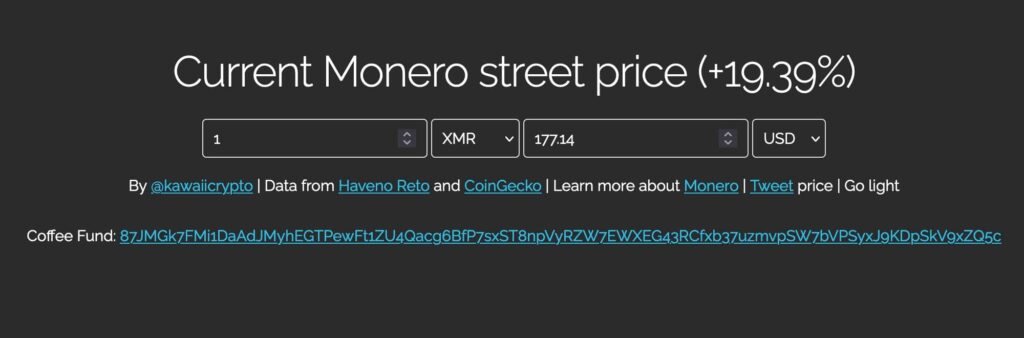

In the meantime, Monero accumulates over 5% daily losses in the mainstream market, trading on centralized exchanges. Nevertheless, the privacy-focused cryptocurrency shows strength in alternative and decentralized exchange markets, according to the Monero Street Price Index.

By press time, XMR trades at a nearly 20% premium on “street” markets, with an exchange rate of $177 against the dollar, while trading at $148 according to the TradingView index. As long as the premium remains, this opens up an arbitrage opportunity.

The street price index is calculated using Monero’s last exchange rate against other currencies on Haveno.

In closing, traders expect increased volatility for crypto assets in the coming days, requiring extra caution with leverage positions. While these cryptocurrencies currently display signs of strength, everything can change in the blink of an idea, especially considering a relatively low-liquidity market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.