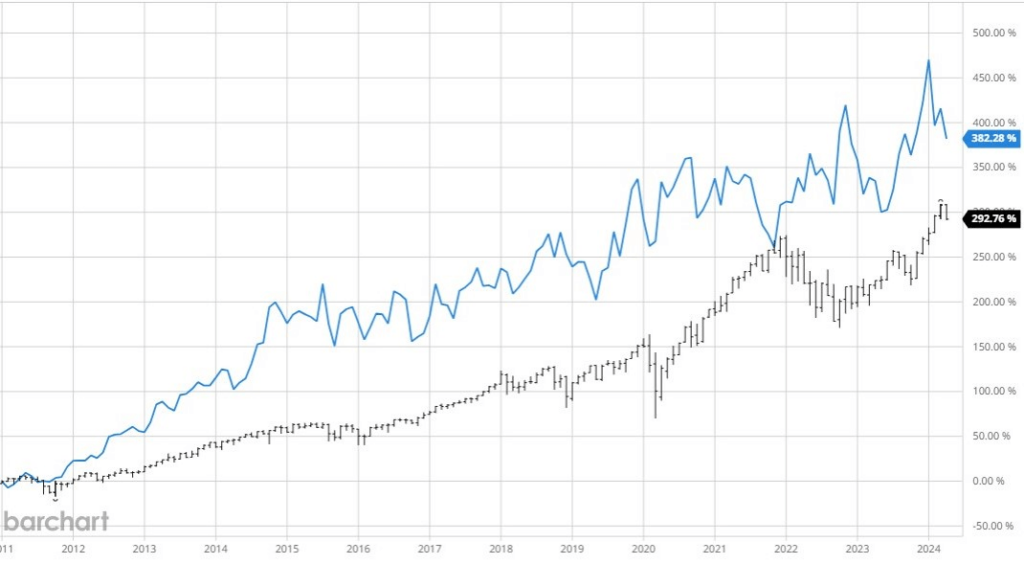

Dividend investing can be a profitable strategy for traders, providing an extra source of income alongside potential stock gains. Amgen (NASDAQ: AMGN) has demonstrated strong performance, surpassing the average return of the S&P 500.

Since initiating dividend payouts in 2011, AMGN shares have outperformed the S&P 500, with a return of 382.28% compared to the index’s 292.76%.

Earnings ratio and dividend yield make a compelling case for AMGN’s stock

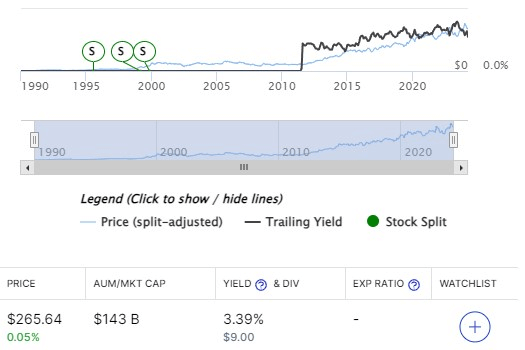

After its 2024 pullback, Amgen’s stock is trading at a forward earnings multiple of 13.6, considered a bargain within its blue-chip biotech peers. This is lower than the peer group’s average of 17 and compares favorably to the S&P 500’s forward earnings multiple of around 20.

Regarding dividends, Amgen offers an attractive annualized yield of 3.39%, surpassing the 3% average yield of major pharmaceutical stocks and the 1.35% average yield of S&P 500 companies. This makes Amgen stand out as an income-generating stock.

Amgen’s MariTide could drive its revenues

MariTide is a prominent candidate for weight loss treatment, with estimated peak sales of up to $4 billion annually. However, it’s essential to recognize that MariTide still faces significant hurdles before it reaches the market, and it may encounter various challenges along the way.

Despite these uncertainties, it’s important to note that Amgen’s success doesn’t solely rely on MariTide. Even if MariTide doesn’t outperform the S&P 500, Amgen’s stock is expected to yield positive returns in the coming years. This is because Amgen boasts a strong product portfolio, a promising clinical pipeline, a capable management team, and a reliable dividend program.

Overall, Amgen’s shares offer a relatively low-risk opportunity for growth, with the potential for market-beating returns over the long term. Therefore, investors seeking growth with a moderate risk tolerance may find this high-yield dividend stock appealing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.