Investors are accustomed to seeing insiders make profitable trades, especially among US politicians. However, there are times when these insiders make mistakes and lose a significant portion of their investment in a short period.

This is precisely what happened to Rep. Michael McCaul. On April 4 and 5, he purchased $350,000 worth of Meta (NASDAQ: META) stock before voting ‘yes’ on the TikTok ban bill.

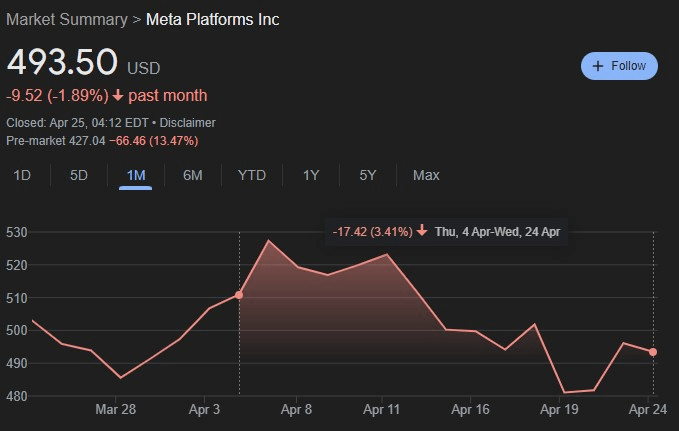

Unfortunately for him, his trade didn’t pan out as expected, at least not in the short term. META stock dropped by 3.41% from his purchase until the last market closing.

And now, those META shares losses have increased even further, falling a substantial 13.47% in the premarket.

When writing, combined losses amounted to 16.88%, as META shares plunged to $427.04 from $493.50, inflicting a significant loss on McCaul’s investment.

How much did McCaul exactly lose?

McCaul invested $700,000 in Meta stock when each share was priced at $510.92. However, the value of Meta stock has since declined, with each individual share now worth $428.50.

The investment initially bought approximately 1,369 shares. At the current price, the value of those shares amounts to around $586,543.09. Consequently, McCaul has incurred a loss of roughly $113,456.91 on his investment in Meta stock.

Perhaps the signs were already there for META stock

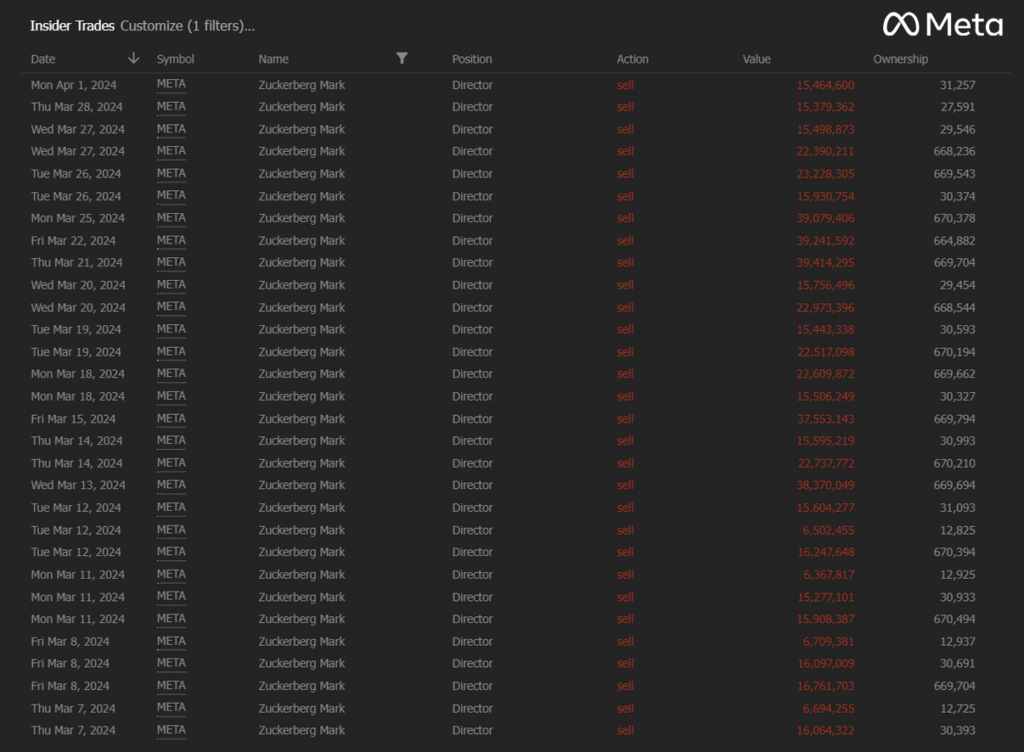

One of the troubles META stock experienced was the heavy selling insider activity, especially from the CEO, Mark Zuckerberg, who sold almost $600 million worth of META shares in just March alone, prompting concern among investors.

What happened to META stock?

Meta Platforms, Facebook’s parent company, made headlines with its first-quarter earnings report, surpassing market expectations.

However, despite this positive news, the company’s stock took a significant hit, plummeting by as much as 19% in after-hours trading before retracing marginally. This drop was attributed to disappointing second-quarter revenue forecasts and an increased spending plan for artificial intelligence initiatives.

Investors question whether Meta’s ongoing performance can justify its impressive 39% year-to-date growth. Despite ranking as the second-best performer among US big tech companies this year, trailing only Nvidia (NASDAQ: NVDA), today’s decline threatens to wipe out approximately $240 billion from Meta’s market capitalization.

However, META shares have recovered since, with a 13% pre-market loss. In the next few hours, we will find out whether they manage to recover further or the drop continues.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.